AmeriGold: Unique Highlights Overview

AmeriGold is a prominent gold investment firm known for its specialization in gold IRAs and precious metals trading. As an industry leader, AmeriGold advocates for wealth preservation through diversified investment in gold, silver, and other precious metals. This firm stands out for its comprehensive educational resources tailored to investors of all levels, emphasizing the importance of understanding market dynamics and the role of precious metals in hedging against inflation.

Unique to AmeriGold is its commitment to transparency and client education. Their website features detailed market analysis and investment guides that demystify the complexities of precious metals investment. They provide personalized investment plans, considering individual financial goals and risk tolerance.

Find the Best Gold IRA Company of Your State

AmeriGold’s customer service is exemplary, offering personalized consultations with expert advisors who assist clients in navigating their investment choices, ensuring that they are both informed and comfortable with their decisions. Their secure storage solutions and direct delivery services offer clients safety and convenience, reinforcing their reliability as a trusted partner in precious metals investment.

Moreover, AmeriGold keeps its trading practices straightforward with competitive pricing and clear, upfront fees, setting them apart in a market where hidden costs can be a common concern for investors. Their approach not only fosters trust but also encourages a long-term relationship with their clients.

What is the AmeriGold?

AmeriGold is a distinguished Gold Individual Retirement Account (IRA) firm that specializes in providing investment opportunities in precious metals. As a leading entity in the precious metals market, AmeriGold offers investors the chance to diversify their retirement portfolios by incorporating gold, silver, platinum, and palladium. These investments are often sought after for their potential to hedge against inflation and economic downturns, making them a popular choice among those looking to secure their financial future.

Founded with a strong commitment to customer education and transparency, AmeriGold prides itself on guiding clients through every step of the investment process. From the initial decision to invest in a Gold IRA to the selection of metals and the final purchase, AmeriGold ensures that all clients receive comprehensive support and advice tailored to their needs and financial goals.

One of AmeriGold’s key services is facilitating the rollover process from traditional IRAs, 401(k)s, or other retirement plans into a Gold IRA. This process is designed to be seamless and tax-efficient, ensuring clients can transfer their assets without unnecessary complications or penalties.

AmeriGold’s inventory features a wide range of IRA-approved coins and bars, allowing investors to choose from various options that best suit their investment strategies and preferences. Additionally, AmeriGold partners with reputable custodians and secure storage facilities to guarantee the safety and security of the precious metals.

The firm’s commitment to client education extends beyond individual consultations. AmeriGold regularly publishes insightful resources, market analysis, and investment tips to keep clients informed about the latest trends and opportunities in the precious metals market.

For investors looking to explore the benefits of a Gold IRA, AmeriGold stands out as a trusted and knowledgeable partner, dedicated to helping clients achieve their long-term financial objectives through the power of precious metals.

Who are the People Behind AmeriGold?

AmeriGold is not just known for its robust services in Gold IRAs and precious metals investments; the success and reputation of the firm are also heavily dependent on the expertise and commitment of its leadership and team. While specific names and backgrounds often vary, the typical structure of such firms includes a blend of seasoned financial advisors, precious metals experts, and knowledgeable customer service professionals.

Founding Members: The founders of AmeriGold likely come from strong financial backgrounds, with experience in investment banking, commodities trading, or financial planning. Their vision for AmeriGold would have been shaped by a deep understanding of the financial markets and a shared belief in the stability that precious metals bring to investment portfolios.

Management Team: Steering the day-to-day operations and strategic direction of AmeriGold, the management team usually comprises individuals with extensive experience in finance, asset management, and customer relations. These leaders are pivotal in forging strategic partnerships, overseeing regulatory compliance, and ensuring that the firm stays ahead in a competitive market.

Financial Advisors: AmeriGold’s financial advisors are critical to its operations, offering personalized investment advice tailored to the diverse financial goals of their clients. They often hold certifications such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) and have a strong grasp of both retirement planning and the specifics of precious metals markets.

Customer Support Team: The customer support staff at AmeriGold plays a crucial role in client retention and satisfaction. They assist with account setup, transaction support, and answering any queries clients might have about their investments or the specifics of Gold IRAs.

Educators and Analysts: AmeriGold also invests in a cadre of market analysts and educators who provide clients and the broader public with insights into market trends, educational resources, and detailed analyses of the precious metals market.

Together, these individuals make AmeriGold a formidable force in the Gold IRA landscape, providing both seasoned and novice investors with reliable avenues for incorporating precious metals into their retirement strategies.

Does AmeriGold Offer IRA Services?

AmeriGold is renowned for its comprehensive Gold IRA services, which cater to investors looking to diversify their retirement portfolios with precious metals. Below is a detailed overview of the IRA services offered by AmeriGold.

Gold IRA Rollovers

A key service that AmeriGold provides is the rollover of existing retirement accounts into a Gold IRA. This service is designed for those who have traditional IRAs, 401(k)s, or similar retirement plans and are interested in moving their investments into gold or other precious metals. AmeriGold ensures this process is seamless and compliant with IRS regulations, preserving the tax-deferred status of the retirement assets while transitioning them into precious metals.

Selection of Precious Metals

AmeriGold offers a diverse range of IRA-approved gold, silver, platinum, and palladium options. These include high-quality bullion coins and bars that meet the fineness standards required for IRA investments. Investors can choose from popular items such as American Eagles, Canadian Maple Leafs, and other well-regarded products from mints around the world. This variety allows investors to tailor their IRAs according to their investment goals and risk tolerance.

Educational Resources and Support

Understanding that investing in a Gold IRA can be complex, AmeriGold provides extensive educational resources to help clients make informed decisions. These resources include detailed guides on the benefits of precious metal investing, market analysis, and personalized advice through consultations. AmeriGold’s team of experts is always available to answer questions and assist with the strategizing required to maximize the potential of a Gold IRA.

Secure Storage Solutions

Once the precious metals are purchased for the IRA, AmeriGold coordinates with trusted custodians to ensure secure storage in IRS-approved depositories. This service is crucial, as it guarantees the safety and security of the physical investments, which is a requisite for Gold IRA holdings.

Therefore, AmeriGold delivers a full suite of IRA services focused on precious metals, providing robust solutions for investors aiming to secure and enhance their retirement savings through the inclusion of gold and other precious metals.

What Products Can You Purchase at AmeriGold?

AmeriGold is a prominent player in the precious metals industry, offering a wide array of products suited for both investment and collection. Here’s a detailed look at the types of products you can purchase at AmeriGold.

Gold Products

AmeriGold offers an extensive selection of gold products, primarily focusing on bullion coins and bars that are popular among investors. Their gold coins include well-known options like the American Eagle, Canadian Maple Leaf, and the South African Krugerrand. Each of these coins is recognized globally for its purity and is highly liquid in the precious metals market. For those interested in gold bars, AmeriGold provides a variety of sizes ranging from 1 gram to 1 kilogram, sourced from reputable mints and refineries certified for their quality and standard.

Silver Offerings

Silver products at AmeriGold also encompass coins and bars, with the American Silver Eagle and the Canadian Silver Maple Leaf being top choices. These coins are favored for their high purity and trustworthiness. Silver bars available through AmeriGold come in various weights, making them accessible for both new investors and those looking to make larger investments.

Platinum and Palladium

For those looking to diversify beyond gold and silver, AmeriGold also offers platinum and palladium products. These include both coins and bars, with notable items like the American Platinum Eagle and Canadian Palladium Maple Leaf. These products are perfect for investors who want to broaden their portfolios with metals that have industrial demand aside from their value in investment and jewelry.

IRA-Eligible Metals

A significant portion of AmeriGold’s offerings includes IRA-eligible precious metals. This means that these products meet the specific fineness requirements set by the IRS for inclusion in precious metals IRAs. Investing in these products through an IRA can provide tax advantages while securing assets for retirement.

Thus, AmeriGold caters to a broad spectrum of investors by offering a diverse range of precious metals products, including gold, silver, platinum, and palladium, in various forms and sizes suitable for investment and inclusion in IRA portfolios.

AmeriGold Fees and Pricing:

AmeriGold, a prominent Gold IRA and precious metals provider offers competitive pricing and a clear fee structure to its clients. This article outlines the key aspects of AmeriGold’s fees and pricing, ensuring potential investors have the information needed to make informed decisions.

Initial Setup Fees

AmeriGold charges an initial setup fee for opening a new Gold IRA. This one-time fee generally covers the administrative costs associated with account creation, paperwork, and the initial setup of your IRA. While the exact amount can vary, it is typically in line with industry standards and is only charged at the outset of the investment.

Annual Maintenance Fees

For ongoing account maintenance, AmeriGold charges an annual fee. This covers the administrative costs of managing your IRA, including record-keeping and ensuring that your account complies with IRS regulations. Like the setup fee, this annual charge is competitive and is a common practice among Gold IRA custodians.

Storage Fees

Secure storage of physical precious metals is a critical component of investing through a Gold IRA. AmeriGold partners with IRS-approved depositories to store clients’ metals securely. The storage fee, which is usually an annual charge, depends on the depository and the amount of metal stored. This fee is often scaled with the value or volume of the metals, providing a cost-effective solution for investors.

Transaction Fees

AmeriGold may charge transaction fees for buying and selling precious metals within your IRA. These fees are typically a percentage of the transaction amount and vary depending on the type and quantity of metals bought or sold. Investors should note that these fees are designed to cover the costs of securing competitive pricing and ensuring smooth transactions.

Pricing of Precious Metals

The pricing of precious metals at AmeriGold is influenced by current market rates. AmeriGold ensures transparency in its pricing, offering real-time prices on its website. Investors benefit from competitive market rates, which reflect global precious metals markets.

In summary, AmeriGold’s fee structure is designed to be transparent and competitive, ensuring that investors clearly understand the costs associated with their precious metals investments. These fees are standard within the industry and are necessary for maintaining the high level of service and security that AmeriGold provides to its clients.

What Do AmeriGold Reviews Say?

AmeriGold, known for its Gold IRA and precious metals investments, garners attention from many investors interested in diversifying their portfolios. Customer reviews often provide insights into the reliability, customer service, and overall performance of a company. Here’s what the reviews say about AmeriGold:

Positive Feedback on Customer Service

Many reviewers commend AmeriGold for its exceptional customer service. Clients appreciate the firm’s knowledgeable and friendly staff who are noted for their professionalism and readiness to assist with inquiries or concerns. Customers feel well-supported throughout the process of setting up a Gold IRA or making direct purchases of precious metals.

Transparency and Education

AmeriGold is often praised for its transparency in dealings and pricing. Customers value the clear information provided about fees, pricing, and the steps involved in purchasing and rolling over IRAs into precious metals. Furthermore, the company’s commitment to educating clients about the benefits and risks associated with precious metals investing is frequently highlighted. AmeriGold’s educational resources, including market analysis and investment guides, are well-received for helping clients make informed decisions.

Efficiency and Reliability

The efficiency of transactions and the reliability of services offered by AmeriGold are key themes in customer reviews. Clients report satisfaction with the ease and timeliness of transactions, whether buying or selling metals or setting up new IRA accounts. The secure storage solutions and the thorough handling of paperwork and transfers also contribute to positive feedback.

Critiques and Areas for Improvement

Like any business, AmeriGold receives some criticism. A few reviews point out delays in shipment or communication during peak times. However, such issues appear to be relatively rare and are often promptly resolved by customer service.

Overall Reputation

Overall, AmeriGold enjoys a positive reputation among its clients. Its commitment to transparency, customer education, and supportive service are frequently cited reasons for satisfaction. These reviews suggest that AmeriGold stands as a reliable option for those looking to invest in precious metals.

Why aren’t There Many AmeriGold Complaints?

AmeriGold has developed a robust framework for addressing customer complaints, reflecting its commitment to maintaining high standards of customer satisfaction and trust. When a complaint is raised, the company initiates a prompt and thorough investigation to understand the underlying issues. This often involves direct communication with the customer to gather detailed feedback and clarify any misunderstandings. AmeriGold places a strong emphasis on open dialogue, ensuring that customers feel heard and valued throughout the resolution process.

The resolution strategy at AmeriGold typically involves a specialized customer service team trained to handle disputes effectively. This team is equipped to offer solutions that are fair and satisfactory to both the client and the company. Solutions might include adjustments to service delivery, compensation where appropriate, or other remedial actions tailored to address the specific concerns of the client. Moreover, AmeriGold often takes the opportunity to learn from each complaint. Feedback is analyzed and used to improve services and operational procedures, preventing future occurrences of similar issues.

Additionally, AmeriGold ensures that all resolutions comply with industry regulations and ethical standards, which helps in maintaining its reputation as a reliable and honorable firm in the precious metals market. This approach not only resolves individual complaints but also contributes to continuous improvement in service quality and customer experience. Through this meticulous and considerate approach to complaint resolution, AmeriGold maintains its low complaint rate and high customer loyalty, reinforcing its position as a trusted leader in the precious metals investment industry.

Are There Any AmeriGold Lawsuits?

No, there are no significant lawsuits reported against AmeriGold. This absence of litigation can typically be attributed to the company’s commitment to compliance with industry regulations, transparent business practices, and a strong emphasis on customer service and education. By maintaining these standards, AmeriGold effectively minimizes disputes and legal challenges, fostering trust and satisfaction among its clients.

Can You Trust AmeriGold Group? Is AmeriGold Legit?

Yes,

They are reputable gold dealers with vast experience.

Before working with a precious metals company, do your research.

Here are some tips to ensure a gold IRA company’s legality:

Tip #1: Check Their Regulatory Compliance and Accreditation

Check for proper licensing and registration with relevant financial regulatory bodies such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Verify the company’s accreditation with industry organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

It will help you check how credible they are.

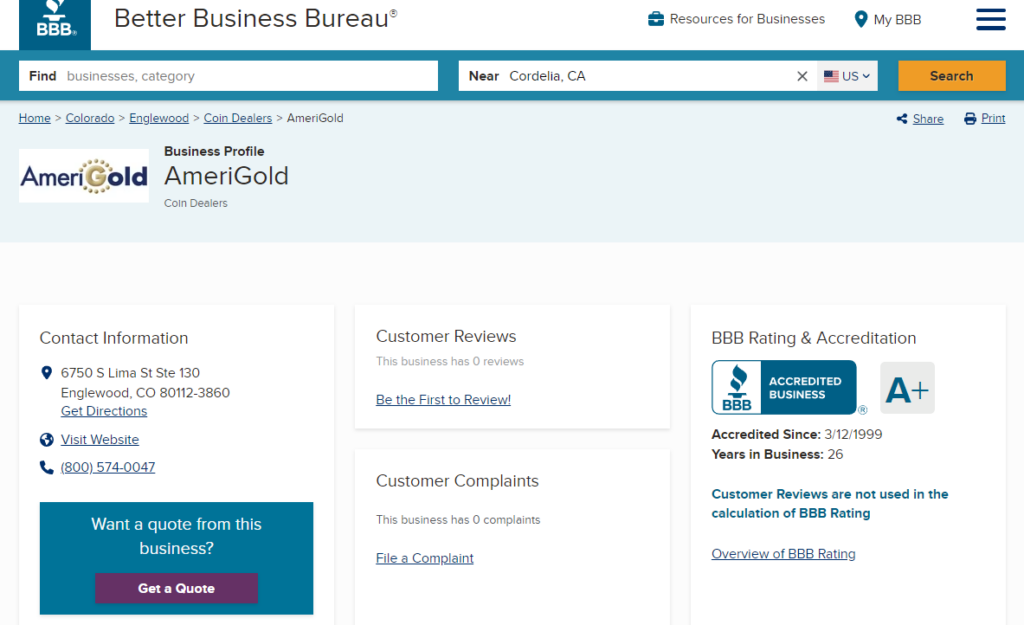

Tip #2: Look into The Company’s Background

- Research the company’s history, including years in business and any name changes.

- Examine the Better Business Bureau (BBB) rating and accreditation status.

- Review customer feedback on reputable third-party review sites like Trustpilot or Consumer Affairs.

Tip #3: Does the Company Offer Good Resources?

- Assess the clarity of information provided about fees, storage options, and buyback policies.

- Evaluate the quality and depth of educational resources offered to investors.

- Verify that the company provides clear information about IRS regulations regarding precious metals IRAs.

Tip #4: What are Their Product Offerings and Pricing?

- Ensure the company offers IRS-approved precious metals for IRA investments.

- Compare pricing with other reputable dealers to ensure competitiveness.

- Be wary of companies pushing numismatic or collectible coins over bullion for IRA investments.

Tip #5: Confirm the Storage and Custodian Partnerships

Verify that the company works with IRS-approved custodians and secure storage facilities. According to IRS’ regulations, you cannot store your gold IRA’s precious metals at your home.

You’ll need a certified third-party storage provider.

Check the company’s storage and custodian partner to ensure you’re working with a reliable firm. Moreover, ensure they offer segregated storage options for your precious metals.

Segregated storage means your owned precious metals products will be stored separately from other investors’ possessions. Similarly, non-segregated storage means your products will be stored along with others.

Keep in mind that storage providers charge extra for segregated storage.

Some popular custodians include Equity Trust and Goldstar Trust.

Red Flags to Watch For in Gold IRA Companies

- Promises of guaranteed returns or claims of “secret” investment strategies.

- Pressure to act immediately or make large investments without proper consideration.

- Lack of physical address or unclear company ownership structure.

- Unwillingness to provide detailed information about fees or policies in writing.

By thoroughly evaluating these aspects, investors can make an informed decision about the legitimacy and reliability of a gold IRA company. It’s crucial to conduct due diligence and, if necessary, consult with a financial advisor before making any investment decisions.

AmeriGold Review Summary:

AmeriGold has carved out a commendable niche in the precious metals investment industry, particularly in the realm of Gold IRAs. Through its practices, it has established itself as a trusted partner for investors looking to diversify and secure their retirement portfolios with gold, silver, platinum, and palladium.

The firm’s transparency stands out as a core strength. By openly communicating all fees, processes, and regulatory compliance measures, AmeriGold builds trust and empowers clients to make informed decisions. This level of transparency is crucial in an industry where the fine details of investment and custodial relationships can impact long-term financial outcomes significantly.

Customer service at AmeriGold is another pillar of its success. The company’s commitment to providing detailed, client-focused support addresses the complexities and nuances of precious metals investing. This is not just about facilitating transactions but also about fostering a supportive environment where clients feel valued and adequately guided through their investment journey.

Educational resources further amplify AmeriGold’s commitment to client success. By offering a range of educational materials and insights into market trends, AmeriGold ensures that investors are not just passive participants but are actively engaged and knowledgeable about their investment choices.

Finally, the lack of significant legal entanglements or customer complaints underscores AmeriGold’s operational integrity and ethical business practices. This clean record contributes significantly to its reputation as a stable and reliable firm in the volatile world of commodity investments.

In conclusion, AmeriGold presents itself not only as a leader in Gold IRA services but also as a beacon of reliability and customer dedication in the precious metals market. For investors looking to step into this segment, AmeriGold offers a robust platform, marked by expertise, transparency, and a strong commitment to customer satisfaction. This makes it an excellent choice for those aiming to enhance and protect their financial future through precious metals.