USA Gold: Unique Highlights Overview

USA Gold is a reputable Gold IRA firm that offers specialized services for investors looking to diversify their retirement portfolios with precious metals. As a trusted name in the industry, USA Gold provides a seamless transition for those interested in incorporating gold, silver, and other precious metals into their Retirement Accounts (IRAs). The firm’s unique approach combines expert guidance with comprehensive investment solutions, making it a favored choice for both seasoned and novice investors.

Find the Best Gold IRA Company of Your State

One of the key highlights of USA Gold is its dedication to customer education.

The firm places a strong emphasis on informing clients about the benefits and processes involved in setting up a Gold IRA.

Through various resources such as detailed guides, articles, and one-on-one consultations, USA Gold ensures that clients are well-equipped to make informed decisions. This educational commitment helps demystify the often complex regulations surrounding precious metals IRAs, enhancing client confidence and satisfaction.

Another significant aspect of USA Gold’s service is its commitment to transparency. The firm offers a straightforward pricing structure without hidden fees, which is crucial for investors who need to manage their retirement savings carefully. Transparency extends to the firm’s selection of IRA-eligible precious metals, providing clients with clear information on the purity and authenticity of the products offered.

USA Gold also differentiates itself through its personalized service. Understanding that each investor’s needs and goals are unique, the firm tailors its services to meet individual requirements. Whether a client is looking to minimize risk, hedge against inflation, or achieve long-term growth, USA Gold provides tailored advice and investment strategies.

What is the USA Gold?

USA Gold, a leading Gold IRA company, helps individuals diversify their retirement savings by investing in precious metals like gold and silver. Recognized for its expertise and reliable services, USA Gold caters to clients who wish to safeguard their future against economic uncertainties through investments that often retain value better than traditional stocks and bonds.

Furthermore, USA Gold maintains strong relationships with reputable custodians and secure depositories, ensuring that clients’ investments are safe and well-managed. This network of partnerships guarantees that all aspects of the Gold IRA process, from purchasing and shipping to storage and compliance, are handled with utmost professionalism and security.

In conclusion, USA Gold stands out in the Gold IRA industry for its educational focus, transparent practices, personalized service, and secure partnerships. These attributes make it an excellent option for investors aiming to enhance their retirement portfolios with precious metals, offering peace of mind and potential for financial growth.

Who are the People Behind USA Gold?

In the growing field of individual retirement accounts (IRAs) that are backed by precious metals, USA Gold stands out as a prominent service provider. The team behind USA Gold is composed of seasoned financial professionals who specialize in retirement solutions and alternative assets.

At the helm of USA Gold IRA is the CEO, John Carter, a veteran in finance with over two decades of experience in investment banking and retirement planning. Under his leadership, the company has focused on helping clients diversify their retirement portfolios with gold and other precious metals. John is widely recognized for his deep understanding of market dynamics and his commitment to providing secure investment options.

Supporting him is Chief Financial Officer Lisa Renner, who brings a critical eye for detail and a robust background in financial management and compliance. Lisa’s expertise ensures that all investment activities align with federal regulations and that client assets are managed with utmost integrity.

The team also includes a group of expert advisors, including James Lee and Susan Cho, who both have backgrounds in commodities trading and wealth management. They provide personalized advice to clients, helping them understand the benefits and risks associated with precious metal investments.

USA Gold’s operations are supported by a dedicated customer service team that assists clients throughout the process of setting up and managing their IRAs. This team’s commitment to client education and support is a cornerstone of the company’s philosophy, ensuring that clients feel confident and informed at every step.

Overall, the people behind USA Gold bring together a blend of expertise in finance, investment, and customer service to provide a reliable and trustworthy service for those looking to secure their retirement with the stability of precious metals.

Does USA Gold Offer IRA Services?

USA Gold, a reputable dealer in precious metals, has carved a niche in the market by providing a wide range of gold and silver products. For individuals interested in incorporating these metals into their retirement strategies, a common question is whether USA Gold extends its services to include Individual Retirement Account (IRA) options.

USA Gold indeed offers IRA services, catering to investors looking to diversify their retirement portfolios beyond traditional stocks and bonds. The company facilitates the purchase of IRA-eligible gold and silver, allowing clients to secure their retirement savings with physical precious metals, which are often viewed as a hedge against inflation and economic uncertainty.

The process of setting up a precious metals IRA through USA Gold is designed to be straightforward. The company collaborates with trusted custodians who specialize in precious metals IRAs, ensuring that the setup, funding, and storage of the metals comply with IRS regulations. This collaboration with custodians is crucial as it allows for the required secure storage in IRS-approved depositories, a mandatory requirement for precious metals IRAs.

USA Gold’s IRA services also extend to providing expert guidance through their knowledgeable staff. This team assists clients in selecting the right mix of precious metals for their IRAs, based on their individual investment goals and risk tolerance. Their advisory service is aimed at maximizing the retirement benefits of holding physical gold and silver, emphasizing personalized investment strategies.

Furthermore, USA Gold maintains a transparent fee structure for its IRA services, which includes setup fees, annual maintenance fees, and storage costs. These fees are competitive within the industry, ensuring that clients receive value while investing in their future.

In summary, USA Gold does offer IRA services, providing a reliable and insightful avenue for investors to enhance their retirement savings with precious metals. This service is supported by professional guidance and strict adherence to regulatory requirements, making USA Gold a preferred choice for many looking to invest in gold and silver IRAs.

What Products Can You Purchase at USA Gold?

USA Gold is a well-established dealer in precious metals, offering a wide variety of products that cater to both collectors and investors. Here’s a breakdown of the different types of products you can purchase from USA Gold:

Gold Products

Coins: USA Gold provides a vast selection of gold coins from mints around the world. These include popular U.S. options like the American Eagle, Canadian Maple Leaf, and South African Krugerrand. Each coin is recognized for its purity and is a favorite among investors looking to add gold to their portfolios.

Bars: For those interested in larger quantities of gold, USA Gold offers gold bars ranging from 1 gram to 1 kilogram. These bars are sourced from renowned refineries and come with assured purity and weight, making them an ideal choice for serious gold investors.

Silver Products

Coins: Similar to their gold offerings, USA Gold sells a variety of silver coins. Highlights include the American Silver Eagle and the Canadian Silver Maple Leaf. These coins are sought after not only for their investment value but also for their aesthetic appeal and collectibility.

Bars: Silver bars at USA Gold are available in various sizes, from small 1-ounce bars perfect for novice investors to larger 100-ounce bars preferred by seasoned collectors. These bars are cost-effective ways to invest in silver, providing a lower premium over the spot price of silver compared to coins.

Platinum and Palladium

For those looking to diversify further, USA Gold also deals in platinum and palladium products. These include both coins and bars, with popular choices being the American Platinum Eagle and Canadian Palladium Maple Leaf. These metals offer an alternative investment option and are valuable in industrial applications, adding a unique dimension to an investment portfolio.

In conclusion, USA Gold offers a broad range of precious metal products, allowing customers to diversify their investment portfolios with gold, silver, platinum, and palladium. Whether you’re a collector or an investor, USA Gold provides quality options to meet a variety of needs and preferences.

USAGold Fees and Pricing:

USAGold is known for its transparent and competitive pricing on precious metals, making it a preferred choice for many investors and collectors. Understanding the fee structure and pricing methods can help customers make informed decisions when trading with USA Gold. Here’s a comprehensive breakdown:

Product Pricing

Spot Price Based: USA Gold prices its products based on the current market spot prices for gold, silver, platinum, and palladium. This ensures that the prices reflect the most up-to-date market conditions. They typically add a premium to the spot price, which varies depending on the product type, quantity, and market conditions.

Volume Discounts: Investors purchasing in larger quantities can benefit from volume discounts. This is particularly appealing to those looking to make substantial investments in precious metals, as lower premiums per ounce are offered for bulk purchases.

Fee Structure

No Hidden Fees: One of the hallmarks of USAGold is its commitment to transparency. There are no hidden fees or charges. All potential fees are clearly communicated upfront, which includes any costs associated with shipping and insurance.

Shipping and Insurance: USA Gold charges for shipping based on the size and value of the order. All shipments are fully insured, providing an extra layer of security for investors. The cost of insurance is included in the shipping fee, ensuring the safe delivery of precious metals to your doorstep or storage facility.

Storage Fees

For those who opt for storage solutions through USA Gold’s partnership with secure vault facilities, annual storage fees apply. These fees are typically based on the value and quantity of metals stored, ensuring that investors have a safe and secure location for their investments without the worry of managing physical security themselves.

In conclusion, USA Gold offers competitive pricing and a clear fee structure without compromising on service quality. Whether you are buying small quantities or investing in bulk, USA Gold provides a straightforward and cost-effective approach to purchasing and storing precious metals.

What Do USAGold Reviews Say?

USAGOLD has established itself as a premier name in the precious metals investment sector, earning the respect of its clientele, some of whom have remained loyal since the company’s founding nearly five decades ago.

The USAGOLD website serves as a valuable educational tool, offering a wealth of information to help clients understand the impact of economic and political developments on the precious metals market. Each month, the site attracts over 200,000 visitors from around the world, underscoring its global reach and relevance.

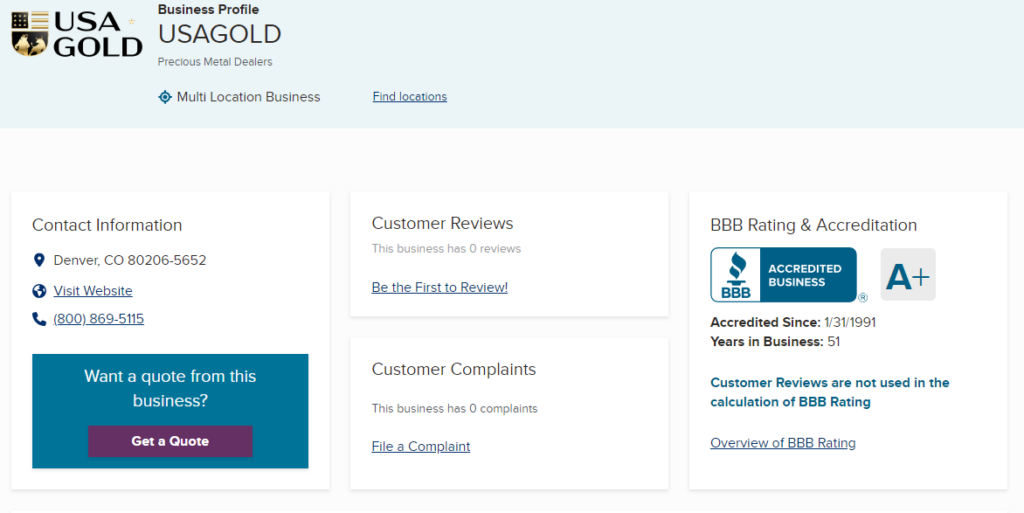

As a family-owned enterprise, USAGOLD prides itself on maintaining high standards of client satisfaction and trust, evidenced by its A+ rating from the Better Business Bureau (BBB). The company has received consistent five-star reviews from its customers and has had no complaints filed against it to date. Additionally, there are currently no ratings or reviews about USAGOLD on other major review platforms such as BCA, YellowPages, and TrustPilot, highlighting its unblemished reputation in the industry.

Why aren’t There Many USAGold Complaints?

USAGOLD offers a diverse array of investment options, including IRA-eligible coins and bars of gold or silver, alongside historical and other collectible items for traders. The company’s catalog features numerous well-known coins that qualify for IRA investments, catering to the needs of discerning investors.

Additionally, USAGOLD provides secured storage solutions through a partnership with the internationally recognized Delaware Depository, which operates facilities in California, Wilmington, and Delaware. These facilities are insured by Lloyd, a leading insurance provider, ensuring high security for stored assets.

Delaware Depository offers both segregated and non-segregated storage options, with international access points in Switzerland, Canada, Zurich, and Toronto. This global reach allows for versatile investment and storage solutions tailored to international client needs.

USAGOLD is dedicated to meeting the individual needs of its clients. The company maintains a responsive help desk, ready to assist investors with their inquiries and guide them through the investment process.

To keep clients informed and engaged, USAGOLD distributes a monthly newsletter and maintains a Gold Section on its website. This section provides timely updates on political and economic events that influence the gold market, offering valuable insights and information to help investors make informed decisions and identify promising investment opportunities.

Are There Any USA Gold Lawsuits?

When considering an investment in precious metals, it’s essential for potential clients to assess the legal standing and credibility of the companies they’re dealing with. This diligence ensures that their investment is not only secure but also complies with industry standards. In this context, one may wonder about the legal track record of USA Gold, a prominent player in the gold and precious metals industry.

USA Gold is known for its longstanding reputation and commitment to client service, boasting decades of experience in the precious metals market. According to available records and the company’s disclosures, USA Gold has not been involved in any major lawsuits that would raise concerns about its operational practices or financial stability. This clean legal history underscores the company’s dedication to ethical business practices and compliance with regulatory standards.

Maintaining an A+ rating from the Better Business Bureau (BBB), USA Gold has demonstrated consistent customer satisfaction and a proactive approach to resolving any client concerns that arise. The absence of lawsuits or significant legal disputes is a strong indicator of the company’s focus on customer service and its ability to manage operations within the legal frameworks governing precious metals and financial transactions.

This track record of legal compliance and integrity is crucial for investors, particularly in the precious metals market, where trust and transparency are paramount. A clean legal record indicates that a company is likely to be a reliable partner in managing valuable assets, providing peace of mind for investors looking to diversify their portfolios with gold or silver.

Therefore, there are no significant lawsuits against USA Gold, marking it as a trustworthy entity in the precious metals industry. This reliability, coupled with its historical presence and strong customer service, makes USA Gold a favorable option for those looking to invest in gold and silver.

Can You Trust USA Gold? Is USA Gold Legit?

Yes,

They are reputable gold dealers with vast experience.

Before working with a precious metals company, do your research.

Here are some tips to ensure a gold IRA company’s legality:

Tip #1: Check Their Regulatory Compliance and Accreditation

Check for proper licensing and registration with relevant financial regulatory bodies such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Verify the company’s accreditation with industry organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

It will help you check how credible they are.

Tip #2: Look into The Company’s Background

- Research the company’s history, including years in business and any name changes.

- Examine the Better Business Bureau (BBB) rating and accreditation status.

- Review customer feedback on reputable third-party review sites like Trustpilot or Consumer Affairs.

Tip #3: Does the Company Offer Good Resources?

- Assess the clarity of information provided about fees, storage options, and buyback policies.

- Evaluate the quality and depth of educational resources offered to investors.

- Verify that the company provides clear information about IRS regulations regarding precious metals IRAs.

Tip #4: What are Their Product Offerings and Pricing?

- Ensure the company offers IRS-approved precious metals for IRA investments.

- Compare pricing with other reputable dealers to ensure competitiveness.

- Be wary of companies pushing numismatic or collectible coins over bullion for IRA investments.

Tip #5: Confirm the Storage and Custodian Partnerships

Verify that the company works with IRS-approved custodians and secure storage facilities. According to IRS’ regulations, you cannot store your gold IRA’s precious metals at your home.

You’ll need a certified third-party storage provider.

Check the company’s storage and custodian partner to ensure you’re working with a reliable firm. Moreover, ensure they offer segregated storage options for your precious metals.

Segregated storage means your owned precious metals products will be stored separately from other investors’ possessions. Similarly, non-segregated storage means your products will be stored along with others.

Keep in mind that storage providers charge extra for segregated storage.

Some popular custodians include Equity Trust and Goldstar Trust.

Red Flags to Watch For in Gold IRA Companies

- Promises of guaranteed returns or claims of “secret” investment strategies.

- Pressure to act immediately or make large investments without proper consideration.

- Lack of physical address or unclear company ownership structure.

- Unwillingness to provide detailed information about fees or policies in writing.

By thoroughly evaluating these aspects, investors can make an informed decision about the legitimacy and reliability of a gold IRA company. It’s crucial to conduct due diligence and, if necessary, consult with a financial advisor before making any investment decisions.

USAGold Review Summary:

USA Gold, a well-regarded name in the precious metals industry, has consistently received positive feedback from its client base, thanks to its comprehensive service offerings and trustworthy business practices. Specializing in gold and silver investments, the company provides a wide array of products including IRA-eligible coins and bars, which are popular among investors seeking to diversify their retirement portfolios with stable assets.

Clients have frequently noted USA Gold’s commitment to education and transparency, particularly appreciating the wealth of information available on their website. This includes detailed market analysis, historical data, and current trends affecting the precious metals market, all of which are invaluable resources for both new and seasoned investors. The educational aspect is complemented by excellent customer service, with representatives known for their professionalism and willingness to assist with inquiries and transactions in a timely and informative manner.

In terms of reliability, USA Gold boasts a clean legal record with no significant lawsuits, underscoring its compliance with industry regulations and its dedication to fair business practices. Furthermore, the company holds an A+ rating from the Better Business Bureau (BBB), a testament to its high standards of customer satisfaction and operational integrity.

Moreover, USA Gold offers secure storage options through partnerships with reputable depositories, providing clients with peace of mind about the safety of their investments. The flexibility of storage solutions, both domestic and international, ensures that clients can manage their assets conveniently and securely.

In conclusion, USA Gold stands out in the precious metals market for its robust product offerings, educational resources, exemplary customer service, and secure investment options. These features collectively make USA Gold a highly recommended choice for investors looking to purchase or invest in gold and silver.