Fisher Capital Group is a prominent financial services firm specializing in precious metals investments, offering clients avenues to diversify their portfolios and safeguard wealth. The organization’s success is driven by a team of seasoned professionals whose expertise and leadership have been instrumental in its growth and reputation.

Find the Best Gold IRA Company of Your State

People Behind Fisher Capital Group:

At the helm of Fisher Capital Group is Alexander Spellane, the Chief Executive Officer. Despite not pursuing a traditional college education, Alexander achieved his first million dollars before the age of 30, demonstrating his entrepreneurial spirit and acumen. Under his leadership, Fisher Capital has built a reputation as a seasoned precious metal IRA business, ensuring clients’ peace of mind by anchoring their wealth securely in gold.

Apart from him, the company consists of various finance professionals who help consumers start their precious metals journey.

Products Available at Fisher Capital Group:

Fisher Capital Group specializes in precious metals investments, offering a diverse range of products to help clients diversify their portfolios and safeguard wealth. Below is an overview of their product offerings:

1. Gold and Silver Bullion Coins

Fisher Capital provides a selection of gold and silver bullion coins, valued based on their metal content. These coins are popular among investors seeking tangible assets.

2. Exclusive Precious Metal Coins

In addition to standard bullion, Fisher Capital offers exclusive coins that are limited in mintage, historic, or possess unique attributes, potentially increasing their desirability over time.

3. Fractional Coins

For investors interested in smaller denominations, fractional coins are available. These smaller weight products can be more cost-effective and offer flexibility for smaller transactions.

4. Precious Metals IRAs

Fisher Capital specializes in facilitating Precious Metals Individual Retirement Accounts (IRAs), allowing clients to include physical gold and silver in their retirement portfolios. This service includes assistance with account setup, funding, and selection of appropriate precious metal assets.

5. Gold and Silver Bars

While specific details are not provided in the available sources, Fisher Capital’s offerings likely include gold and silver bars, which are common investment products in the precious metals market.

Fisher Capital emphasizes a personalized approach, guiding clients through the selection process to align with their investment goals and preferences. The firm also provides educational resources to help investors make informed decisions regarding precious metals investments.

How to Open a Gold IRA with Fisher Capital Group

A Gold IRA is an excellent way to diversify your retirement portfolio and protect your savings against inflation and economic uncertainty. Fisher Capital Group specializes in helping clients open and manage Precious Metals IRAs, including Gold IRAs, with a streamlined process that ensures compliance and convenience. Here’s a step-by-step guide to opening a Gold IRA with Fisher Capital Group.

1. Understand the Basics of a Gold IRA

Before opening a Gold IRA, it’s essential to understand how it works. A Gold IRA is a self-directed individual retirement account (IRA) that allows you to invest in physical gold and other precious metals, as opposed to traditional stocks, bonds, or mutual funds. The gold must meet IRS requirements for purity and storage.

Key Features:

- Tax Advantages: Similar to traditional IRAs, contributions to a Gold IRA may be tax-deferred, and gains are not taxed until distribution.

- Portfolio Diversification: Investing in gold can help balance risk in a volatile market.

- Secure Storage: IRS regulations require gold to be stored in approved depositories.

2. Choose Fisher Capital Group as Your Gold IRA Custodian

Fisher Capital Group offers custodial services and expertise in setting up Gold IRAs. Their team guides you through the process, ensuring compliance with IRS rules and making the experience hassle-free.

Why Fisher Capital Group?

- A+ rating from the Better Business Bureau.

- Expertise in precious metals investing.

- Personalized customer service to meet individual financial goals.

3. Open a Self-Directed IRA

The first step in creating a Gold IRA is to open a self-directed IRA with Fisher Capital Group. A self-directed IRA allows for alternative investments, such as gold and other precious metals.

Steps to Open Your Account:

- Complete the Application: Contact Fisher Capital Group to fill out the application form for a self-directed IRA. Their representatives will assist with any questions.

- Fund Your Account: Transfer funds into your self-directed IRA. This can be done through:

- A rollover from an existing IRA or 401(k).

- A transfer from another retirement account.

- Direct contributions to the new account.

4. Choose Your Gold Investments

Once your account is funded, Fisher Capital Group helps you select eligible gold products that meet IRS standards. Eligible options include:

- Gold Coins:

- American Gold Eagle

- Canadian Gold Maple Leaf

- Australian Kangaroo/Nugget Coins

- Gold Bars:

- Minted by approved refiners and meeting the minimum purity requirement of 99.5%.

5. Purchase and Arrange Storage

After selecting your gold products, Fisher Capital Group facilitates the purchase and ensures the gold is securely stored in an IRS-approved depository. These depositories are designed to meet strict security and compliance standards.

Key Points About Storage:

- You cannot store the gold at home or in a personal safe.

- Approved depositories include facilities with high-security vaults, insurance, and regular audits.

6. Manage and Monitor Your Gold IRA

Fisher Capital Group provides tools and resources to help you manage your Gold IRA effectively. This includes:

- Ongoing Support: Dedicated account managers available to answer questions and assist with additional investments.

- Market Updates: Insights into the gold market to inform your investment decisions.

- Transparency: Regular account statements to track the performance of your Gold IRA.

7. Plan for Distributions

When you reach retirement age, you can begin taking distributions from your Gold IRA. Fisher Capital Group assists with the distribution process, ensuring compliance with IRS rules and minimizing tax implications.

Distribution Options:

- Physical Gold: Take possession of the gold directly.

- Cash Equivalent: Liquidate your gold for cash.

Opening a Gold IRA with Fisher Capital Group is a straightforward process that combines expert guidance, secure storage, and a commitment to customer satisfaction. Whether you’re looking to hedge against inflation or diversify your retirement portfolio, Fisher Capital Group offers the expertise and support you need to make informed decisions.

Fisher Capital Group Fees and Pricing:

Fisher Capital Group specializes in precious metals investments, offering services such as Gold Individual Retirement Accounts (IRAs) and direct purchases of gold and silver. Understanding the associated fees and pricing is crucial for investors considering these options.

Gold IRA Fees

Establishing a Gold IRA with Fisher Capital Group involves several costs:

- Account Setup Fee: A one-time fee of $95 is charged to initiate the self-directed IRA account.

- Annual Maintenance Fee: An annual fee of $95 covers administrative services and account maintenance.

- Storage Fees: Physical gold must be stored in an IRS-approved depository. Storage fees start from as low as $100 per year, depending on the chosen depository and the amount of gold held.

Direct Purchase Pricing

For clients interested in purchasing gold or silver outside of an IRA, Fisher Capital Group offers a range of products:

- Product Pricing: Prices for gold and silver coins or bars are based on current market rates, which fluctuate daily. Fisher Capital Group provides transparent pricing aligned with real-time market values.

- Shipping and Handling: Shipping costs vary based on the shipment’s contents and the chosen carrier. Specific shipping fees are not disclosed on the company’s website.

Buyback Policy

Fisher Capital Group offers a buyback program for precious metals purchased through them:

- Buyback Pricing: The company will repurchase items at current market value, which may be more or less than the original purchase price.

Additional Considerations

Investors should be aware of potential additional costs:

- Market Fluctuations: The value of precious metals can vary, affecting the overall investment’s worth.

- Tax Implications: Depending on individual circumstances, there may be tax considerations related to buying, selling, or holding precious metals.

Fisher Capital Group Reviews and Complaints:

Fisher Capital Group, a financial services firm specializing in precious metals investments, has garnered attention for its offerings and customer service. Prospective clients often seek insights into the company’s reputation through various review platforms. Below is an overview of Fisher Capital Group’s ratings and reviews across notable sites:

Better Business Bureau (BBB): Fisher Capital Group holds an A+ rating from the BBB, indicating a strong commitment to resolving customer complaints and maintaining transparent business practices. However, the company has a limited number of customer reviews on the BBB platform, with an average rating of 2.67 out of 5 stars based on three customer reviews. citeturn0search6

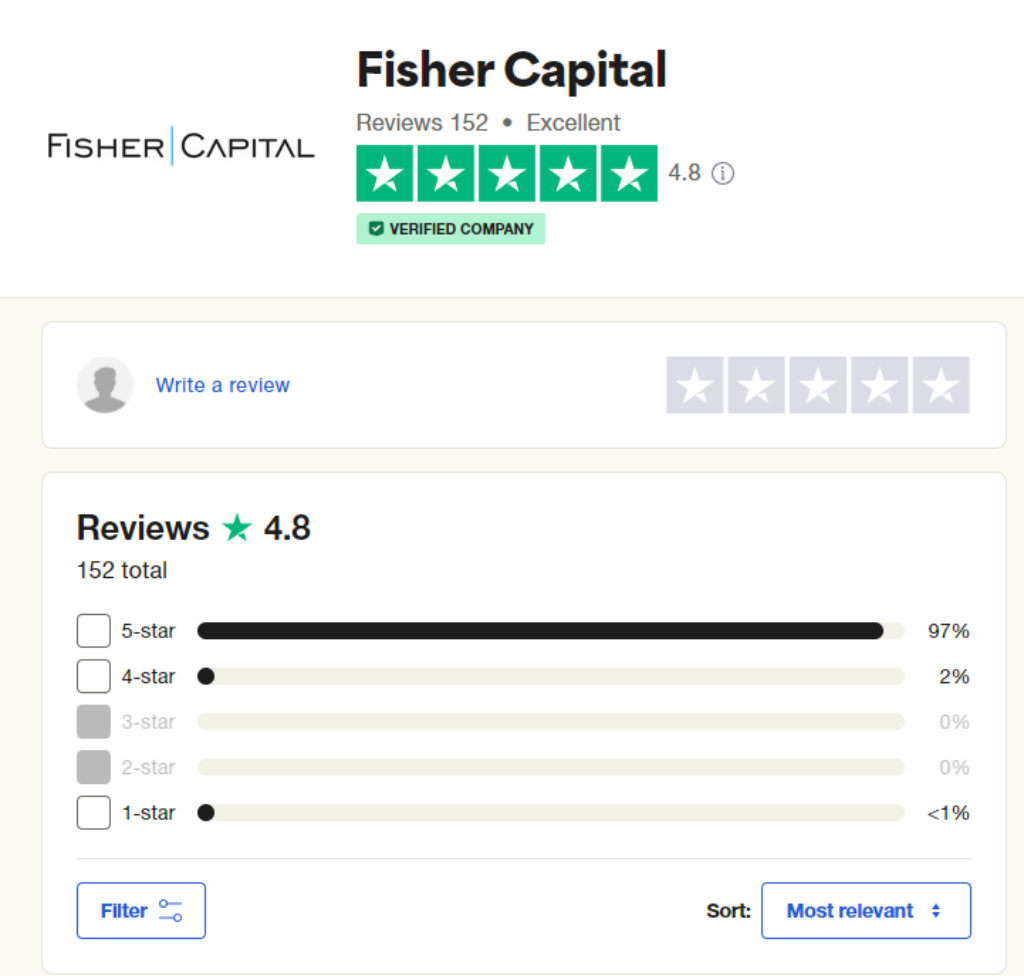

Trustpilot: On Trustpilot, Fisher Capital Group has received a 4.8 out of 5-star rating, reflecting high customer satisfaction. Clients have praised the company’s professionalism, transparency, and the quality of its investment products.

ConsumerAffairs: Fisher Capital Group has an overall satisfaction rating of 4.6 out of 5 stars on ConsumerAffairs, based on 21 customer reviews. Clients have highlighted the company’s knowledgeable staff and seamless investment process.

Yelp: As of the latest available information, Fisher Capital Group does not have a significant presence on Yelp, with few or no customer reviews.

Fisher Capital Group’s A+ rating with the BBB reflects a strong commitment to ethical business practices. High ratings on platforms like Trustpilot and ConsumerAffairs indicate a positive customer experience. However, the limited number of reviews on some platforms suggests that potential clients should conduct thorough research and consider direct communication with the company to assess its suitability for their investment needs.

How Fisher Capital Group Resolves Complaints

Fisher Capital Group has positioned itself as a trusted partner in the financial services sector, specializing in precious metals investments. However, like any company, it occasionally faces customer concerns or complaints. This article explores how Fisher Capital Group addresses and resolves complaints, highlighting its approach to maintaining customer satisfaction.

1. Proactive Customer Support

Fisher Capital Group emphasizes open communication and responsive customer service. Customers can reach out to the company through multiple channels, including:

- Phone Support: Clients can call the support team at (800) 617-5373 to discuss their concerns.

- Email and Online Forms: The company’s website provides a contact form for submitting complaints or inquiries directly to the support team.

By offering easy access to support, Fisher Capital ensures that customers can voice their concerns promptly and effectively.

2. Structured Complaint Resolution Process

When a customer files a complaint, Fisher Capital Group follows a structured process to ensure that the issue is resolved fairly and efficiently. This process includes:

- Acknowledgment of Complaints: The company promptly acknowledges complaints, typically within 24-48 hours, to assure customers that their concerns are being addressed.

- Investigation: Fisher Capital conducts a thorough review of the complaint, including an assessment of transaction records, account details, and communication logs.

- Resolution: Once the root cause of the issue is identified, the company works to provide a fair resolution, which may include refunds, replacements, or further clarification of policies.

3. Transparency and Customer Education

One of Fisher Capital Group’s strengths is its focus on transparency. The company strives to educate customers about its policies, products, and processes to minimize misunderstandings. This includes:

- Clear documentation of terms and conditions during transactions.

- Educating customers about market risks associated with precious metals investments.

- Providing detailed invoices and purchase agreements for clarity.

This proactive approach reduces the likelihood of complaints arising from unclear expectations or miscommunication.

4. Leveraging BBB Resources

Fisher Capital Group maintains an A+ rating with the Better Business Bureau (BBB), a testament to its commitment to ethical business practices and complaint resolution. When a complaint is filed through the BBB, Fisher Capital:

- Responds promptly to the customer’s concerns.

- Provides a detailed explanation of the situation and the steps taken to resolve it.

- Seeks to close cases with mutually agreeable outcomes, ensuring that customers feel satisfied with the resolution.

5. Continuous Improvement

Feedback from customer complaints serves as a valuable learning tool for Fisher Capital Group. The company uses this information to improve its internal processes and prevent similar issues in the future. Key strategies include:

- Regular training for customer service representatives.

- Updating policies to reflect customer feedback and market trends.

- Investing in technology to enhance the customer experience, such as order tracking and transparent reporting tools.

Is There Any Lawsuit Involving Fisher Capital Group:

Yes, Fisher Capital Group has been involved in legal proceedings. In April 2023, the Commodity Futures Trading Commission (CFTC) filed a civil enforcement action against Fisher Capital LLC and its principal, Alexander Spellane, alleging a fraudulent scheme targeting elderly individuals.

However, the company has since resolved the issue.

Moreover, they have worked on improving their operations to ensure no such issues reoccur.

Fisher Capital Group Review Summary

Fisher Capital Group demonstrates a commitment to resolving complaints through a structured, transparent, and customer-focused approach. While the company has faced challenges, its proactive measures in customer support and complaint resolution reflect an effort to maintain trust and satisfaction.

For current or prospective clients, staying informed about Fisher Capital Group’s policies and practices is essential. By understanding how the company handles concerns, customers can feel confident in their investment decisions and their ability to address any issues that arise.