Whether you’re a cautious investor or a gold enthusiast, you might have come across the name of Patriot Gold Group.

They are a prominent gold IRA provider with a significant product catalog.

But, are they worth your money?

How is their track record?

How much fees do they charge?

This Patriot Gold Group review will help you find answers to these questions and more.

I’ll be going over their fees, products, services, and all other aspects possible.

This way, you can get a clear idea of whether Patriot Gold Group is legit or not.

Find the Best Gold IRA Company of Your State

About Patriot Gold Group: A Brief Overview

| Category | Details |

|---|---|

| Fees | – IRA Setup Fee: $225 (waived for investments over $30,000) |

| – Storage Fees: $250 for the first year, $200 annually thereafter | |

| – No Fees for Life: Available for accounts with a balance of $250,000 | |

| Pricing | – Minimum Investment: $25,000 for Investor Direct Pricing |

| – First-Year Rollover Cost Reimbursement: $260 | |

| Products | – Physical Metals: Gold and silver coins, bullion bars |

| – IRA-Eligible Coins: Includes exclusive and proof coins from the U.S., Canada, Australia | |

| – Types of Metals: Gold, silver, platinum, palladium | |

| Unique Highlights | – A+ BBB Rating: Indicates strong customer service and reliability |

| – 24-Hour Account Setup: Quick and efficient account creation process | |

| – Direct Owner Interaction: Clients work directly with company owners | |

| – Conditional No Fees for Life IRA: Potential savings on annual fees | |

| Online Ratings | – Generally positive reviews across various platforms, highlighting customer service and transparency. Ratings vary but typically reflect satisfaction with services provided. |

Patriot Gold Group offers a range of investment options in precious metals, with competitive pricing structures and unique benefits tailored to investors looking to diversify their portfolios through IRAs.

What is Patriot Gold Group?

Patriot Gold Group is a precious metals dealer specializing in helping individuals invest in gold and other precious metals, particularly through Gold IRAs (Individual Retirement Accounts). The company focuses on offering gold and silver coins, bars, and bullion to investors, as well as assisting with the setup and management of self-directed IRAs that include these precious metals.

Key Features of Patriot Gold Group:

- Gold and Silver IRAs: Patriot Gold Group helps investors open self-directed IRAs that allow investments in physical gold, silver, and other precious metals. This is an attractive option for those looking to diversify their retirement portfolios and hedge against economic instability or inflation.

- No Fee for Life IRA: They offer a “No Fee for Life” IRA option for eligible accounts, which may waive storage and custodial fees for larger investments (usually over $100,000). This is a unique feature that differentiates them from other Gold IRA providers.

- Competitive Pricing: Patriot Gold Group is known for offering competitive pricing on precious metals, often emphasizing that they allow investors to buy directly from dealers, avoiding middlemen and ensuring cost savings.

- Personalized Service: The company places a strong emphasis on customer service, with specialists guiding clients through the process of setting up a Gold IRA, purchasing metals, and ensuring compliance with IRS regulations. They are particularly recognized for their customer-focused approach.

- Wide Range of Precious Metals: In addition to gold and silver, they also provide access to platinum and palladium, catering to various investor preferences.

- Trust and Ratings: Patriot Gold Group has received favorable ratings from customers and industry watchdogs, such as the Better Business Bureau (BBB) and Trustpilot, for its transparency and client satisfaction.

How Patriot Gold Group Works:

- Account Setup: To invest in a Gold IRA, Patriot Gold Group assists clients in setting up a self-directed IRA with an approved custodian.

- Fund Transfer: Clients can transfer funds from their existing retirement accounts, such as a 401(k) or traditional IRA, to the self-directed Gold IRA without triggering any tax penalties if the process follows IRS guidelines.

- Precious Metals Purchase: After the account is funded, investors can purchase approved precious metals (e.g., gold, silver, platinum) which are then stored in an IRS-approved depository.

- Secure Storage: Patriot Gold Group partners with IRS-approved depositories to ensure that the physical metals are securely stored and remain compliant with tax regulations.

Patriot Gold Group is perfect for those seeking to enhance their retirement savings by investing in precious metals.

Through competitive pricing, exceptional customer service, and tailored Gold IRA offerings, the company has established itself as a top contender in the precious metals investment sector.

This option is especially attractive to individuals looking for enduring stability in their retirement investments.

Also read: Gold IRA Tax Rules

Who are the People Behind Patriot Gold Group?

Patriot Gold Group is led by a team of experienced professionals with diverse backgrounds in finance, geology, and precious metals. Here are the key figures behind the company:

Jack Hanney

- Position: Chief Executive Officer, Co-Owner, Senior Partner

- Experience: Over 15 years in sales and trading, previously held senior roles at major precious metals firms. Hanney founded Patriot Gold Group with a focus on a client-centered approach to gold and silver investments, emphasizing transparency and education in the market.

Andy Clay

- Position: Senior Portfolio Manager

- Experience: Extensive background in managing investment portfolios, particularly in precious metals and retirement accounts. Clay plays a crucial role in guiding clients through their investment strategies.

Larrin Devereaux

- Position: Chief Marketing Officer

- Experience: Responsible for marketing strategies that enhance the visibility and reputation of Patriot Gold Group within the industry. His efforts focus on client engagement and education about precious metal investments.

Trevor Newton

- Position: President, Director

- Experience: A founding shareholder with a strong background in the resource sector. Newton has expertise in financing and project development, holding degrees in Economics from the University of Victoria and Simon Fraser University.

Zachary Black

- Position: Director

- Experience: A resource geologist with over 15 years of experience in mining operations and geological exploration. Black is recognized for his expertise in geostatistical modeling and mineral resource estimation.

Robert Coale

- Position: Chairman of the Board

- Experience: A professional engineer with over 60 years of experience in resource-related business management. Coale specializes in property evaluation and mineral processing, contributing significant industry knowledge to the board.

This leadership team combines extensive experience across various sectors to provide clients with informed guidance on precious metal investments, reinforcing Patriot Gold Group’s commitment to exceptional customer service and transparency.

Does Patriot Gold Group Offer IRA Services?

Yes, Patriot Gold Group offers Gold IRAs as part of their services, allowing investors to include physical gold and other precious metals in their retirement accounts. Here’s how it works:

1. Opening a Self-Directed IRA

- To start investing in a Gold IRA, Patriot Gold Group helps you set up a self-directed IRA. This type of IRA allows investments in alternative assets, including precious metals, instead of the more common stocks and bonds.

2. Choosing a Custodian

- A custodian is required to manage your Gold IRA account. Patriot Gold Group works with trusted custodians who are IRS-approved to handle precious metals. The custodian ensures that all regulatory requirements are met.

3. Fund Transfer or Rollover

- You can transfer funds from an existing IRA, 401(k), or another qualified retirement account into your new Gold IRA. This process is tax-free, as long as it adheres to IRS guidelines, especially regarding timing (60 days to complete a rollover).

4. Purchasing Gold

- Once your account is funded, you can purchase IRS-approved physical gold (at least 99.5% pure) through Patriot Gold Group. They offer a variety of products, including gold bullion and coins. You may also purchase other precious metals like silver, platinum, or palladium, depending on your investment strategy.

5. Storage in an Approved Depository

- The gold and other precious metals in your IRA must be stored in an IRS-approved depository, not at home or in a personal safe. Patriot Gold Group assists in arranging secure storage, and you typically have a choice between segregated (your metals stored separately) or commingled storage (your metals stored with other investors’ assets).

6. Managing the Account

- The custodian manages the account, including paperwork, reporting, and compliance with IRS rules. You will be able to monitor your investment and work with Patriot Gold Group to make any adjustments, like adding more metals to your IRA or rebalancing your portfolio.

7. Taking Distributions

- When you reach retirement age (typically 59½ or older), you can take distributions from your Gold IRA. You have two options: liquidating the gold for cash or receiving the actual physical gold. If you take early distributions, taxes and penalties may apply, just like with any other IRA.

Benefits of a Gold IRA with Patriot Gold Group:

- Portfolio Diversification: Adding gold to your retirement portfolio helps reduce risk by diversifying away from more volatile assets like stocks.

- Hedge Against Inflation: Gold is often seen as a hedge against inflation and currency devaluation, which can protect your wealth over time.

- No Fee for Life IRA: For qualifying investments (generally $100,000 or more), Patriot Gold Group offers a “No Fee for Life” IRA, meaning custodial and storage fees are waived.

In summary, Patriot Gold Group provides a seamless process for setting up and managing a Gold IRA, helping investors incorporate physical gold into their retirement savings strategy. This service is especially appealing for those seeking long-term security and protection from market volatility.

The Buyback Program by Patriot Gold Group

Yes, Patriot Gold Group offers buyback services to its customers. This service allows investors to sell their precious metals, such as gold or silver, back to the company when they decide to liquidate their assets or take a distribution from their Gold IRA.

How the Buyback Program Works:

- Request a Buyback: When you’re ready to sell your gold or other precious metals, you can contact Patriot Gold Group to initiate the buyback process. They typically provide a smooth and straightforward process for existing clients.

- Offer Price: Patriot Gold Group will provide you with a buyback offer based on the current market price of gold or the precious metal in question. The price they offer will depend on factors such as market conditions and the form of the metal (bullion, coins, etc.).

- Shipping and Verification: After agreeing to the buyback offer, you’ll need to ship the metals back to the company or the depository where they are stored. Once received, Patriot Gold Group will verify the authenticity and purity of the metals before completing the transaction.

- Payment: After the metals are authenticated, Patriot Gold Group will issue payment. Payment can be made in various forms, such as a check or bank transfer, depending on your preference.

Key Features of the Buyback Program:

- No Penalties: If you’re selling back metals as part of an IRA distribution, there are no additional penalties from Patriot Gold Group itself, but you will need to be mindful of any applicable taxes based on IRS regulations.

- Transparency: Patriot Gold Group is known for its transparency in the buyback process, offering fair market rates and clear communication throughout the process.

This buyback service can be an important feature for investors looking to liquidate their gold holdings without navigating the secondary market, providing a convenient and trusted option to turn precious metals back into cash.

Patriot Gold Group Products:

When it comes to investing in precious metals, Patriot Gold Group stands out as a reputable dealer that offers a variety of products designed to cater to both new and seasoned investors. Known for their customer-centric approach and extensive product lineup, let’s delve into the diverse options available through Patriot Gold Group.

Gold Investment Products

Gold Coins:

Patriot Gold Group offers a range of gold coins, which are favored by investors for their collectible value and gold content. Popular choices include:

- American Eagle Gold Coins: Known for their beautiful design and government guarantee for weight and purity.

- Canadian Maple Leaf Gold Coins: Prized for their high purity and recognition globally.

- Australian Kangaroo Gold Coins: They stand out with their unique designs and .9999 fine gold purity.

These coins are not only a form of investment but also a piece of history that can be passed down through generations.

Gold Bars:

For those looking at a more straightforward investment, gold bars can be a more cost-effective way to purchase gold due to their lower premiums over spot price compared to coins. Patriot Gold Group offers gold bars in various sizes from 1 gram to 1 kilogram, catering to different investment scales.

Silver Investment Products

Silver Coins:

- American Silver Eagles: One of the most sought-after silver coins, they are recognized worldwide.

- Canadian Silver Maple Leafs: Offered with new security features and exceptional purity.

- Silver Rounds: Produced by various private mints, these rounds come in many designs and sizes.

Silver coins are a popular choice for those looking to diversify their investment portfolios without a significant upfront investment.

Silver Bars:

Patriot Gold Group provides silver bars that are typically more budget-friendly per ounce than coins, making them an excellent option for bulk investments. These bars are available in standard sizes like 10 oz, 1 kg, and 100 oz.

Platinum and Palladium Options

For investors interested in metals with industrial demand, Patriot Gold Group also offers platinum and palladium products:

- Platinum Coins and Bars: These are less common but have a steady demand in industrial applications, making them a niche but potentially lucrative investment.

- Palladium Bars: As a rare metal used heavily in the automotive industry, palladium bars are available for those looking to diversify further.

IRA-Eligible Precious Metals

Patriot Gold Group shines in providing options for those looking to include precious metals in their retirement plans. Many of their products are IRA-eligible, meaning they meet the purity and fineness standards required for inclusion in precious metals IRAs. This includes certain gold, silver, platinum, and palladium options, providing a robust selection for tax-advantaged investing.

Why Choose Patriot Gold Group?

Expertise and Guidance:

Patriot Gold Group isn’t just about selling precious metals; they are committed to educating their clients. They offer personalized service and investment guidance tailored to individual financial goals, which is especially valuable for those new to precious metals.

Customer Service:

Highly rated for customer service, they make the investment process smooth and straightforward. The team at Patriot Gold Group is known for their transparency and dedication to customer satisfaction.

Security and Trust:

With a strong reputation in the industry and favorable reviews across various platforms, investing with Patriot Gold Group offers peace of mind alongside the potential for financial growth.

Whether you are an experienced investor or just starting out, Patriot Gold Group offers a comprehensive range of precious metals products that can enhance your investment portfolio. Their commitment to quality service and extensive selection makes them a preferred choice for precious metals investors.

Patriot Gold Group Fees and Pricing

Patriot Gold Group, like many precious metals dealers, typically charges several types of fees associated with the purchase, storage, and management of precious metals, especially when these metals are held within an IRA. Here’s a breakdown of common fees you might encounter:

1. IRA Fees

- Setup Fees: This one-time fee is charged when you open a new IRA account. The amount can vary but is generally around $50 to $100.

- Annual Maintenance Fees: IRA accounts incur annual fees for account maintenance and administrative services provided by the custodian. These fees are typically around $75 to $250 per year, depending on the custodian and the specifics of the services offered.

2. Storage Fees

- Annual Storage Fees: Precious metals need to be stored securely, usually in third-party depositories. The annual storage fee can be a flat rate or a percentage of the value of the stored metals, generally ranging from $100 to $300 per year.

3. Commission Fees

- Sales Commissions: When buying precious metals, Patriot Gold Group may charge a commission that covers the facilitation of the transaction. The rate can vary based on the type and volume of metals purchased.

4. Buyback Fees

- While not a fee directly charged, when selling metals back to Patriot Gold Group, the buyback price is typically slightly below the market rate, effectively serving as a cost to the seller.

5. Shipping and Handling Fees

- Shipping Fees: For direct purchases that require shipping, fees depend on the insurance value and the shipping method. Some promotions may offer free shipping.

6. Miscellaneous Fees

- Wire Transfer Fees: If you’re making payments via wire transfer, your bank may charge you a fee, which is not a fee from Patriot Gold Group but still a cost to consider.

Patriot Gold Group often highlights their “no fee for life” IRA under certain conditions, such as maintaining a minimum investment amount. This can include waiving fees for account setup, maintenance, and storage under those qualifying conditions, which can be a significant saving for eligible investors.

For the most accurate and specific details on the current fee structure, it would be best to directly consult Patriot Gold Group’s website or contact their customer service. They can provide a detailed and personalized breakdown of all applicable fees based on your particular investment choices and amounts.

Patriot Gold Group’s Custodian and Storage Partners:

Patriot Gold Group partners with several custodians and storage facilities to provide services for their precious metals IRA accounts. These partnerships allow them to offer secure and compliant storage options and administrative services necessary for the proper management of a precious metals IRA. Here’s a general overview of the types of entities typically involved:

Custodians

The custodian is responsible for the security and administration of the IRA assets. Custodians approved by the IRS for precious metals IRAs are typically financial institutions like banks, trust companies, credit unions, or brokerage firms that are licensed and regulated. Patriot Gold Group usually works with custodians who specialize in precious metals and are well-versed in the specific requirements for these types of investments. Popular choices in the industry include:

- Equity Trust Company

- GoldStar Trust Company

- Strata Trust Company

- Self Directed IRA Services (Horizon Bank)

These custodians help ensure that the IRA is compliant with all IRS rules and regulations, including those related to contributions, distributions, and allowable investments.

Storage Facilities

For the physical storage of precious metals, Patriot Gold Group collaborates with high-security depositories that specialize in storing gold, silver, platinum, and palladium. These facilities are insured and certified, providing a safe environment for investors’ precious metals. Common storage options include:

- Delaware Depository: A highly secure facility that offers segregation and non-segregation storage options, known for its comprehensive insurance coverage.

- Brink’s Global Services: Renowned for its secure transportation and storage solutions, Brink’s provides a global network of vaults including locations in major markets such as New York, Salt Lake City, and Los Angeles.

The choice of custodian and storage facility can depend on the investor’s preferences, the types of metals purchased, and the specific services each partner offers. It’s crucial for investors to understand the terms of storage, including the fees, security measures, insurance coverage, and access to their metals.

Patriot Gold Group Reviews and Ratings:

Patriot Gold Group is a notable firm in the precious metals industry, celebrated for its customer-centric approach and dedication to transparency. Prospective investors and industry watchers often turn to review platforms to gauge the reliability and service quality of companies like Patriot Gold Group. Here’s an in-depth analysis of Patriot Gold Group’s customer ratings across several key review platforms, illustrating the company’s standing in the market.

Better Business Bureau (BBB)

Overview:

Patriot Gold Group boasts an A+ rating from the BBB, a mark that signifies trust and integrity in its business practices. This rating is based on factors like the company’s interaction with customers, the handling of customer complaints, and transparency in business operations. An A+ rating is the highest possible mark from the BBB, indicating that Patriot Gold Group meets the Bureau’s rigorous standards for business conduct.

Customer Reviews:

The company holds an average of 4 out of 5 stars from customer reviews on the BBB site, which suggests generally favorable feedback but also room for some improvement. The absence of registered complaints indicates that while minor issues may arise, they are typically resolved to the customer’s satisfaction without escalating to formal grievances.

Trustpilot

Overview:

Trustpilot scores Patriot Gold Group at 5 out of 5 stars, based on hundreds of reviews. This platform allows verified buyers to share their experiences, providing potential customers with insight into the company’s service quality and product satisfaction.

Customer Feedback:

Reviewers on Trustpilot frequently commend Patriot Gold Group for its knowledgeable staff and responsive customer service. Many reviews highlight the company’s ability to provide detailed and helpful guidance on investments, making it a preferred choice for both new and seasoned precious metals investors.

Google Reviews

Overview:

On Google, Patriot Gold Group has achieved an impressive average rating of 4.9 out of 5 stars. This nearly perfect score from a large number of reviews points to a consistent level of high customer satisfaction and strong business performance.

Key Highlights:

Customers appreciate the straightforward and personal interaction they receive from the company, noting that the team at Patriot Gold Group is both professional and accommodating, ensuring a smooth transaction process.

Consumer Affairs

Overview:

With a perfect 5-star rating on Consumer Affairs, Patriot Gold Group stands out for its exceptional customer service and reliable delivery of services. This platform confirms the authenticity of its reviews through stringent verification processes, ensuring that all feedback is genuine and reflective of true customer experiences.

Positive Reviews:

Reviews on Consumer Affairs often highlight the company’s expertise in precious metals and the ease of setting up a Gold IRA. Many customers report positive outcomes from their investments, praising the personalized advice and ongoing support offered by Patriot Gold Group.

The consistently high ratings and positive reviews across multiple platforms suggest that Patriot Gold Group has built a solid reputation in the precious metals market. The company is praised for its integrity, expertise, and customer-focused approach, making it a reliable choice for those looking to invest in precious metals. As always, investors are encouraged to perform their due diligence and consider all aspects of customer feedback when choosing to invest with any firm.

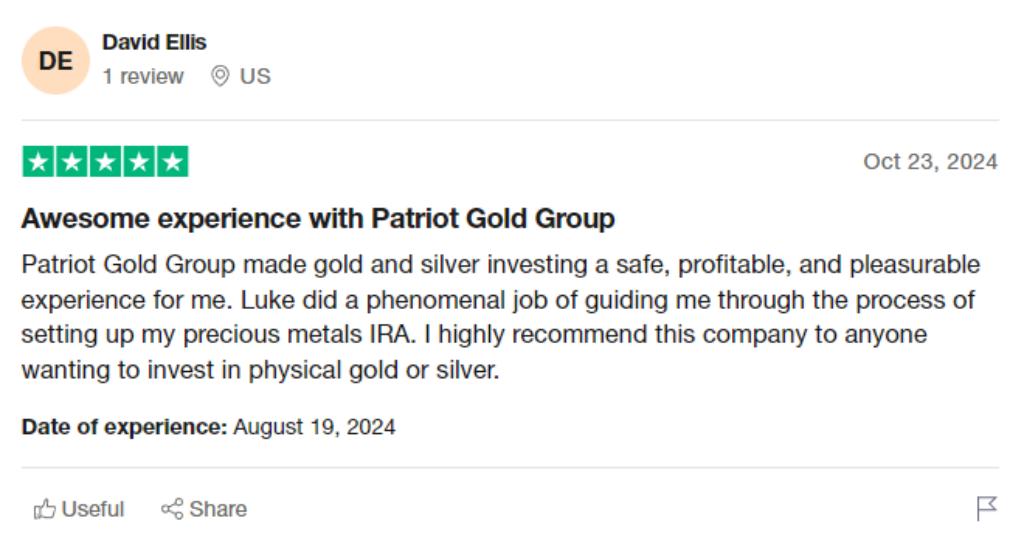

Examples of Patriot Gold Group Reviews:

In this section, I’m sharing a few examples of Patriot Gold Group reviews.

They will give you an idea of what to expect when working with them:

Patriot Gold Group had made gold and silver investing a safe, profitable, and pleasurable experience for them. Luke had done a phenomenal job of guiding him through the process of setting up his precious metals IRA. He highly recommended that company to anyone who wanted to invest in physical gold or silver.

They had recently worked with Michael C. at Patriot Gold Group, and they couldn’t have been more satisfied with the experience. Setting up the Gold IRA had been incredibly easy, and transferring the funds had been a smooth and hassle-free process. Michael demonstrated professionalism and knowledge, addressing all of the questions posed and instilling confidence throughout the entire process. They had peace of mind knowing that they had diversified their portfolio with gold and silver as assets. Since making the purchase, there had already been some solid growth, and there was anticipation for the long-term benefits.

They began by expressing their admiration for the company, noting that from the moment they asked questions to the completion of their purchase, everything went smoothly. Tim Ranson was the broker who explained everything that was needed to make an informed decision. He guided her through the application process and collaborated with her IRA company for the transfer. They could not have asked for a more flawless and quick transaction.

Are There Any Patriot Gold Group Complaints?

While Patriot Gold Group consistently obtains good rankings for customer satisfaction, it, like any other firm, has had some consumer complaints. These issues are relatively rare and are usually addressed quickly by the company.

Complaints frequently revolve around the clarity of communication regarding costs and the mechanics of gold IRA transactions. Some consumers have voiced concern with receiving specific information in writing or asking clarification on custodial relationships and cost structures.

However, it’s important to note that these complaints do not appear to represent a widespread or systemic issue within the company.

Patriot Gold Group actively engages with customers to resolve complaints and has demonstrated a commitment to maintaining high standards of customer service. This engagement is reflected in the company’s responses on platforms such as the Better Business Bureau (BBB) and Trustpilot, where they attempt to address and resolve any issues raised by customers.

Overall, the volume of complaints is low compared to the number of positive reviews, suggesting that most customers are satisfied with their services and customer support.

How Patriot Gold Group Resolves Complaints:

Patriot Gold Group takes a proactive approach to resolving customer complaints, emphasizing customer satisfaction and continuous service improvement. Based on information available from various reviews and company practices, here’s how they generally handle complaints:

- Direct Response: Patriot Gold Group often responds directly to complaints lodged on public platforms like the Better Business Bureau (BBB) and Trustpilot. This response typically includes an acknowledgment of the issue, an apology if appropriate, and an offer to rectify the problem in a manner satisfactory to the customer.

- Resolution Offers: When addressing complaints, Patriot Gold Group may offer various resolutions depending on the nature of the complaint. This can include refunds, exchanges, or specific corrections to the services provided. Their responses aim to ensure that the resolution aligns with customer expectations and complies with company policies.

- Customer Service Follow-Up: For issues raised directly through their customer service channels, the company aims to provide timely and effective solutions. They encourage customers to reach out via phone or email to ensure that any concerns are addressed promptly and effectively.

- Feedback Implementation: Patriot Gold Group appears to take customer feedback seriously, using insights gained from complaints to improve their services and operations. This commitment to quality and service improvement helps in maintaining customer trust and satisfaction over time.

- Transparency and Education: In resolving complaints, Patriot Gold Group also emphasizes transparency and customer education, helping customers understand the details of their transactions and the characteristics of precious metals investments.

While specific details of their complaint resolution process are not publicly detailed, the positive ratings and reviews across multiple platforms suggest that Patriot Gold Group is effective in addressing and resolving customer complaints in a manner that maintains customer satisfaction and loyalty.

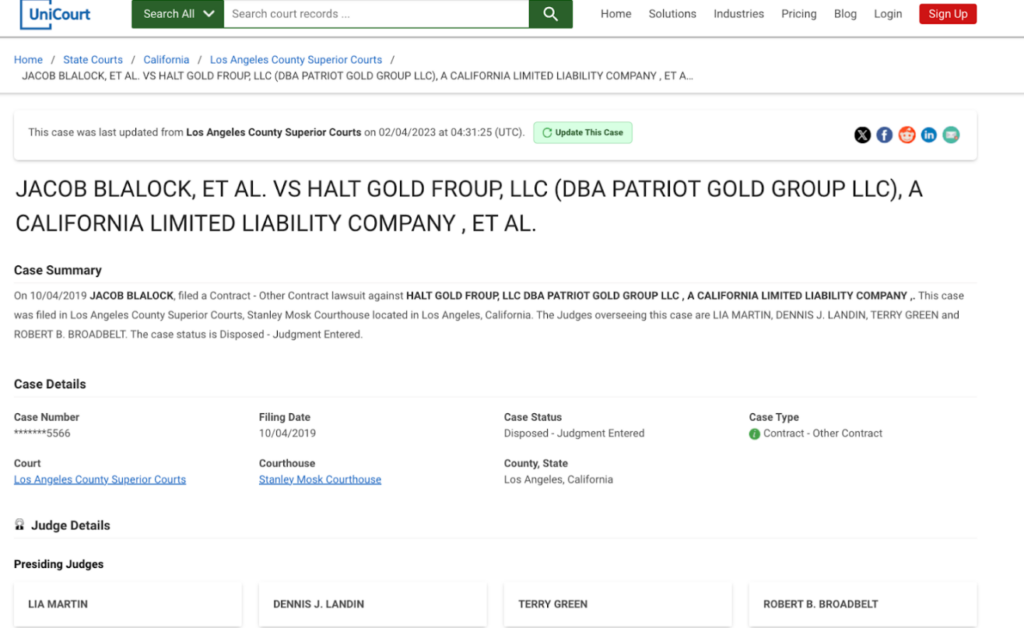

Is There Any Patriot Gold Group Lawsuit?

Patriot Gold Group has faced at least one lawsuit in the past, which was a breach of contract case filed by Jacob Blalock in October 2019.

The case was heard at the Stanley Mosk Courthouse in Los Angeles, California. This lawsuit has since been resolved, and a judgment was entered. Current searches indicate that there are no ongoing lawsuits involving Patriot Gold Group, which suggests that the company has addressed the issues raised in the past suit and continues to operate without legal complications.

The resolved nature of the lawsuit and the absence of ongoing legal actions could be seen as positive signs for potential investors or customers looking into Patriot Gold Group’s reliability and trustworthiness in the precious metals market.

It’s always best to look into the legal history of a company.

If you’re interested in doing independent research, follow these tips:

Tip #1: Check Their Regulatory Compliance and Accreditation

Check for proper licensing and registration with relevant financial regulatory bodies such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Verify the company’s accreditation with industry organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

It will help you check how credible they are.

Tip #2: Look into The Company’s Background

- Research the company’s history, including years in business and any name changes.

- Examine the Better Business Bureau (BBB) rating and accreditation status.

- Review customer feedback on reputable third-party review sites like Trustpilot or Consumer Affairs.

Tip #3: Does the Company Offer Good Resources?

- Assess the clarity of information provided about fees, storage options, and buyback policies.

- Evaluate the quality and depth of educational resources offered to investors.

- Verify that the company provides clear information about IRS regulations regarding precious metals IRAs.

Tip #4: What are Their Product Offerings and Pricing?

- Ensure the company offers IRS-approved precious metals for IRA investments.

- Compare pricing with other reputable dealers to ensure competitiveness.

- Be wary of companies pushing numismatic or collectible coins over bullion for IRA investments.

Tip #5: Confirm the Storage and Custodian Partnerships

Verify that the company works with IRS-approved custodians and secure storage facilities. According to IRS’ regulations, you cannot store your gold IRA’s precious metals at your home.

You’ll need a certified third-party storage provider.

Check the company’s storage and custodian partner to ensure you’re working with a reliable firm. Moreover, ensure they offer segregated storage options for your precious metals.

Segregated storage means your owned precious metals products will be stored separately from other investors’ possessions. Similarly, non-segregated storage means your products will be stored along with others.

Keep in mind that storage providers charge extra for segregated storage.

Some popular custodians include Equity Trust and Goldstar Trust.

Red Flags to Watch For in Gold IRA Companies

- Promises of guaranteed returns or claims of “secret” investment strategies.

- Pressure to act immediately or make large investments without proper consideration.

- Lack of physical address or unclear company ownership structure.

- Unwillingness to provide detailed information about fees or policies in writing.

By thoroughly evaluating these aspects, investors can make an informed decision about the legitimacy and reliability of a gold IRA company. It’s crucial to conduct due diligence and, if necessary, consult with a financial advisor before making any investment decisions.

FAQs on Patriot Gold Group

Here are some frequently asked questions (FAQs) about Patriot Gold Group, covering aspects of their reviews, fees, products, and overall service:

How reliable are the reviews for Patriot Gold Group?

Reviews on platforms like Trustpilot and the Better Business Bureau (BBB) suggest that Patriot Gold Group is highly regarded, with ratings that often exceed 4 out of 5 stars. These reviews commend the company for its customer service and expertise in precious metals.

What common themes appear in positive reviews of Patriot Gold Group?

Positive reviews often highlight the company’s knowledgeable staff, responsive customer service, and the ease of setting up and managing precious metals IRAs. Customers appreciate the thorough support in navigating their investment options.

Are there any concerns raised in customer reviews?

While most reviews are positive, some customers have mentioned issues such as a lack of transparency and difficulty getting certain information in writing. These are, however, relatively few compared to the positive comments.

What are the typical fees associated with Patriot Gold Group’s services?

Patriot Gold Group charges a setup fee for new IRAs, annual maintenance fees, and storage fees, though specific amounts can vary. Notably, they offer a “no fee for life” option for larger accounts meeting certain conditions.

Are there any promotions or fee waivers offered by Patriot Gold Group?

Yes, Patriot Gold Group has promotions such as waiving the setup fee for investments over certain amounts and covering the first three years of storage fees for qualifying accounts.

What types of precious metal products does Patriot Gold Group offer?

Patriot Gold Group offers a variety of gold and silver products suitable for investment, including popular coins like the American Gold Eagle, Canadian Gold Maple Leaf, and various bullion bars. They also offer platinum and palladium products.

Are all of Patriot Gold Group’s products eligible for IRA investments?

Not all precious metals products are IRA-eligible, but Patriot Gold Group offers a selection of gold, silver, platinum, and palladium products that comply with IRA eligibility requirements. They provide detailed guidance on which products qualify for these accounts.

What distinguishes Patriot Gold Group from other precious metals dealers?

Patriot Gold Group is noted for its direct customer interaction model, where clients can deal directly with company owners and senior partners, which enhances personalized service and reduces overhead costs.

How does Patriot Gold Group support new investors?

They provide extensive educational resources and personalized assistance to help new investors understand precious metals markets and the benefits of including such assets in their retirement planning.

These FAQs offer a snapshot of the key aspects of engaging with Patriot Gold Group for precious metals investments. For more detailed information, it is best to directly consult their website or contact their customer service.

Patriot Gold Group Review: Conclusion

Overall, Patriot Gold Group has many qualities that make it an impressive gold IRA provider.

Their diverse product catalog coupled with their strong reputation makes them a strong content for our best gold IRA companies‘ rankings.

However, before you proceed, I recommend browsing the market further.

This way, you can ensure that you have the right info on hand.

What are your thoughts on Patriot Gold Group? Let me know in the comments!