A Monex IRA is a self-directed individual retirement account (IRA) that allows you to hold physical precious metals, such as gold, silver, platinum, and palladium, as part of your retirement portfolio. Monex is a well-known precious metals dealer with decades of experience in the industry, and they provide investors with the opportunity to purchase metals to be held within their IRA.

Unlike traditional IRAs that are often limited to paper assets like stocks and bonds, a Monex IRA allows you to diversify by adding tangible assets. This type of IRA is often referred to as a “Precious Metals IRA” or “Gold IRA.”

Find the Best Gold IRA Company of Your State

Types of Precious Metals in a Monex IRA

Monex offers a variety of precious metals that can be included in your IRA. The IRS has specific regulations about what types of metals can be held in an IRA, and Monex adheres to these standards. The approved metals must meet minimum fineness requirements to qualify. Here are the primary types of metals you can invest in:

- Gold: Must be .995 fine (99.5% pure). Popular choices include American Gold Eagles, Canadian Gold Maple Leafs, and Austrian Gold Philharmonics.

- Silver: Must be .999 fine (99.9% pure). This includes American Silver Eagles, Canadian Silver Maple Leafs, and Australian Silver Kangaroos.

- Platinum: Must be .9995 fine (99.95% pure). American Platinum Eagles and Canadian Platinum Maple Leafs are common options.

- Palladium: Must be .9995 fine (99.95% pure). Palladium bars and coins from approved refiners are eligible.

Monex ensures that all metals purchased for IRAs meet the IRS guidelines.

Why Invest in a Monex Precious Metals IRA?

Investing in a Monex IRA provides a hedge against market volatility and inflation, particularly during times of economic uncertainty or currency devaluation. Here are several reasons why individuals might choose to invest in a Monex IRA:

- Diversification: Precious metals offer diversification beyond traditional financial assets, helping to balance risk in a portfolio.

- Inflation Protection: Gold and other precious metals tend to retain value over time, especially during inflationary periods when paper assets may lose purchasing power.

- Wealth Preservation: Precious metals have historically been a store of value, making them an attractive option for long-term wealth preservation.

- Tangible Assets: Unlike stocks or bonds, precious metals are physical assets that can be stored and owned directly within an IRA.

How Does a Monex IRA Work?

A Monex IRA works similarly to a traditional IRA but includes physical precious metals rather than paper assets. Here’s how it operates:

- Open a Self-Directed IRA: You need to open a self-directed IRA with a custodian that allows alternative investments such as precious metals.

- Fund the Account: You can fund your IRA through contributions, transfers, or rollovers from other retirement accounts.

- Select Metals: Once your account is funded, you can choose which precious metals to purchase from Monex.

- Storage: The metals are stored in an IRS-approved depository to ensure they meet the regulatory standards.

- Monitoring and Growth: Over time, the value of your precious metals may fluctuate based on market conditions, and you can monitor the growth of your investment.

Monex works with reputable custodians and storage facilities to facilitate this process for investors.

Setting Up a Monex Precious Metals IRA

Setting up a Monex IRA involves a few essential steps. It’s a relatively straightforward process but requires a bit more involvement than setting up a standard IRA. Here’s a step-by-step guide:

- Choose a Custodian: Since you cannot directly hold precious metals in your IRA, you’ll need a custodian to manage the account. Monex can recommend trusted custodians who specialize in self-directed IRAs.

- Fund the Account: After selecting a custodian, you can fund your new IRA through a rollover, transfer from another IRA, or through regular contributions.

- Purchase Precious Metals: Work with Monex to select the precious metals that best align with your investment strategy. Monex will handle the purchase and ensure the metals meet IRS requirements.

- Storage: Your precious metals will be stored in a secure, IRS-approved depository until you decide to take distributions or liquidate the assets.

Monex provides comprehensive support throughout the setup process, making it easy for investors to get started.

Types of Monex IRA Accounts

There are several types of IRA accounts available, and a Monex IRA can be set up within any of these frameworks, depending on your individual needs and tax situation:

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred. Taxes are paid when withdrawals are made during retirement.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

- SEP IRA: A Simplified Employee Pension IRA is designed for self-employed individuals or small business owners. Contributions are tax-deductible, and earnings grow tax-deferred.

- SIMPLE IRA: A Savings Incentive Match Plan for Employees IRA is a type of IRA designed for small businesses, offering tax-deferred growth and employer contributions.

Each type of IRA has different rules regarding contributions, taxation, and withdrawals. Consult with a financial advisor to determine which type of IRA is right for you.

Benefits of Investing in Precious Metals through Monex IRA

Investing in a Monex IRA offers several unique benefits that can enhance your retirement portfolio:

- Portfolio Diversification: Including physical assets like gold or silver can provide balance and reduce overall portfolio risk.

- Inflation Hedge: Precious metals are often seen as a safeguard against inflation, protecting purchasing power when currencies lose value.

- Global Demand: Precious metals are in demand worldwide, making them liquid and easy to sell when needed.

- Long-Term Stability: Historically, metals like gold have maintained their value over long periods, offering a sense of security during economic downturns.

Risks and Considerations of a Monex IRA

While a Monex IRA offers significant benefits, it’s important to consider the associated risks:

- Price Volatility: Precious metals can experience significant price fluctuations, which can lead to both gains and losses in a short period.

- No Dividends or Interest: Unlike stocks or bonds, precious metals do not generate dividends or interest, so they rely entirely on capital appreciation for growth.

- Storage Fees: Since physical metals must be stored in a secure depository, custodial and storage fees can accumulate over time.

- Limited Liquidity: While precious metals are generally easy to sell, they are not as liquid as stocks or bonds, which can be traded instantly.

Understanding these risks will help you make informed decisions about investing in a Monex IRA.

Monex vs. Traditional IRAs

A Monex IRA differs from a traditional IRA in several ways. While both types of accounts allow tax-deferred growth, the key differences lie in the types of investments allowed:

- Asset Classes: Traditional IRAs typically hold paper assets like stocks, bonds, or mutual funds. A Monex IRA, on the other hand, allows physical precious metals.

- Risk Profile: Precious metals can be more volatile than stocks and bonds but offer protection against certain types of risk, like inflation or economic instability.

- Growth Potential: Stocks and bonds may provide dividends and interest, while precious metals rely on market price increases.

Choosing between a Monex IRA and a traditional IRA depends on your risk tolerance, investment goals, and outlook on the economy.

The Role of Custodians in a Monex IRA

In a self-directed IRA like the Monex Precious Metals IRA, a custodian plays a crucial role in managing and administering the account. The IRS requires that all IRAs be held by a custodian, as investors are not allowed to directly take possession of the metals within an IRA.

The custodian is responsible for:

- Account Setup: Assisting you in opening and maintaining your self-directed IRA.

- Transaction Management: Handling the purchase and sale of precious metals within your account in coordination with Monex.

- Storage Arrangements: Ensuring your metals are safely stored in an IRS-approved depository.

- Compliance: Ensuring that all transactions comply with IRS rules and regulations, especially regarding the purchase of eligible metals and the proper handling of tax reporting.

Monex works with various trusted custodians that specialize in self-directed IRAs. Custodian fees typically include account setup, annual maintenance, and storage fees, which can vary based on the value of your assets.

Monex Precious Metals Reviews Across Different Platforms:

Monex, a veteran in the precious metals industry, has garnered mixed reviews across various platforms, reflecting diverse customer experiences. Here’s a detailed look at how Monex scores on Trustpilot, Yelp, Google Reviews, and the Better Business Bureau (BBB), providing insights into its service quality and customer satisfaction.

Trustpilot Ratings

- High Ratings: Monex boasts a high rating of 4.9 out of 5 stars on Trustpilot, based on a significant number of reviews (approximately 2,908 reviews). This indicates strong customer satisfaction in areas such as customer service, product quality, and transaction ease.

- Customer Feedback: Positive reviews on Trustpilot highlight the knowledge, professionalism, and friendliness of Monex staff, suggesting that interactions with the company are generally favorable and efficient.

Yelp Ratings

- Lower Ratings: On Yelp, Monex has a much lower rating of 2.5 out of 5 stars, based on 30 reviews. This stark contrast with Trustpilot ratings suggests that some customers may have had less favorable experiences.

- Common Complaints: Negative reviews often mention poor customer service and issues with product quality or delivery, indicating potential areas for improvement in operations and customer engagement.

Google Reviews

- Moderate Ratings: Google Reviews show an average rating of 3.2 out of 5 stars from 20 reviews. This moderate score further supports the mixed feedback seen across platforms.

- Varied Experiences: Reviews on Google reiterate the inconsistency in customer service and the quality of interactions customers have with Monex, ranging from very positive to unsatisfactory.

BBB Ratings

- Good Rating but Not Accredited: The BBB gives Monex an A rating but notes that the company is not accredited. The BBB rating is based on business interactions and complaint resolutions, suggesting Monex maintains a decent level of business conduct.

- Issues with Complaint Resolution: Some reviews and BBB’s own notes indicate that Monex has room to improve in handling and resolving customer complaints effectively. Issues cited include unresponsiveness to customer disputes and failure to resolve conflicts satisfactorily.

Summary of Customer Sentiments

Monex demonstrates a mixed reputation across different review platforms. While some customers report high satisfaction, particularly highlighted by Trustpilot, others express dissatisfaction, especially regarding customer service and the handling of complaints. This variability suggests that potential customers should approach Monex with a balanced view, acknowledging both the positive experiences and the areas where the company appears to struggle.

Recommendations for Prospective Customers

- Research Thoroughly: Prospective customers should read multiple reviews across various platforms to get a comprehensive understanding of what to expect.

- Compare Services: It may also be beneficial to compare Monex’s services, fees, and product offerings with other companies in the precious metals market to find the best fit for individual investment needs.

- Customer Service Interaction: Engaging with Monex’s customer service before committing to any transactions can provide personal insight into how the company treats its clients and handles inquiries.

Given the discrepancies in reviews, conducting due diligence is crucial. Potential investors should consider all aspects of Monex’s service offerings and online customer reviews to make an informed decision about whether to engage with the company for their precious metals investments.

Tax Implications of Opening a Gold IRA with Monex Precious Metals

One of the main advantages of a Monex IRA, like other retirement accounts, is its favorable tax treatment. However, understanding the specific tax rules related to your IRA is essential for maximizing benefits and avoiding penalties.

- Tax-Deferred Growth: In a traditional Monex IRA, your investments grow tax-deferred, meaning you won’t pay taxes on gains until you take distributions in retirement. This allows your investment to compound more effectively over time.

- Roth IRA Tax Benefits: If you have a Roth Monex IRA, you pay taxes upfront on contributions, but your future withdrawals in retirement are tax-free, including any gains from the sale of precious metals.

- Early Withdrawal Penalties: If you withdraw from your Monex IRA before the age of 59½, you will likely face a 10% early withdrawal penalty in addition to regular income taxes on the distribution (for traditional IRAs). There are some exceptions to this rule, such as certain medical expenses or first-time home purchases.

- Required Minimum Distributions (RMDs): Traditional IRAs require you to start taking RMDs once you turn 73 (as of 2024). The value of the precious metals in your account will be factored into the RMD calculation. If you don’t take RMDs, you could face hefty penalties.

Tax planning is an important aspect of managing your Monex IRA. Consider working with a tax advisor to ensure you understand how contributions, distributions, and the eventual sale of metals will affect your tax situation.

Monex and IRS Regulations on Precious Metals IRAs

Monex complies with IRS regulations regarding the inclusion of precious metals in IRAs. The IRS has strict rules about which types of metals can be held in an IRA, and Monex ensures all of its products meet these criteria.

Key IRS regulations include:

- Eligible Metals: Only certain precious metals, such as gold, silver, platinum, and palladium, are allowed in an IRA. Additionally, these metals must meet specific fineness standards to qualify:

- Gold: .995 fine

- Silver: .999 fine

- Platinum: .9995 fine

- Palladium: .9995 fine

- Storage Requirements: All precious metals in an IRA must be stored in an IRS-approved depository. You cannot store the metals at home or in a personal safe. Monex works with secure, IRS-approved facilities to store your metals.

- Prohibited Transactions: The IRS prohibits self-dealing in IRAs, meaning you cannot buy metals from yourself or use them for personal benefit until you take a qualified distribution.

Monex ensures full compliance with these regulations, providing peace of mind for investors looking to maintain a tax-advantaged retirement account.

Trustpilot Reviews: Monex

Monex has had 3,461 evaluations from customers, and it has received 4.9 stars overall.

#1. Don Stockton provided me with various explanations. In just a few short weeks, the last guy I had there cost me thousands of dollars because he failed to explain how the system worked, what options I had, and what I could do.

#2. The process of purchasing is simplified by art. The transactions are completed in a short amount of time.

Another thing about Art Levine he is very knowledgeable, never puts you on hold and always available to discuss precious metals.

That is why I will continue to use Monex…

I have been a customer of Monex for more than 6 years..

#3. I was disappointed that instead of shipping all of my order together it was sent as two orders thereby costing me double the shipping cost. I do not see the reasoning for that. It’s making me think twice about ordering from Monex again or referring my friends.

#4. service was fine but charges for shipping was allocated for each each of 3 items , yet they all arrived in same box.should have been one shipping cost and lower. other firms do not charge for shipping and cost of product same or less. I am, as always, really pleased with the result.

#5. referred to concerning a gold Valcambi CombiBar that is capable of being divided into several pieces. Was told they don’t have that specific brand of gold but I would receive one of 3 different types of combi bars. The gold that I was given was in the form of normal bars. Two distinct brands, as well as two of the packages that were opened and stapled, were included. Both the customer support team and the salesperson who initially made the transaction were unwilling to assist in resolving the issue. Considering the abundance of fake pamp bars that are now available, I will have a difficult time selling an open package bar to anyone other than monex. Not a single person would be recommended to use this company.

Storage Options for Precious Metals in a Gold IRA

Precious metals in a Monex IRA must be stored in an IRS-approved depository. These facilities are highly secure and designed to protect your assets from theft or damage.

There are typically two types of storage options:

- Segregated Storage: Your metals are stored separately from other investors’ metals, ensuring that the exact items you purchase will be returned to you when you make a withdrawal. This option usually comes with higher fees but offers greater assurance that your specific coins or bars will be kept intact.

- Commingled Storage: Your metals are stored along with other investors’ metals, although your holdings are still accounted for and tracked. This is a more cost-effective option but does not guarantee the return of the exact bars or coins you originally purchased, only items of equivalent value and quality.

Monex offers both segregated and commingled storage options through their custodial partners, giving investors flexibility based on their preferences and budget.

Withdrawal Rules and Penalties

As with other IRAs, there are specific rules regarding withdrawals from a Monex Precious Metals IRA. Here’s what you need to know:

- Age Requirement: You can begin taking distributions from your gold IRA at age 59½ without penalties. However, if you withdraw funds or physical metals before this age, you may be subject to a 10% early withdrawal penalty and income taxes.

- Required Minimum Distributions (RMDs): For traditional gold IRAs, RMDs must begin at age 73. If you fail to take RMDs, you could be penalized 50% of the amount you were supposed to withdraw. Roth IRAs are not subject to RMDs during your lifetime.

- In-Kind Distribution: One unique aspect of a Monex IRA is that you can take an in-kind distribution, meaning you receive the physical precious metals rather than cash. This can be advantageous if you believe the metals will continue to increase in value or you want to hold them personally.

Understanding the distribution rules is important for managing your retirement and avoiding unnecessary penalties.

How to Transfer or Rollover into a Monex IRA

If you already have a retirement account (such as a traditional IRA, 401(k), or Roth IRA), you can transfer or rollover those funds into a Monex IRA without incurring penalties or taxes, as long as the transfer is handled properly.

- IRA to IRA Transfer: This is the simplest option and involves transferring funds from an existing IRA directly to your new self-directed Monex IRA. There are no taxes or penalties as long as the transfer is done directly between custodians.

- Rollover from a 401(k): If you are leaving an employer or want to move funds from an old 401(k), you can roll those funds into a Monex IRA. In this case, you would request a distribution from the 401(k) plan, and then you have 60 days to deposit the funds into your new IRA to avoid penalties or taxes.

- Direct Rollover: To avoid any tax complications, you can also opt for a direct rollover, where the funds are transferred directly from your 401(k) or another retirement plan into your new Monex IRA.

Monex’s team can guide you through the rollover or transfer process, ensuring that the transition is smooth and compliant with IRS regulations.

Are There Any Lawsuits against Monex?

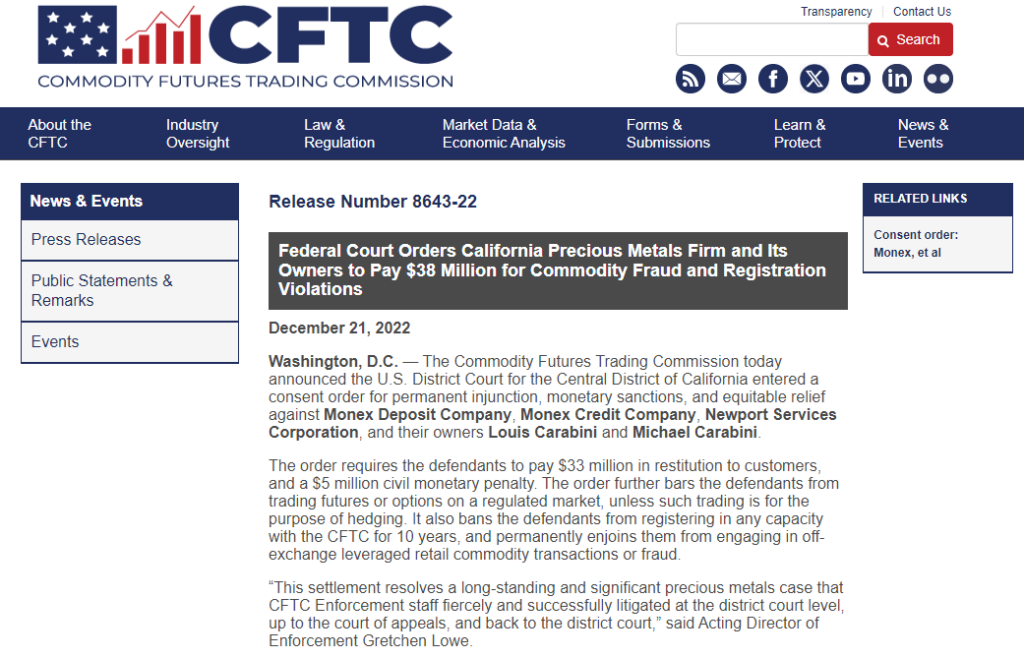

Monex Precious Metals has faced significant legal challenges, particularly from the Commodity Futures Trading Commission (CFTC). The CFTC filed an anti-fraud enforcement action against Monex, alleging that the company misled customers through its leveraged precious metals trading program, known as Atlas. This program involved trading precious metals on margin, which led to substantial customer losses.

Key Lawsuit Details:

- Court Rulings: The U.S. Court of Appeals for the Ninth Circuit ruled against Monex, affirming a preliminary injunction that was part of the CFTC’s enforcement action. This decision marked a significant legal setback for Monex, as the court found sufficient grounds for the CFTC’s allegations of fraud.

- Financial Penalties: Monex was ordered to pay $33 million in restitution to customers and a $5 million civil monetary penalty. This order came after it was determined that the company’s trading practices were deceptive, promising safe and secure investments that were in reality highly risky and led to investor losses.

- Operational Restrictions: Following the lawsuit, Monex is barred from trading futures or options, which significantly impacts the scope of services they can offer to customers going forward.

However, that legal issue has since been resolved.

Currently, Monex Precious Metals is free from any legal disputes and is focused on helping consumers preserve their wealth.

Conclusion

A Monex Precious Metals IRA offers a unique opportunity for investors looking to diversify their retirement portfolios with tangible assets like precious metals. For those concerned about inflation, market volatility, or economic uncertainty, adding gold, silver, platinum, or palladium to a gold IRA can provide both security and growth potential.

Before deciding if a Monex IRA is right for you, consider the following:

- Investment Goals: Are you looking for long-term wealth preservation, or do you have a more aggressive growth strategy? Precious metals can fit into either, but they require careful consideration of market trends and economic conditions.

- Risk Tolerance: Precious metals can be volatile in the short term, so they are best suited for investors with a higher tolerance for risk or those seeking to hedge against specific financial threats like inflation.

- Diversification Needs: If your current retirement portfolio is heavily invested in stocks, bonds, or mutual funds, adding precious metals can provide balance and reduce overall portfolio risk.

With decades of experience, Monex is a trusted name in the precious metals market, and its partnership with reputable custodians makes the Monex IRA an attractive option for those looking to invest in physical assets for retirement.