The volatility of traditional financial markets, coupled with the increasing uncertainty surrounding global economic conditions, has led investors to explore alternative assets for safeguarding their wealth. One of the most popular options is investing in precious metals, particularly gold. Among various platforms offering gold-backed individual retirement accounts (IRAs), APMEX, or the American Precious Metals Exchange, has garnered attention for its reliability, industry experience, and variety of offerings.

Introduction to Gold IRAs

A Gold IRA is a self-directed individual retirement account that allows investors to hold physical gold, as well as other precious metals like silver, platinum, and palladium, instead of traditional paper assets like stocks and bonds. Gold IRAs are becoming an attractive option for investors seeking to diversify their portfolios and hedge against inflation, market downturns, or geopolitical risks.

Unlike regular IRAs, where assets are typically tied to the performance of financial markets, a Gold IRA is backed by the intrinsic value of precious metals, providing stability. With the ever-increasing demand for portfolio diversification, companies like APMEX have positioned themselves as key players in the market by offering Gold IRAs.

Find the Best Gold IRA Company of Your State

About APMEX

APMEX (American Precious Metals Exchange) was founded in 2000 and is one of the largest and most reputable online retailers of precious metals in the United States. Based in Oklahoma City, APMEX offers a wide array of products, including gold, silver, platinum, and palladium coins, bars, and bullion.

APMEX’s reputation for transparency, extensive product offerings, and customer service has made it a trusted source for investors looking to purchase precious metals for both personal and retirement investment purposes. One of its primary services is the facilitation of Gold IRAs through its partnerships with trusted custodians and depositories.

APMEX Gold IRA: How It Works

Investing in a Gold IRA through APMEX is relatively straightforward. The process generally involves three key steps:

- Setting Up the Self-Directed IRA: To invest in a Gold IRA, the first step is to establish a self-directed IRA through a custodian. APMEX does not act as a custodian but works with several trusted custodians who specialize in precious metals IRAs. These custodians include companies like Equity Trust, STRATA Trust, and GoldStar Trust.

- Selecting Precious Metals: Once the IRA is set up, investors can use the funds within the account to purchase physical precious metals. APMEX offers a wide variety of IRS-approved gold, silver, platinum, and palladium products that can be held in an IRA.

- Storage: After the purchase, the precious metals must be stored in an IRS-approved depository. APMEX partners with some of the industry’s most secure and reliable storage facilities, ensuring that the investor’s assets are safely stored in a secure, IRS-compliant depository.

Benefits of Investing in an APMEX Gold IRA

There are several benefits to investing in a Gold IRA through APMEX, including:

A. Portfolio Diversification

Precious metals offer a layer of diversification that traditional investments like stocks and bonds cannot provide. Gold, in particular, tends to perform well during times of economic uncertainty, serving as a hedge against inflation and currency devaluation.

B. Protection Against Inflation

Gold has historically retained its value even when fiat currencies depreciate due to inflation. Investors often turn to gold when inflation erodes the purchasing power of paper currency, making it an attractive asset to include in a retirement portfolio.

C. Long-Term Stability

Unlike equities and other paper assets that fluctuate based on market conditions, gold is known for its relative price stability over the long term. This makes it an appealing asset for retirement savings, where long-term growth and security are key goals.

D. Tax Benefits

A Gold IRA offers the same tax benefits as traditional IRAs. Contributions made to a Gold IRA can be tax-deferred, allowing investors to grow their retirement savings without paying taxes on their gains until distributions are taken during retirement. Additionally, Roth Gold IRAs allow for tax-free growth, as distributions during retirement are not taxed.

Gold IRA vs. Traditional IRA

To understand the unique benefits of a Gold IRA, it’s important to compare it to traditional IRAs:

- Investment Type: Traditional IRAs are typically invested in stocks, bonds, mutual funds, and ETFs, whereas a Gold IRA invests in physical precious metals.

- Risk Profile: While traditional IRAs are tied to the performance of financial markets, which can be volatile, Gold IRAs offer a more stable investment since the value of gold tends to remain relatively consistent over time.

- Liquidity: Traditional IRAs may offer higher liquidity, as assets can be sold or converted to cash more easily than physical metals. However, precious metals in a Gold IRA can still be liquidated or exchanged for other assets, though the process might take longer.

- Taxation: Both types of IRAs offer tax advantages, but Gold IRAs specifically benefit from the long-term capital gains tax treatment of precious metals.

Are There Any Lawsuits Against APMEX?

Currently, there is no lawsuit involving American Precious Metals Exchange.

However, in the past, the company has faced the following lawsuits:

- A-World Trade, Inc. v. APMEX, Inc.: This lawsuit involved allegations of price-fixing and predatory pricing among sellers of precious metal bullion products on eBay. The case focused on whether there was an illegal agreement among the defendants that restricted competition, but the court found no plausible evidence of such an agreement, largely due to participation in eBay’s Daily Deals Program which did not indicate any anticompetitive behavior.

- TRAYNOR v. APMEX, INC.: This lawsuit was filed regarding the accessibility of the APMEX website. The plaintiff alleged that the website did not comply with the ADA (Americans with Disabilities Act) standards, specifically pointing out issues like missing alt-text for images and redundant links which could hinder accessibility for visually impaired users. The lawsuit sought injunctive relief to make the website fully compliant with ADA standards, along with compensatory damages and other legal remedies.

It’s worth noting that despite these hurdles, the company has succeeded at establishing itself as an industry leader.

Why Choose APMEX for a Gold IRA?

APMEX has established itself as a reputable player in the precious metals market for several reasons:

- Extensive Product Range: APMEX offers a wide variety of IRS-approved precious metals, including coins and bars from around the world, allowing investors to choose the best products for their portfolio.

- Industry Experience: With over two decades in the precious metals industry, APMEX has developed a strong reputation for trustworthiness and transparency, making it a reliable partner for investors.

- Educational Resources: APMEX provides investors with access to a wealth of educational resources, ensuring that they can make informed decisions about their precious metals investments.

- Partnerships with Trusted Custodians: APMEX partners with well-regarded custodians to manage the self-directed IRA process, ensuring that clients receive expert assistance throughout their investment journey.

Also read: Best Gold IRA Providers in Oklahoma

APMEX Storage Partners

APMEX ensures the safety and security of the precious metals in its Gold IRAs by partnering with some of the top depositories in the industry. These depositories are IRS-approved and adhere to stringent security standards to protect investors’ assets. Some of the storage facilities APMEX collaborates with include:

- Brinks Global Services: Known for its robust security measures, Brinks offers fully insured, segregated storage solutions.

- Delaware Depository: A highly trusted depository, Delaware Depository offers secure storage and comprehensive insurance coverage for precious metals.

- Loomis International: Another major player in secure storage, Loomis is recognized globally for its high-security vaults and transparent reporting.

When choosing a depository, investors can decide between segregated or non-segregated storage. Segregated storage means that their metals are stored separately from those of other investors, while non-segregated storage allows for co-mingling of metals.

Precious Metals Options with APMEX

APMEX provides a broad range of IRS-approved precious metals for Gold IRA investors, including:

A. Gold

Gold is the most popular choice for precious metals IRAs due to its long-standing reputation as a store of value. APMEX offers gold bullion bars and coins from reputable mints worldwide, such as:

- American Gold Eagle Coins

- Canadian Gold Maple Leaf Coins

- Austrian Gold Philharmonic Coins

- Gold Bars from recognized refiners like PAMP Suisse and Credit Suisse

B. Silver

Silver is another common investment for Gold IRAs. Though its value tends to fluctuate more than gold, it provides investors with greater exposure to industrial demand. Some popular silver options include:

- American Silver Eagle Coins

- Canadian Silver Maple Leaf Coins

- Silver Bars from reputable mints

C. Platinum and Palladium

Though less common, platinum and palladium are also available for Gold IRAs. These metals are primarily used in industrial applications, particularly in the automotive industry, which can affect their value. Investors seeking additional diversification might consider adding platinum or palladium to their portfolios.

Are There Any APMEX Complaints? How are They Resolved?

Like any other company, APMEX has received some critcism online.

There are some complaints on Trustpilot and BBB regarding shipping delays.

However, APMEX takes the complaints very seriously and has worked extensively in resolving them.

Customer service is an essential component of any successful investment platform, and APMEX excels in this regard. The company offers multiple avenues for customers to seek help, including:

- Phone Support: APMEX provides a customer service hotline with representatives knowledgeable about both precious metals and Gold IRAs.

- Email Support: Investors can also reach out via email for assistance with account management, product questions, or order inquiries.

- Live Chat: For more immediate concerns, APMEX offers a live chat feature on its website, allowing investors to get real-time help with their questions.

APMEX is also known for its responsive service, handling customer inquiries efficiently, and ensuring satisfaction throughout the purchasing process. This level of customer support is especially important when dealing with a Gold IRA, as investors may have detailed questions about account setup, precious metals selection, and storage options.

APMEX’s commitment to providing accurate and timely information helps alleviate concerns, making the investment process smoother for both novice and experienced investors alike.

Overview of APMEX Reviews on Different Platforms

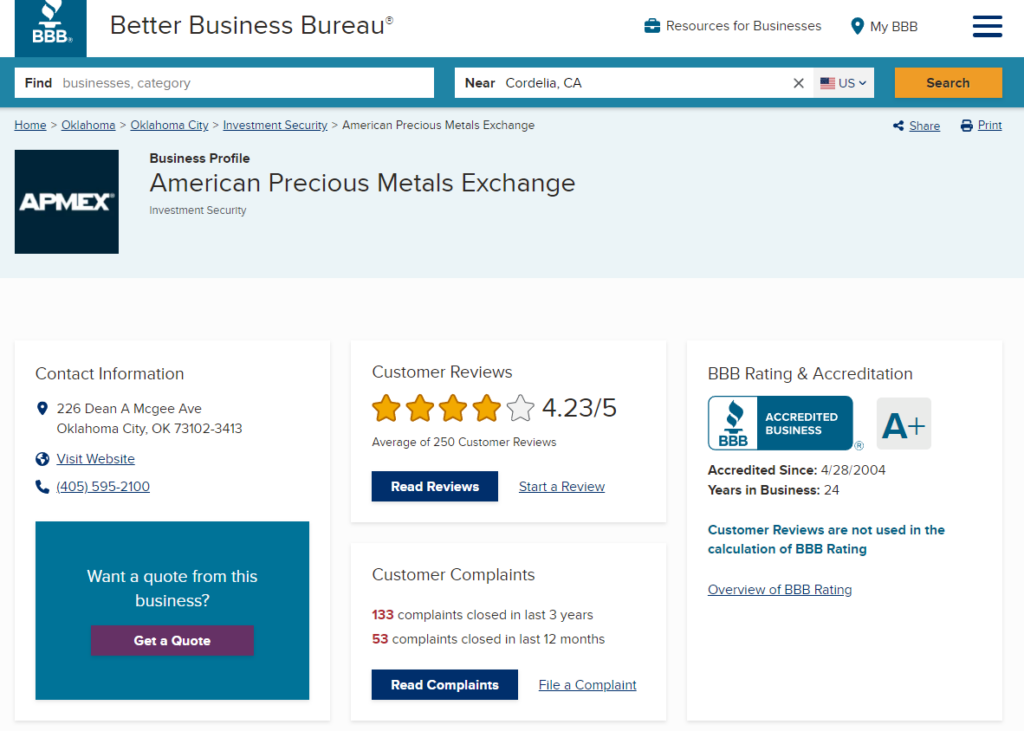

APMEX, known formally as American Precious Metals Exchange, is a leading retailer in the precious metals industry, dealing with products such as gold, silver, and platinum coins and bars. Here is a more detailed analysis of APMEX’s ratings based on reviews from the Better Business Bureau (BBB) and the general approach to customer feedback as observed on various platforms.

APMEX Reviews on Better Business Bureau (BBB)

A+ Rating

APMEX has been awarded an A+ rating by the BBB, indicating a high level of confidence in their business practices. The BBB rating system assesses businesses based on several factors including complaint history, transparency about business practices, and adherence to BBB’s standards of advertising. A high rating like an A+ suggests that APMEX has a proven track record of resolving customer issues and maintaining trustworthy business practices.

Customer Feedback

BBB also hosts customer reviews and complaint details, allowing potential buyers to see both positive and negative experiences. These reviews provide insights into how APMEX handles customer service, product quality, and dispute resolution. It’s important to read through these reviews to get a balanced view of consumer experiences.

Importance of Diverse Review Sources

While BBB offers comprehensive insights, the overall customer satisfaction can also be reflected through various other platforms, albeit specific ratings for APMEX on platforms like Capterra were not available. However, understanding the importance of diverse feedback sources like Capterra helps in comprehending the broader perspective of customer satisfaction and service quality. Capterra typically hosts reviews for software, but the methodology and emphasis on detailed customer feedback are relevant in assessing the reliability and applicability of reviews across different types of service platforms.

The A+ rating on BBB is a strong endorsement of APMEX’s customer service and business practices. Prospective customers are encouraged to review APMEX’s detailed customer feedback on BBB and consider the general importance of diverse customer reviews to get a well-rounded view of the company. This approach ensures that consumers can make informed decisions based on a comprehensive understanding of APMEX’s service quality and reliability.

Examples of APMEX Reviews (Trustpilot)

The average rating for APMEX is 1.6 stars, and it has 7,942 reviews.

#1. As far as the precious metals industry is concerned, Apmex is the 800-pound gorilla. In addition to being legitimate, I make use of them for both physical storage through Citadel, which is owned by them. In addition, I have made purchases from them as well for direct delivery.

Apmex is also the owner of the OneGold platform, which is where I got my gold. I chose the Royal Canadian Mint as the repository for that gold. In spite of the fact that their premiums are greater, they are willing to negotiate with you if you make frequent purchases as I do.

#2. As a repeat customer, I am a regular. Every year, I make at least one purchase from them. Purchasing selected pieces of gold and silver (not all) will result in prices that are comprehensive. Although their app is fantastic and their customer service has been solid up to this point, their shipment is extremely slow (an average of two weeks) and using the United States Postal Service, which could be risky when purchasing gold. A word of advice: if you buy only a tiny amount with them, you will be alright.

#3. Overall you end up getting your order. However, latest order has been delayed for two weeks which is a long time for them to hold your money, but their quality is great. I ordered in April. It’s now May and they said they lost the ticket. It is figured out but very annoying.

#4. To begin, it is difficult to find acceptable sellers online; nonetheless, I have to admit that apmex is significantly more nasty than any other dealer that I have encountered. Their pricing are completely absurd. When compared to the other options. I’ll just go look. Despite the fact that it is the same crap as everyone else, the products in question must have some additional fairy dust or something. The nuts are yours if someone purchases from them. If I had the ability to, I would give it a score of zero stars. It’s awful, and I can’t help but wonder if they have a lot of clientele who are older. You should be ashamed of yourself and vanish because of what you publicly do, Apmex. You are filthy. I am sick.

Fees and Pricing Structure at APMEX

When considering a Gold IRA, understanding the associated fees and costs is crucial for maximizing returns and making informed investment decisions. APMEX’s pricing structure includes several key areas where investors need to pay attention, including product costs, storage fees, and custodian fees.

A. Product Pricing

APMEX is known for offering competitive pricing on its wide range of precious metals. The cost of gold, silver, platinum, and palladium products can fluctuate based on the spot price of the metal, as well as market demand. APMEX provides transparent pricing on all products, with no hidden fees or commissions, which allows investors to clearly see what they’re paying for when they make a purchase.

B. Storage Fees

As per IRS requirements, precious metals held within a Gold IRA must be stored in an approved depository. The depository charges storage fees, which typically depend on whether the metals are stored in a segregated or non-segregated (commingled) manner. Segregated storage tends to be more expensive, as it involves storing your metals separately from those of other investors. Storage fees with APMEX’s depository partners are generally competitive and vary by the amount of metals stored.

C. Custodian Fees

Since APMEX works with third-party custodians for the management of the self-directed IRA, there are custodian fees to consider. These fees usually include account setup fees, annual maintenance fees, and possibly transaction fees for the purchase or sale of metals within the account. Custodian fees may vary depending on the specific custodian chosen, and it is advisable for investors to review these fees carefully to ensure they align with their investment strategy.

D. Shipping Fees

When metals are purchased through APMEX for an IRA, they are shipped directly to the approved depository. While APMEX typically offers free or low-cost shipping for non-IRA purchases, shipping to an IRA depository may carry additional costs. However, since APMEX works with trusted depositories and custodians, they often handle logistics efficiently to minimize these costs.

Considerations for an APMEX Gold IRA

While APMEX offers numerous benefits, there are also a few potential drawbacks to consider:

A. Custodian and Storage Fees

The custodian and storage fees associated with a Gold IRA can add up over time, especially for investors with smaller accounts. These fees may be higher compared to the fees associated with traditional IRAs or other retirement accounts that don’t involve physical assets. Although APMEX partners with cost-effective depositories, the need for secure, third-party storage can still be more expensive than other forms of investment.

B. Limited Liquidity

Although gold and other precious metals are tangible assets, they are less liquid compared to stocks, bonds, or mutual funds. Selling gold from an IRA may take longer than selling shares of stock, as it involves finding a buyer, shipping the metals from the depository, and liquidating the asset. However, gold tends to maintain its value over the long term, so this may not be a significant issue for those seeking long-term stability.

C. Volatility of Precious Metals Prices

While gold is generally seen as a stable asset, it is still subject to price fluctuations based on market conditions, supply and demand, and geopolitical factors. Investors should be prepared for the possibility that their gold holdings could decrease in value, especially over shorter investment periods. However, many investors choose to hold gold as part of a diversified portfolio to mitigate the impact of volatility.

D. No Direct Control Over the Metals

Investors who hold precious metals within an IRA must store them in an approved depository, which means they do not have direct control over the physical metals. This lack of direct access may be a drawback for investors who prefer to have their gold in their personal possession. However, this is a requirement of the IRS for tax-advantaged IRA accounts, and it’s the same for any Gold IRA, not just those facilitated by APMEX.

Steps to Set Up an APMEX Gold IRA

Setting up a Gold IRA with APMEX involves a few key steps. The process is relatively straightforward but requires attention to detail to ensure compliance with IRS regulations.

Step 1: Select a Custodian

Since APMEX itself does not provide custodial services, the first step is to choose an approved custodian to manage your self-directed IRA. APMEX partners with several custodians, including Equity Trust, STRATA Trust, and GoldStar Trust. These custodians specialize in managing precious metals IRAs and handle all IRS reporting and documentation. Investors can contact APMEX directly for assistance in selecting the right custodian for their needs.

Step 2: Fund the IRA

Once the account is set up with a custodian, you’ll need to fund the IRA. This can be done in several ways:

- Direct Contribution: You can make a direct contribution of cash to your new IRA, subject to annual contribution limits.

- Rollover: You may roll over funds from an existing retirement account, such as a 401(k), traditional IRA, or Roth IRA, into your new Gold IRA.

- Transfer: You can also transfer funds directly from another IRA custodian into the new self-directed IRA.

Your chosen custodian will help you navigate the funding process to ensure it is done in compliance with IRS regulations.

Step 3: Purchase Precious Metals

Once the funds are in place, you can use them to purchase the precious metals that will be held in your IRA. APMEX provides a wide selection of IRS-approved gold, silver, platinum, and palladium products. The IRS has strict rules about which metals can be held in an IRA, so be sure to choose products that meet the purity requirements (e.g., gold must be at least 99.5% pure, and silver must be at least 99.9% pure).

Step 4: Arrange Storage

After purchasing the metals, APMEX will ship them to an IRS-approved depository for secure storage. The custodian and depository will work together to ensure that the precious metals are properly stored and reported to the IRS. You will receive regular reports on the value of your holdings and account statements from the custodian.

Step 5: Manage the Account

Once the account is set up and the metals are in storage, you can manage your Gold IRA just like any other retirement account. This includes monitoring the value of your holdings, making additional contributions (if desired), or taking distributions once you reach retirement age. As with traditional IRAs, you can begin taking distributions penalty-free at age 59½. However, if you take distributions before this age, you may be subject to penalties and taxes.

APMEX Review: Conclusion

APMEX is a well-established and trusted provider in the precious metals industry. It offers a robust platform for investors looking to diversify their retirement portfolios with a Gold IRA. The company’s extensive range of precious metals products, transparent pricing, and partnerships with reputable custodians and depositories make it a solid choice for both novice and seasoned investors.

Investing in a Gold IRA through APMEX provides numerous benefits, including portfolio diversification, protection against inflation, and long-term stability. Additionally, APMEX’s strong commitment to customer service, educational resources, and secure storage solutions help ensure that investors can navigate the often-complex world of precious metals investing with confidence.

However, potential investors should also be mindful of the associated fees, the relatively lower liquidity of precious metals, and the fact that gold prices can be volatile over short periods. Understanding these factors and carefully assessing one’s own financial goals and risk tolerance is key to making the right decision.

In conclusion, for those seeking to safeguard their retirement savings with a tangible asset that has stood the test of time, APMEX’s Gold IRA offering provides a compelling option. As with any investment, due diligence is critical, and APMEX’s reputation and resources provide a strong foundation for success in precious metals investing.