If you’re looking to invest in a self-directed IRA, you must’ve come across IRA Financial Group.

They are a prominent company with over 13 years of industry experience.

However, are they the best option for you?

Can you trust them with your funds?

Find the answer in this detailed article:

Find the Best Gold IRA Company of Your State

About IRA Financial Group:

IRA Financial Group was formed by Adam Bergman, a former tax and ERISA lawyer who worked for some of the world’s finest firms. His principal objective evolved over time to assist retirement account members in taking advantage of the financial independence that self-directed accounts provide. After formally starting operations 13 years ago, the company has grown and is now based in Miami, Florida.

The company’s primary goal is to educate retirees on how to protect their assets by placing them in self-directed IRAs and solo 401(k)s. Furthermore, the organization uses cutting-edge banking technology to advise customers on how to make sound investments and raise the assets in their self-directed IRA, IRA, solo 401(k), or other retirement plans. Currently, the company has advised over 23,000 people on how to protect and grow their assets.

During the company’s 13-year history, their professionals have recommended customers to spend more than $4.6 billion in alternative investments. According to the testimonies on their official website, the majority of their clients regard their employees’ financial honesty as the most important reason for the company’s continuous reliability.

In truth, given my extensive expertise working in the alternative investing market, I’ve discovered several reasons why the company is so highly regarded as financial advisors. I’ll go over each of these reasons in the remainder of this essay.

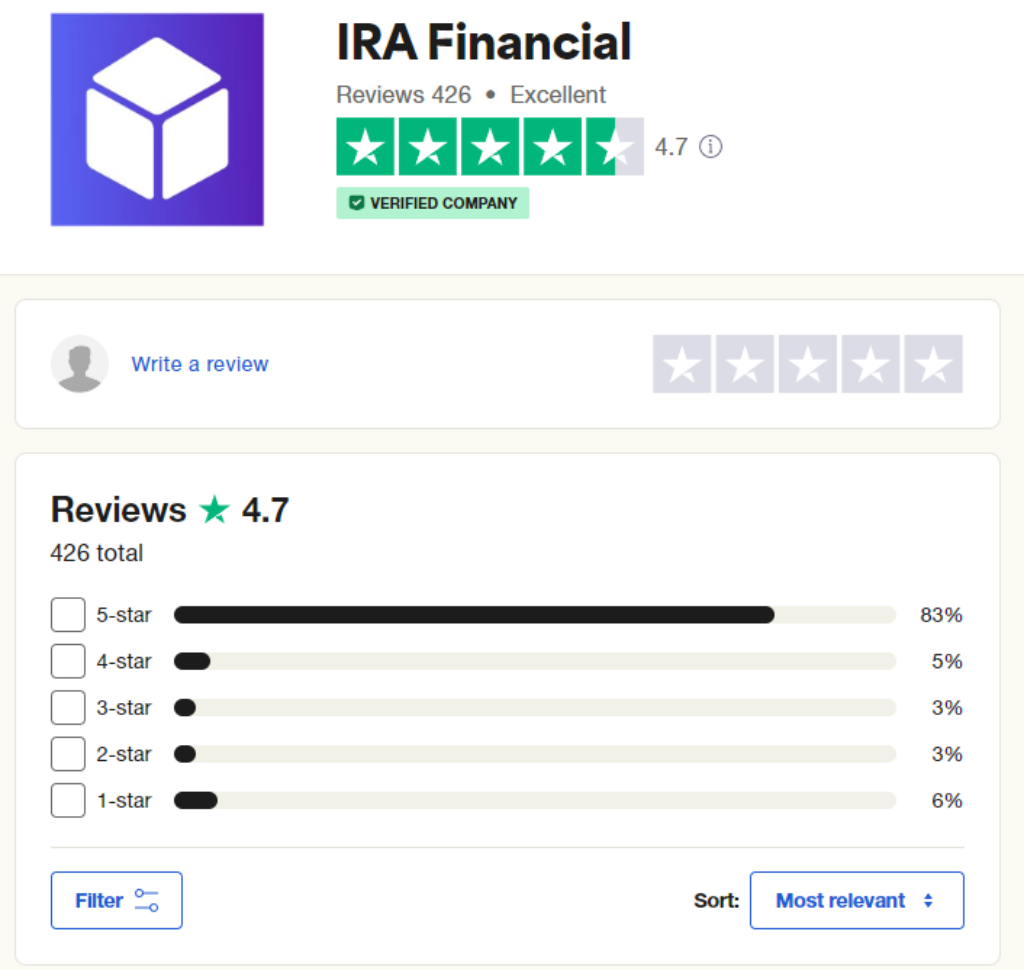

IRA Financial Group Reviews and Ratings Online:

IRA Financial Group has received various ratings across multiple review platforms, reflecting a mix of customer experiences and feedback. Here’s a summary of their ratings on several key sites:

Better Business Bureau (BBB)

– Rating: A+

– Complaints: 6 complaints closed in the last three years, with 4 closed in the past year.

– Customer Reviews: Average rating of 1.77/5 based on 13 reviews.

Trustpilot

– Rating: 4.1/5 based on approximately 110 reviews.

Google My Business

– Rating: 4.6/5 based on 219 reviews.

– Rating: 4.3/5 based on around 125 reviews, with some lower ratings noted.

Summary of Customer Feedback

Overall, customer feedback tends to highlight several strengths and weaknesses:

Strengths

– Customer Service: Many clients appreciate the responsive and knowledgeable customer service team.

– Ease of Use: Users often praise the platform for its user-friendly interface and efficient processes for managing self-directed IRAs.

– Expert Guidance: The expertise of staff in handling complex IRA matters is frequently mentioned positively.

Weaknesses

– Minor Complaints: A few customers reported issues such as unexpected fees or being targeted by scams after setting up their accounts, although these were generally resolved satisfactorily by the company.

This diverse range of ratings indicates that while IRA Financial Group is generally well-regarded, there are areas where customer experiences can vary significantly.

Examples of IRA Financial Group Reviews:

I’m sharing a few examples of IRA Financial Group reviews I found online:

Dealing with Maria Esposito had been a true pleasure. She had been knowledgeable, pleasant, organized, attentive, and to top it all off, she had been a wonderful person.

He highly recommended Maria and the Rollover Business Start Up solution provided by IRA Financial. It had been a game changer in her life and was worth every penny.

Kimberly had been extremely helpful in determining what they needed to do to manage their account effectively. She researched their account while on hold and found that more information was needed to assist them. She returned to the phone and stated that she needed to conduct further research. She mentioned that she would return their call rather than leaving them on hold for an extended period. She called back by the end of the day, within an hour, and explained exactly what they needed to do.

Maria had been the one who guided him through the entire process. IRA Financial had really assisted the business in getting off the ground, and Maria had guided them through the entire process, as it could be quite stressful. They had been looking to have a ROBS transaction for their company and found that those individuals were definitely the right choice to go with.

Certainly, the clients of IRA Financial Group are quite happy with the company and its services.

You can find plenty of positive reviews for them on Trustpilot and their website.

Fees at IRA Financial Group: Is There any Hidden Fees?

IRA Financial Group is known for its transparent fee structure, and it emphasizes that there are no hidden fees associated with its services. Here are the key points regarding their fees:

Fee Structure

- Self Directed IRA: $400 per year

- Self Directed IRA LLC: $999 setup fee, $400 annual fee

- Solo 401(k): $699 setup fee, $399 annual fee

- IRAfi Crypto: $100 per year

Transparency and No Hidden Fees

IRA Financial Group explicitly states that it does not charge additional transaction fees, asset valuation fees, or minimum balance requirements. This transparency is a significant aspect of their service model, aiming to provide clients with clarity about the costs involved in managing their retirement accounts.

Customer Feedback

Customer reviews generally support the notion that IRA Financial Group maintains a straightforward fee structure without unexpected charges. This has contributed to their positive reputation in the industry.

In summary, clients can expect a clear and upfront understanding of the fees they will incur when using IRA Financial Group’s services, with no hidden costs involved.

What Services Does IRA Financial Group Offer?

My more than two decades of experience and research into alternative investments have allowed me to identify a few key aspects that I feel contribute to the company’s dependability. The list below includes all of them.

The company allows consumers to open three distinct types of IRAs with them. All of these IRAs allow for more alternative investments than a self-directed IRA from a financial institution. That being stated, let’s take a deeper look at each one and how they differ.

Self-directed Roth IRA

The account is very similar to a regular self-directed IRA, with the only variation being how it accepts contributions made after tax. These forms of donations ensure that you do not receive an immediate tax deduction. Furthermore, any withdrawals you make in retirement are tax-free, assuming you meet certain account requirements.

Speaking of criteria, self-directed Roth IRAs have income limits that determine how much you can contribute and remove from your account. These restrictions are changed and altered to reflect your modified adjusted gross income (MAGI). If your MAGI exceeds the threshold, your contribution limitations could be reduced or possibly abolished.

Self-directed IRA

Traditional self-directed IRAs are less complicated and have fewer restrictions. In reality, self-directed IRAs developed by the IRA Financial Group give customers more options for investing in alternative investments. Aside from traditional investments in equities, bonds, and mutual funds, the company allows users to invest in:

Real Estate: Customers can choose from recently developed projects, land lots, and mobile homes while making this investment.

Precious Metals: Specifically, the company allows users to invest in less volatile gold and silver coins to diversify their portfolios.

Cryptocurrency: IRA Financial Group, one of the few financial investment businesses to do so, allows you to invest in cryptocurrencies for the long term (no trading).

This form of self-directed IRA will still require a custodian, and all investments will require the custodian’s approval. One significant advantage of opening a self-directed IRA with IRA Financial Group is that there is no minimum investment required to get started. This can be highly useful because it allows you to make crucial investments very early on.

Self-directed IRA LLC

The main distinction between a standard self-directed IRA and a self-directed IRA LLC is “checkbook control”. For this sort of IRA, the corporation creates a special purpose limited liability company (LLC) with you as the manager.

This sort of LLC is held by the IRA and managed by the IRA holder. Essentially, you have the option to choose your investments and can make them faster and with fewer expenses. In a nutshell, a self-directed IRA LLC enables the account user to avoid many of the delays and fees associated with employing a full-service IRA provider.

401(k)s

If you’re a little late in saving for your retirement, IRA Financial Group also offers the option of setting up a solo 401(k). This arrangement allows you to invest up to $60,000 in the account at once, which includes both your salary and employer deferral payments. Participants over the age of 50 can donate up to $73,500 to jumpstart their retirement savings.

The organization also allows you to withdraw up to $50,000 for emergency purposes without going through a custodian. More crucially, setting up a solo 401(k) is substantially less expensive than setting up a self-directed IRA LLC since it eliminates the need to set aside cash for the formation of an LLC under your name.

Individuals in IRA Financial Group’s solo 401(k) plans can make any type of alternative investment that falls under the Internal Revenue Code. Individuals who want to set up a solo 401(k) must meet certain eligibility requirements. That’s because the solo 401(k) is an IRS-sponsored retirement plan for sole entrepreneurs, consultants, and enterprises with no full-time employees. Keeping that in mind, organizations must meet two qualifying conditions to set up a solo 401(k):

- Being self-employed

- Absence of full-time employees and IRA rollovers

After registering on their app, IRA Financial Group facilitates the transfer of cash from your existing retirement account to the newly established IRA. In fact, their pros are constantly ready to help you with your direct buy and rollover needs.

The company allows rollovers from the following retirement accounts:

- IRAs (individual retirement accounts)

- Roth IRA, assuming that the investor pays taxes on the converted money.

- SEP plans include 401(k)s and 403(b)s.

Their customer service representatives guide you through the entire procedure step by step and even educate you about which investment accounts are not eligible for rollovers into your IRA.

The ROBS Option

Rollovers as Business Startups (ROBS) is one of the IRA Financial Group’s most unusual investment alternatives.

The first step in IRA Financial Group’s ROBS Solution is to form a corporation using any “XYZ” name. This organization is then transformed into a firm that you totally own. After that, you can utilize cash from your IRA or another retirement account to recompense the corporation before getting any personal compensation. This method facilitates the production of tax-free dividends from these transactions.

Essentially, the ROBS solution allows you to invest in your own or someone else’s small business without having to pay any fines when you withdraw assets from your retirement accounts to use as a down payment on a firm.

Opening a self-directed IRA with IRA Financial Group involves several steps. Here’s a general guide on how you can proceed:

1. Contact IRA Financial Group

- Initial Inquiry: Start by visiting their website or calling their customer service. You can schedule a free consultation to speak with a specialist about your needs and the process of opening a self-directed IRA.

- Learn About Your Options: During your consultation, you’ll learn about the different types of self-directed IRAs available (traditional, Roth, SEP, SIMPLE, etc.), and how their services work.

2. Choose the Type of Self-Directed IRA

- Traditional IRA: Tax-deferred contributions. You pay taxes when you withdraw the funds in retirement.

- Roth IRA: Contributions are made with after-tax dollars, and withdrawals in retirement are tax-free.

- SEP IRA or SIMPLE IRA: These are for self-employed individuals or small business owners who want to set up retirement plans for themselves and their employees.

3. Submit the Application

- Fill Out the Application: IRA Financial Group provides an online application form. This will require personal information, your selected IRA type, beneficiary details, and how you want to fund the account (transfer, rollover, or contribution).

- Submit Documents: You may need to provide documents such as identification and previous retirement account statements if you are transferring or rolling over funds.

- Review Fees: Make sure to understand the fee structure for managing your self-directed IRA. Fees may include setup costs, annual maintenance fees, and transaction fees depending on the investments.

4. Fund the IRA

- Transfer or Rollover: You can move funds from another retirement account, such as a 401(k) or a traditional IRA, into the self-directed IRA without penalty if done correctly. IRA Financial Group will guide you through the transfer or rollover process.

- Direct Contribution: You can contribute funds directly into the account (subject to IRS contribution limits based on the type of IRA).

5. Start Investing

- Choose Investments: Once your self-directed IRA is set up and funded, you can begin making investments. IRA Financial Group allows you to invest in a wide range of assets, including:

- Real estate

- Private companies

- Precious metals

- Cryptocurrency

- Tax liens

- Promissory notes, and more.

- Investment Documentation: Ensure that all investments comply with IRS rules and that you maintain proper documentation. IRA Financial Group will help guide you through the paperwork required to make your investments.

6. Ongoing Management

- Manage the Account: After your self-directed IRA is established, you are responsible for managing your investments, but IRA Financial Group can provide support for administrative and compliance-related matters.

- Monitor Fees and Compliance: Self-directed IRAs have specific rules, such as prohibited transactions and disqualified persons, which you must follow to avoid penalties. IRA Financial Group can assist with ensuring compliance with IRS regulations.

7. Access Online Dashboard

- You’ll likely be given access to IRA Financial’s online platform, which allows you to manage your account, track investments, and communicate with their support team.

The entire process can be completed in as little as 10-15 days, depending on how quickly funding is transferred from your existing account. Keep in mind that IRA Financial Group is a custodian and administrator for self-directed IRAs but does not provide investment advice, so you’ll be responsible for choosing and managing your investments.

To get started, you can visit the IRA Financial Group website or call them to initiate the process.

Is There Any IRA Financial Group Lawsuit?

In 2022, IRA Financial Group (aka IRA Financial Trust) had sued the crypto exchange named Gemini.

The IRA Financial complaint alleged that Gemini had failed to protect its clients’ assets, claiming that a series of security measures had all failed once thieves exploited IRA Financial’s “master key” on Feb. 8.

“IRA had learned – through difficult experiences, as explained below – that whoever possessed the master key could bypass all the supposed security protections,” the complaint stated. Gemini had never informed IRA about the power of that master key.

A spokesperson for Gemini stated to CoinDesk that they rejected the allegations in the lawsuit. They claimed that their security standards were among the highest in the industry and that they were constantly updating them to ensure their customers were always protected. In this matter, as soon as IRA Financial notified them of the security incident, they acted quickly to mitigate the loss of funds from the accounts.

Additionally, IRA Financial Group has been subject to another lawsuit involving allegations of unauthorized telemarketing practices. This class-action lawsuit accused the company of making unsolicited calls to individuals whose numbers were listed on the National Do Not Call Registry.

This practice, if proven, would violate the Telephone Consumer Protection Act, which protects consumers from unsolicited telemarketing calls.

How IRA Financial Trust Ensures Your Assets Remain Secure:

IRA Financial Group has established itself as a trustworthy provider in the self-directed IRA and Solo 401(k) markets through several key practices and features. Their commitment to security, transparency, customer education, and compliance with regulatory standards all contribute to their credibility. Here’s a detailed look at what makes IRA Financial Group trustworthy:

1. Comprehensive Compliance and Expertise

IRA Financial Group is well-regarded for its expertise in the complex arena of self-directed retirement solutions. The company’s staff includes tax professionals and financial experts who are well-versed in IRS regulations, ensuring that their clients’ retirement plans are compliant with current laws and regulations. This deep expertise not only helps clients navigate the complexities of retirement planning but also secures IRA Financial Group’s standing as a reliable authority in the field.

2. Dedicated Customer Education

IRA Financial Group places a strong emphasis on educating their clients, which is fundamental for those engaging with self-directed IRAs and Solo 401(k)s, where investors have more control over their investment choices. They provide a wealth of educational resources, including articles, blogs, podcasts, and videos that cover various aspects of retirement planning and investment strategies. This dedication to educating their clients helps build transparency and trust, as well-educated investors are more likely to understand and navigate potential risks effectively.

3. Robust Security Measures

After experiencing a significant cyber attack that resulted in the loss of $36 million in cryptocurrency from customer accounts, IRA Financial Group has likely increased its focus on cybersecurity measures. Such measures are crucial in the digital age, particularly when managing high-value assets and sensitive personal information. Enhancing security protocols and infrastructure is not only necessary for protecting against further attacks but also critical in restoring and maintaining client trust.

4. Personalized Customer Service

IRA Financial Group offers personalized customer service, where clients can directly contact their specialists, which enhances the customer experience and trust. Personalized service ensures that clients’ unique investment needs and questions can be addressed promptly and accurately, allowing for a more tailored investment strategy that aligns with individual financial goals.

5. Transparency in Fee Structure

Transparency is key to trustworthiness in the financial services industry. IRA Financial Group openly discloses their fee structures without hidden costs, which garners significant trust from clients. Understanding exactly what fees are paid and what services are provided removes a lot of the mystery and unease that can come with financial investments.

6. Positive Customer Reviews and High Ratings

IRA Financial Group generally receives positive reviews across various consumer platforms. High ratings and positive feedback from existing clients attest to the company’s reliability and quality of service, further cementing its reputation as a trustworthy provider.

7. Innovative Solutions

The company stays at the forefront of retirement investment options, offering innovative solutions like the ability to invest in cryptocurrencies and real estate through IRAs. This not only provides clients with diverse investment options but also demonstrates IRA Financial Group’s commitment to leveraging technology and new market trends to benefit their clients.

IRA Financial Group’s dedication to compliance, customer education, security, transparency, and personalized service are pivotal in making it a trustworthy option for managing self-directed IRAs and Solo 401(k)s. As with any financial services provider, potential clients should conduct their own due diligence, but IRA Financial Group’s established track record and proactive measures in addressing past issues speak to their integrity and commitment to their clients’ financial success.

Consultation and Client Education

Aside from my extensive research and understanding, the IRA Financial Group serves as the “fund administrator” for any IRAs you establish with them. This involves offering regular consultations and educational materials on any and all alternative investments their customers may make.

Aside from that, the organization is committed to better educating their consumers about the investment industry through their website’s learn center.

This learning hub provides a number of useful resources:

You will find a link to the company’s YouTube account, which contains a large collection of well-organized videos. These films offer critical insights for new investors, covering the fundamentals of solo 401(k)s and IRAs. Furthermore, the creator will give discussions on important topics such as prohibited transactions, investment account loans, and the debut of their new IRAfi cryptocurrency platform.

You’ll also find a link to the company’s financial blog, which is strategically created to educate clients on many important themes in the investment sector.

Furthermore, the learning center links to the company’s podcast network, which includes a wide range of investment-related podcasts produced by the company’s creator, Adam Bergman.

After more than two decades of experience in the alternative investments market, I believe this is the most essential one the organization offers. Simply because the education they provide is free and has the potential to empower several generations in terms of knowing their investing options.

Is IRA Financial Group Legit?

Yes, IRA Financial Group is a legit company.

They have been operating in the industry for more than a decade and enjoy a positive reputation.

However, to make sure that you only work with legit companies, it’s best to do proper research.

Below are some tips:

Tip #1: Check Their Regulatory Compliance and Accreditation

Check for proper licensing and registration with relevant financial regulatory bodies such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Verify the company’s accreditation with industry organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

It will help you check how credible they are.

Tip #2: Look into The Company’s Background

- Research the company’s history, including years in business and any name changes.

- Examine the Better Business Bureau (BBB) rating and accreditation status.

- Review customer feedback on reputable third-party review sites like Trustpilot or Consumer Affairs.

Tip #3: Does the Company Offer Good Resources?

- Assess the clarity of information provided about fees, storage options, and buyback policies.

- Evaluate the quality and depth of educational resources offered to investors.

- Verify that the company provides clear information about IRS regulations regarding precious metals IRAs.

Tip #4: What are Their Product Offerings and Pricing?

- Ensure the company offers IRS-approved precious metals for IRA investments.

- Compare pricing with other reputable dealers to ensure competitiveness.

- Be wary of companies pushing numismatic or collectible coins over bullion for IRA investments.

Tip #5: Confirm the Storage and Custodian Partnerships

Verify that the company works with IRS-approved custodians and secure storage facilities. According to IRS’ regulations, you cannot store your gold IRA’s precious metals at your home.

You’ll need a certified third-party storage provider.

Check the company’s storage and custodian partner to ensure you’re working with a reliable firm. Moreover, ensure they offer segregated storage options for your precious metals.

Segregated storage means your owned precious metals products will be stored separately from other investors’ possessions. Similarly, non-segregated storage means your products will be stored along with others.

Keep in mind that storage providers charge extra for segregated storage.

Some popular custodians include Equity Trust and Goldstar Trust.

Red Flags to Watch For in Gold IRA Companies

- Promises of guaranteed returns or claims of “secret” investment strategies.

- Pressure to act immediately or make large investments without proper consideration.

- Lack of physical address or unclear company ownership structure.

- Unwillingness to provide detailed information about fees or policies in writing.

By thoroughly evaluating these aspects, investors can make an informed decision about the legitimacy and reliability of a gold IRA company. It’s crucial to conduct due diligence and, if necessary, consult with a financial advisor before making any investment decisions.

FAQs on IRA Financial Group:

IRA Financial Group frequently receives inquiries regarding its services and offerings. Here are some common questions and answers about the company:

What is IRA Financial Group?

IRA Financial Group is a financial services firm founded in 2010 by Adam Bergman, aiming to help individuals manage self-directed IRAs. The company specializes in providing guidance for investing in both traditional and alternative assets, including real estate, cryptocurrencies, and precious metals.

How does IRA Financial Group work?

The firm operates as a custodian-controlled IRA provider, allowing clients to create and manage their retirement accounts with a focus on alternative investments. Their process typically involves:

- Account Creation: Clients register through the IRA Financial app.

- Asset Transfer: Funds can be rolled over from existing retirement accounts.

- Investment Guidance: IRA Financial provides advice on suitable investment options tailored to individual goals.

What types of investments can I make with an IRA from IRA Financial Group?

Clients can invest in a wide range of assets, including:

- Real Estate: Such as rental properties and raw land.

- Cryptocurrencies: Including Bitcoin and Ethereum through their IRAfi Crypto™ app.

- Precious Metals: Gold, silver, platinum, and palladium.

- Private Equity and Business Ventures: Utilizing structures like ROBS (Rollovers as Business Startups).

What are the fees associated with IRA Financial Group?

IRA Financial Group offers a flat fee structure with no hidden charges, making it easier for clients to understand their costs. Specific fees can vary based on the type of account and services selected, but they emphasize transparency in their pricing model.

How long does it take to set up an account?

Setting up a self-directed IRA typically takes about 2-3 days. The company handles all necessary IRS reporting and paperwork to facilitate the transfer of funds into the new account.

Can I withdraw funds from my IRA?

Yes, clients can withdraw funds under certain conditions. For instance, individuals can withdraw up to $50,000 for emergencies without needing custodian approval when using a solo 401(k) plan.

Is there support available for clients?

IRA Financial Group provides access to experienced specialists who offer dedicated support throughout the investment process. Their team includes tax and ERISA experts who assist clients in navigating their investment options effectively.

These FAQs provide insight into how IRA Financial Group operates and what potential clients can expect when considering their services for retirement planning.