Investment Rarities Inc.: Unique Highlights Overview

Investment Rarities Inc. is an established Gold IRA firm that has been serving investors since 1974. Based in the United States, this firm specializes in providing clients with opportunities to diversify their retirement portfolios through investments in precious metals, specifically gold, which is a cornerstone of their offerings.

Find the Best Gold IRA Company of Your State

Investment Rarities Inc. distinguishes itself in the Gold IRA market with its deep expertise and long-standing reputation. The company is known for its comprehensive support and educational resources that guide clients through the complexities of investing in gold for retirement purposes. Their educational tools are aimed at helping investors understand the benefits of including gold in their IRAs to protect against inflation and economic volatility.

The firm offers a variety of gold investment options suitable for IRAs, including gold coins and bars that meet the IRS purity standards. Their selection features highly sought-after items such as American Gold Eagles and Canadian Gold Maple Leafs, which are popular among investors for their liquidity and recognition across global markets.

One of the key services provided by Investment Rarities Inc. is facilitating the setup and management of Gold IRAs. They collaborate with trusted custodians and provide secure storage solutions to ensure that clients’ investments are safely managed and compliant with IRS regulations. This includes offering insured storage options through partnerships with top-tier depositories.

Moreover, Investment Rarities Inc. prides itself on transparency and customer service. They work closely with clients to tailor investment strategies that align with individual retirement goals, providing personalized advice and ongoing support.

Thus, Investment Rarities Inc. stands out as a Gold IRA firm with nearly five decades of experience, a commitment to client education, and a focus on secure, IRS-compliant investment solutions. Their dedication to customer service and an extensive catalog of gold options make them a reliable choice for those looking to enhance their retirement savings with precious metals.

What is the Investment Rarities Inc.?

Investment Rarities Inc. is a prominent precious metals dealer based in the United States, specializing in gold and silver investments. Established in 1973, the company has developed a significant footprint in the precious metals industry, offering a wide range of products and services designed to meet the investment needs of individual and institutional clients.

Central to Investment Rarities Inc.’s offerings are gold and silver products, which include bullion coins, bars, and collectible numismatic pieces. These offerings cater to investors looking to diversify their portfolios, hedge against economic instability, or secure assets against inflation. The company’s product line is carefully curated to include highly sought-after items such as American Eagles, Canadian Maple Leafs, and other government-issued bullion coins that are popular among investors for their liquidity and purity.

One of the distinguishing features of Investment Rarities Inc. is its commitment to investor education. The company provides extensive resources and expert guidance aimed at helping clients understand the dynamics of precious metals markets and the benefits of including gold and silver in their investment strategies. These resources are particularly beneficial for new investors navigating the complexities of precious metals ownership and investment.

Investment Rarities Inc. also offers personalized services tailored to the unique financial goals and circumstances of each client. This personalized approach ensures that investors receive tailored advice and strategies that align with their long-term financial objectives.

Additionally, the company supports clients in setting up precious metals IRAs, providing a seamless integration of gold and silver into retirement planning. Through partnerships with reputable IRA custodians, Investment Rarities Inc. facilitates the secure, compliant, and efficient management of precious metals IRAs.

In summary, Investment Rarities Inc. is a trusted name in the precious metals industry, known for its quality products, educational commitment, and personalized client services. With decades of experience, the company continues to serve as a reliable partner for investors seeking to enhance their portfolios with precious metals.

Who are the People Behind Investment Rarities Inc.?

Investment Rarities Inc., a respected player in the precious metals industry, was established by Jim Cook, who has been instrumental in shaping the company’s reputation and success since its inception in 1973. As the founder and a passionate advocate for the benefits of investing in precious metals, Cook has driven the company’s commitment to providing high-quality gold and silver investment options alongside educational resources aimed at helping investors understand market dynamics and investment strategies.

The leadership team at Investment Rarities Inc. also includes a group of seasoned professionals, each specializing in different aspects of precious metals trading and investment services. This team’s collective expertise spans various facets of finance, economics, and asset management, ensuring that the company remains at the forefront of industry standards and client service.

A key figure in the company is Tom Cloud, who serves as the Precious Metals Specialist. With decades of experience in the precious metals market, Cloud offers invaluable insights and advice to clients, helping them make informed investment decisions. His deep understanding of market trends and the economic factors affecting precious metals prices is a significant asset to the company and its clients.

The company’s commitment to integrity and customer service is further upheld by its dedicated customer support team, who are trained to assist investors at all stages of their investment journey, from the initial inquiry to ongoing portfolio management. This team ensures that all clients receive personalized attention, making the investment process as straightforward and rewarding as possible.

Overall, the people behind Investment Rarities Inc. are a blend of experienced professionals committed to upholding the company’s legacy of trust, expertise, and client-focused service. Their collective efforts continue to solidify the company’s position as a trusted advisor and provider in the precious metals investment community.

Does Investment Rarities Inc. Offer IRA Services?

Investment Rarities Incorporated (IRI) offers specialized services for individuals looking to incorporate precious metals into their Retirement Accounts (IRAs). This service caters to those who wish to diversify their retirement portfolios with investments in gold and silver, leveraging the traditional stability and potential hedge against inflation that these metals can provide.

IRI works closely with IRA custodians who specialize in precious metals, facilitating the process of setting up a Gold IRA. These custodians are experts in the specific IRS regulations that govern precious metals IRAs, ensuring that all investments are compliant with federal guidelines. This compliance includes adhering to the standards for metal purity and ensuring proper storage in approved depositories.

The process of opening a precious metals IRA with IRI involves several steps. First, clients are guided through the selection of an appropriate custodian based on their specific financial needs and goals. Once the custodian is chosen, IRI assists clients in rolling over existing retirement funds from IRAs, 401(k)s, or other eligible retirement plans into the new precious metals IRA.

IRI’s offerings include a variety of IRA-eligible gold and silver products. These include popular options like American Eagle coins, Canadian Maple Leafs, and other well-recognized bullion coins and bars that meet the fineness requirements set by the IRS. IRI’s expertise in precious metals allows them to provide insightful advice on which products are most beneficial for retirement planning based on current market conditions and future outlooks.

Additionally, IRI emphasizes the importance of secure storage for precious metals IRAs. They coordinate with trusted depository services to ensure that clients’ investments are securely stored and fully insured, providing peace of mind along with a tangible retirement asset.

In summary, Investment Rarities Inc. offers comprehensive services for those interested in adding precious metals to their retirement portfolios, supporting clients with expert advice, compliant products, and secure storage solutions.

What Products Can You Purchase at Investment Rarities Inc.?

Gold coins and bars, silver coins and bars, rare coins and numismatics, U.S. gold coins before 1933, certified and graded coins, collector coins and sets, American Eagle coins, Canadian Maple Leaf coins, South African Krugerrand coins, Chinese Gold Panda coins, and many other items are available from Investment Rarities for investors interested in precious metals.

It also provides these devices with a variety of storage possibilities. include safe, secure storage both domestically and abroad.

Investment Rarities Inc. Fees and Pricing:

Investment Rarities Inc. is known for its extensive array of fees associated with its services, which might be a concern for potential clients due to the company’s lack of transparency regarding these charges. Understanding the fee structure is crucial for investors considering engaging with Investment Rarities for their precious metals needs. Here’s a breakdown of the typical fees you might encounter:

- Buying and Selling Fees: Investment Rarities apply fees to the transactions of buying and selling precious metals. These fees are variable and depend on the type and volume of metals traded. This is a standard practice in the industry, but the specific rates are not clearly disclosed on their website.

- Storage Fees: For clients who opt to store their precious metals through Investment Rarities, there are associated storage fees. These fees can vary based on several factors including the quantity of metal stored and the location of the storage facility. Again, specific fee details are not readily provided, making it difficult for customers to estimate potential costs.

- Appraisal Fees: When precious metals need to be appraised, Investment Rarities charges a fee for this service. The cost can differ depending on the type and amount of metal being appraised. Like other fees, the exact dates are not transparently listed, which could be problematic for clients looking to understand the full scope of their financial obligations.

- Delivery Fees: If customers decide to have their purchased metals delivered, Investment Rarities imposes a delivery fee. This fee varies based on the type and quantity of metals, as well as the delivery destination.

The lack of clear, upfront information about these fees poses a significant issue for transparency, making it difficult for investors to fully trust and evaluate the cost-effectiveness of Investment Rarities compared to other firms in the precious metals market. For investors, especially those new to trading in precious metals, the absence of straightforward fee information could be a major deterrent, prompting them to seek services from more transparent competitors in the industry.

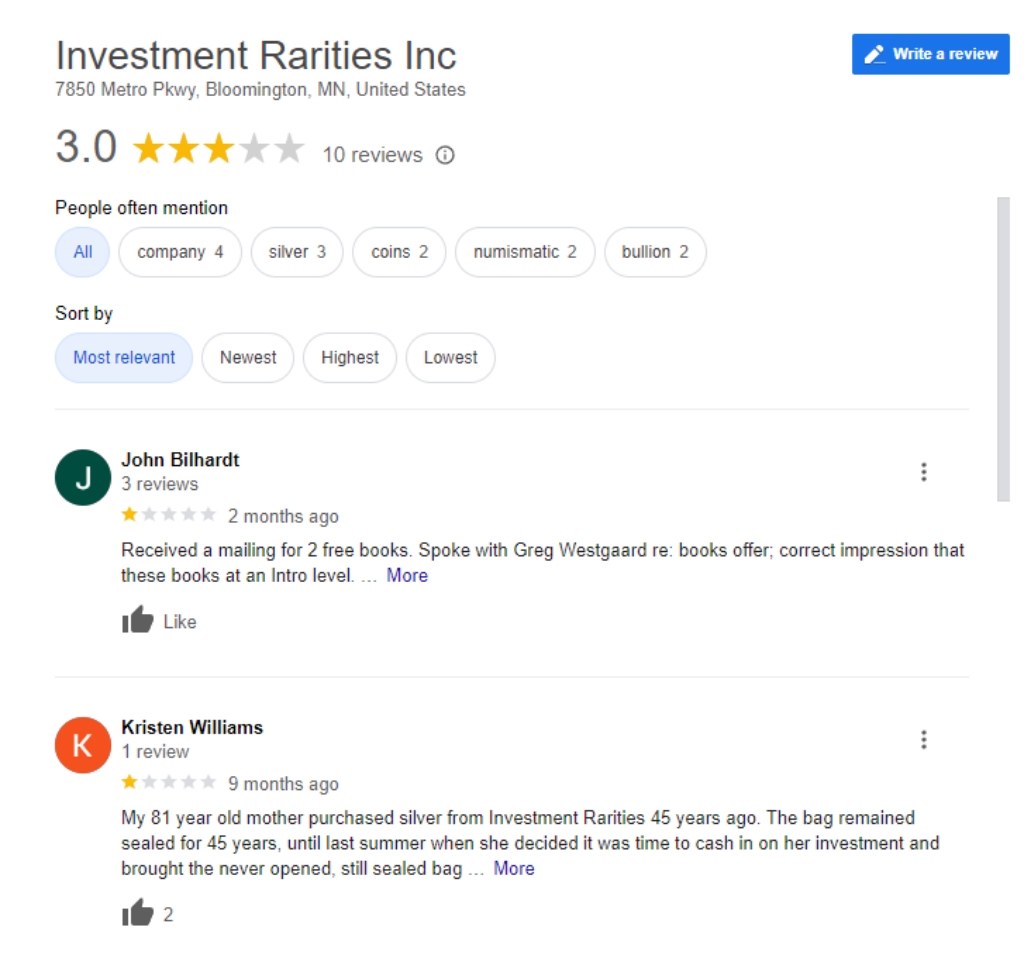

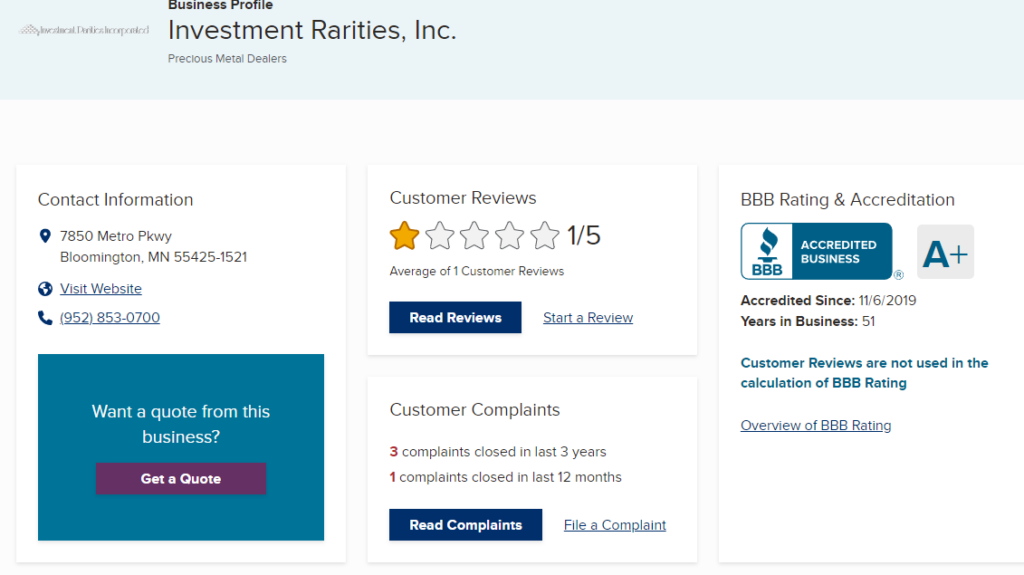

What Do Investment Rarities Inc. Reviews Say?

Investment Rarities has an A+ rating and is BBB accredited. In the past three years, the BBB has resolved three of their concerns. which were all settled to the client’s satisfaction. This company currently has no reviews. Clients commend the business for its expertise, ethics, and honesty.

#1. A customer shared a touching story of resilience and continuity in the face of adversity. After starting a silver investment program, he experienced a severe stroke that left him with significant physical challenges and cognitive difficulties. For a while, he forgot about his investments until his wife stumbled upon some records and reminded him of the silver holdings.

Now at 90 years old and still dealing with the aftermath of the stroke, he finds himself unable to manage financial matters personally. His wife, equally unfamiliar with the details of the investments, needed guidance on understanding the current value, potential gains or losses, and options for redemption of the silver.

Despite these challenges, he reached out for assistance to ensure his wife could be well-informed and supported in managing their investments. He expressed appreciation for the company’s informative newsletter and shared his sorrow that his direct involvement had to end under such circumstances. This story highlights not only the unpredictable nature of life but also the enduring spirit of individuals to adapt and care for their loved ones in all conditions.

#2. Charles L. shares a positive review about a company that trades in valuable commodities like gold and silver. He was referred to the company by a trusted friend, and although he acknowledges that their prices are on the higher side, he confidently regards them as a reputable business. His experience underscores the value of trusted referrals and the company’s strong standing in the market.

Why Aren’t There Many Investment Rarities Inc. Complaints?

Investment Rarities Inc. employs a structured process to resolve customer complaints, aiming to maintain high standards of customer satisfaction and trust. The company’s approach is designed to address grievances efficiently and effectively, ensuring a positive resolution for all parties involved.

The process begins with the prompt acknowledgment of the complaint. This initial step is crucial as it reassures the customer that their concern is being taken seriously and will be addressed without undue delay. Quick acknowledgment helps prevent the feeling of neglect and sets the stage for effective communication.

Following the acknowledgment, Investment Rarities Inc. conducts a detailed investigation into the complaint. This involves reviewing all relevant details, transaction records, and communications related to the issue at hand. The aim is to gain a comprehensive understanding of the situation to ensure that the resolution is based on a thorough analysis of the facts.

Based on the findings from the investigation, Investment Rarities Inc. proposes a resolution to the customer. This resolution is carefully formulated to address the specific concerns raised by the customer while also aligning with the company’s policies. The proposed solutions typically include refunds, exchanges, or other forms of rectification suitable to the nature of the complaint.

Throughout the resolution process, Investment Rarities Inc. maintains clear and open communication with the customer. They ensure that all aspects of the complaint and the steps being taken are clearly explained. This transparency is crucial in building trust and ensures that the customer understands how the issue is being handled.

Finally, after implementing the resolution, Investment Rarities Inc. follows up with the customer to ensure that the issue has been resolved to their satisfaction. This follow-up is a critical part of their process, as it helps confirm that the customer is happy with the outcome and that the solution has effectively addressed their concerns.

Through this methodical and customer-focused approach, Investment Rarities Inc. aims to turn potentially negative experiences into positive ones, reinforcing their commitment to excellent customer service and ensuring that all clients feel valued and respected.

Are There Any Investment Rarities Inc. Lawsuits?

As of the most recent available information, there are no widely reported lawsuits involving Investment Rarities Inc. This absence of significant legal disputes is notable considering the company’s long-standing presence in the precious metals market since its establishment in 1973.

The lack of publicized legal challenges suggests that Investment Rarities Inc. has managed to maintain sound business practices and adhere to industry regulations effectively. Companies in the financial and investment sectors, particularly those dealing with high-value assets like precious metals, are often scrutinized for compliance with legal standards. The absence of litigation can often be viewed as a positive indicator of a company’s commitment to operating within the boundaries of the law and handling customer transactions with integrity.

Investment Rarities Inc.’s approach to customer service may also play a significant role in avoiding legal issues. The company is known for its structured process of handling customer complaints, which involves prompt acknowledgment, thorough investigation, and fair resolution of disputes. This proactive approach to addressing client concerns helps prevent issues from escalating to the level of legal disputes.

Furthermore, the company’s emphasis on educating clients about their investments and the risks associated with precious metals trading is crucial. By ensuring that clients are well informed about the terms of their investments and the nature of the products they are purchasing, Investment Rarities Inc. reduces the potential for misunderstandings that could lead to lawsuits.

However, while the current lack of litigation is a positive aspect of Investment Rarities Inc.’s operations, it remains important for potential clients and partners to conduct their own due diligence. Continuous monitoring and reviewing of any new legal developments or complaints should be part of an investor’s research process when considering engagement with any investment firm.

Overall, the apparent absence of lawsuits against Investment Rarities Inc. contributes to the company’s reputation as a stable and trustworthy entity in the precious metals industry.

Can You Trust Investment Rarities Inc.? Is Investment Rarities Inc. Legit?

Yes,

They are reputable gold dealers with vast experience.

Before working with a precious metals company, do your research.

Here are some tips to ensure a gold IRA company’s legality:

Tip #1: Check Their Regulatory Compliance and Accreditation

Check for proper licensing and registration with relevant financial regulatory bodies such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Verify the company’s accreditation with industry organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

It will help you check how credible they are.

Tip #2: Look into The Company’s Background

- Research the company’s history, including years in business and any name changes.

- Examine the Better Business Bureau (BBB) rating and accreditation status.

- Review customer feedback on reputable third-party review sites like Trustpilot or Consumer Affairs.

Tip #3: Does the Company Offer Good Resources?

- Assess the clarity of information provided about fees, storage options, and buyback policies.

- Evaluate the quality and depth of educational resources offered to investors.

- Verify that the company provides clear information about IRS regulations regarding precious metals IRAs.

Tip #4: What are Their Product Offerings and Pricing?

- Ensure the company offers IRS-approved precious metals for IRA investments.

- Compare pricing with other reputable dealers to ensure competitiveness.

- Be wary of companies pushing numismatic or collectible coins over bullion for IRA investments.

Tip #5: Confirm the Storage and Custodian Partnerships

Verify that the company works with IRS-approved custodians and secure storage facilities. According to IRS’ regulations, you cannot store your gold IRA’s precious metals at your home.

You’ll need a certified third-party storage provider.

Check the company’s storage and custodian partner to ensure you’re working with a reliable firm. Moreover, ensure they offer segregated storage options for your precious metals.

Segregated storage means your owned precious metals products will be stored separately from other investors’ possessions. Similarly, non-segregated storage means your products will be stored along with others.

Keep in mind that storage providers charge extra for segregated storage.

Some popular custodians include Equity Trust and Goldstar Trust.

Red Flags to Watch For in Gold IRA Companies

- Promises of guaranteed returns or claims of “secret” investment strategies.

- Pressure to act immediately or make large investments without proper consideration.

- Lack of physical address or unclear company ownership structure.

- Unwillingness to provide detailed information about fees or policies in writing.

By thoroughly evaluating these aspects, investors can make an informed decision about the legitimacy and reliability of a gold IRA company. It’s crucial to conduct due diligence and, if necessary, consult with a financial advisor before making any investment decisions.

Investment Rarities Inc. Review Summary:

Investment Rarities Inc. has established itself as a respected player in the precious metals industry since its inception in 1973. Specializing in gold and silver products, the company offers a range of investment options suitable for diversifying portfolios, particularly through precious metals IRAs.

Customers generally appreciate the depth of knowledge and the quality of customer service provided by Investment Rarities Inc. The company’s commitment to educating its clients about the intricacies of precious metal investments is often highlighted in reviews. Clients have access to a wealth of resources that help them make informed decisions, which is especially beneficial for those new to precious metals investing.

One of the standout features of Investment Rarities Inc. is its comprehensive selection of products. From gold and silver coins and bars to more unique collectible items, the company caters to a diverse clientele, including both investors and collectors. The products offered are not only varied but also come from reputable sources, ensuring authenticity and quality.

However, some customers have expressed concerns regarding the transparency of the company’s fee structure. While Investment Rarities Inc. provides detailed product information, some clients find the lack of clear, upfront details about fees a bit challenging. This aspect could be improved to enhance customer satisfaction and trust.

Despite these concerns, the overall customer feedback is positive. The company’s ability to maintain a high standard of service over the years, combined with its expert handling of customer relations and complaints, contributes to its strong reputation. Clients feel supported throughout their purchasing journey, from initial inquiry through to after-sales service.

In summary, Investment Rarities Inc. is well-regarded in the precious metals market for its expertise, quality product offerings, and educational resources. While there is room for improvement in fee transparency, the company remains a solid choice for those looking to invest in precious metals.