Investing in precious metals has long been a strategy for diversifying portfolios and safeguarding wealth against economic uncertainties. Among the various avenues available, Gold Individual Retirement Accounts (IRAs) have gained prominence, allowing investors to include physical gold and other precious metals in their retirement planning.

CMI Gold & Silver, established in 1973, stands out as one of the oldest precious metals dealers in the United States, offering a range of services tailored to investors interested in Gold IRAs.

Find the Best Gold IRA Company of Your State

CMI Gold & Silver: A Brief Overview

Founded in Phoenix, Arizona, CMI Gold & Silver has been a significant player in the precious metals market for over five decades. Initially focusing on silver, the company expanded its offerings to include gold, platinum, and palladium, catering to a diverse clientele ranging from individual investors to institutional buyers. Their longevity in the industry underscores a commitment to customer service and a deep understanding of the precious metals market.

Services Offered by CMI Gold & Silver

- Precious Metals Sales

CMI Gold & Silver offers a comprehensive selection of precious metals, including:- Gold Coins and Bars: Products such as American Gold Eagles, Canadian Gold Maple Leafs, and various gold bars.

- Silver Coins and Bars: Including American Silver Eagles, Canadian Silver Maple Leafs, and silver bars of different weights.

- Platinum and Palladium Products: For investors interested in diversifying beyond gold and silver.

- Gold IRAs

Recognizing the growing interest in precious metals for retirement planning, CMI Gold & Silver facilitates the establishment of self-directed IRAs that include physical gold and other approved metals. They guide clients through the process, ensuring compliance with IRS regulations and helping select appropriate products for their retirement accounts. - Market Insights and Education

CMI Gold & Silver places a strong emphasis on educating their clients. Their website features a wealth of resources, including articles, market analyses, and guides on investing in precious metals. This commitment to education empowers investors to make informed decisions aligned with their financial goals.

Setting Up a Gold IRA with CMI Gold & Silver

Establishing a Gold IRA involves several key steps, and CMI Gold & Silver assists in the process:

- Choosing a Custodian

IRS regulations require that physical gold within an IRA be held by an approved custodian. CMI Gold & Silver collaborates with reputable custodians, such as GoldStar Trust Company, to ensure secure storage and compliance with all legal requirements. - Funding the Account

Investors can fund their Gold IRA through various methods:- Transfers: Moving funds from an existing IRA to the new self-directed IRA.

- Rollovers: Transferring assets from a 401(k) or other retirement accounts.

- Contributions: Making new contributions, subject to annual limits set by the IRS.

- Selecting Precious Metals

Not all gold products are eligible for inclusion in a Gold IRA. CMI Gold & Silver assists clients in selecting IRS-approved products, which typically include:- Gold: Minimum fineness of .995.

- Silver: Minimum fineness of .999.

- Platinum and Palladium: Minimum fineness of .9995.

- Examples of eligible products include American Gold Eagles, Canadian Gold Maple Leafs, and certain gold bars.

- Storage Arrangements

The IRS mandates that precious metals in an IRA be stored in an approved depository. CMI Gold & Silver coordinates with custodians to arrange secure storage at facilities like the Delaware Depository, protecting clients’ investments.

Advantages of Choosing CMI Gold & Silver for Your Gold IRA

- Experience and Reputation

With over 50 years in the industry, CMI Gold & Silver has built a solid reputation for reliability and customer service. Their longevity speaks to their expertise and commitment to client satisfaction. - Comprehensive Product Selection

CMI Gold & Silver caters to diverse investor preferences, offering a wide range of IRA-eligible products, allowing for tailored investment strategies. - Educational Resources

The company’s dedication to client education ensures that investors are well-informed about their options, the market, and the intricacies of investing in precious metals. - Transparent Pricing

CMI Gold & Silver is known for competitive pricing and transparency. It provides clients with clear information about premiums and fees associated with their investments.

Considerations and Potential Drawbacks

While CMI Gold & Silver offers numerous benefits, it’s essential to consider potential drawbacks:

- Limited International Services

The company’s primary focus is on the U.S. market, which may limit options for international investors. - Storage Fees

As with all Gold IRAs, there are storage fees associated with holding physical metals. Clients should be aware of these costs and factor them into their investment decisions.

CMI Gold & Silver - Market Volatility

While gold is often seen as a stable investment, it is not immune to market fluctuations. Investors should be prepared for potential price volatility and consider their risk tolerance accordingly.

Are There Any CMI Gold and Silver Lawsuits?

There are currently no lawsuits or legal issues against CMI Gold and Silver. The company appears to be maintaining a clean legal record, which is an important aspect for potential customers considering their services in the precious metals market.

This status can contribute positively to the company’s reputation, providing reassurance to investors regarding its operational integrity and compliance with legal standards.

However, as a cautious investor, you should always look into the legal history of a gold dealer.

Below are some tips on how to conduct your own independent research:

Tip #1: Check Their Regulatory Compliance and Accreditation

Check for proper licensing and registration with relevant financial regulatory bodies such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Verify the company’s accreditation with industry organizations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

It will help you check how credible they are.

Tip #2: Look into The Company’s Background

- Research the company’s history, including years in business and any name changes.

- Examine the Better Business Bureau (BBB) rating and accreditation status.

- Review customer feedback on reputable third-party review sites like Trustpilot or Consumer Affairs.

Tip #3: Does the Company Offer Good Resources?

- Assess the clarity of information provided about fees, storage options, and buyback policies.

- Evaluate the quality and depth of educational resources offered to investors.

- Verify that the company provides clear information about IRS regulations regarding precious metals IRAs.

Tip #4: What are Their Product Offerings and Pricing?

- Ensure the company offers IRS-approved precious metals for IRA investments.

- Compare pricing with other reputable dealers to ensure competitiveness.

- Be wary of companies pushing numismatic or collectible coins over bullion for IRA investments.

Tip #5: Confirm the Storage and Custodian Partnerships

Verify that the company works with IRS-approved custodians and secure storage facilities. According to IRS’ regulations, you cannot store your gold IRA’s precious metals at your home.

You’ll need a certified third-party storage provider.

Check the company’s storage and custodian partner to ensure you’re working with a reliable firm. Moreover, ensure they offer segregated storage options for your precious metals.

Segregated storage means your owned precious metals products will be stored separately from other investors’ possessions. Similarly, non-segregated storage means your products will be stored along with others.

Keep in mind that storage providers charge extra for segregated storage.

Some popular custodians include Equity Trust and Goldstar Trust.

Red Flags to Watch For in Gold IRA Companies

- Promises of guaranteed returns or claims of “secret” investment strategies.

- Pressure to act immediately or make large investments without proper consideration.

- Lack of physical address or unclear company ownership structure.

- Unwillingness to provide detailed information about fees or policies in writing.

By thoroughly evaluating these aspects, investors can make an informed decision about the legitimacy and reliability of a gold IRA company. It’s crucial to conduct due diligence and, if necessary, consult with a financial advisor before making any investment decisions.

CMI Gold & Silver’s Approach to IRA Compliance

Managing a Gold IRA requires adherence to specific IRS regulations, and CMI Gold & Silver ensures that clients comply with these rules throughout the life of their investment. Important compliance aspects include:

- Eligible Metals and Purity Standards: CMI strictly adheres to IRS guidelines by offering only IRA-approved precious metals, meeting minimum fineness levels for each metal (0.995 for gold, 0.999 for silver, and higher for platinum and palladium). They carefully curate products, ensuring clients are always investing in eligible assets.

- Required Minimum Distributions (RMDs): At age 72, IRA holders must start taking Required Minimum Distributions (RMDs). Although this applies mainly to traditional IRAs, if a client holds a traditional Gold IRA, CMI’s representatives advise on how to meet RMD requirements, whether by liquidating a portion of the precious metals or arranging another solution.

- Storage and Custodian Requirements: Unlike traditional assets, precious metals held in a Gold IRA must be stored in an IRS-approved depository, not in personal possession. CMI assists clients in working with trusted custodians and ensures that all IRS rules regarding storage are met.

- Annual Contribution Limits and Tax Implications: As with other IRAs, there are annual contribution limits for Gold IRAs. CMI ensures that clients stay informed of these limits and advises them on potential tax implications, as contributions and withdrawals from a Gold IRA are subject to standard IRS tax rules.

Customer Service and Educational Resources at CMI Gold & Silver

One of the standout features of CMI Gold & Silver is its dedication to customer education. They believe that a well-informed client is better equipped to make confident investment decisions. CMI offers a variety of resources, including:

- Investment Guides: These cover the basics of investing in precious metals, detailing how different metals can serve unique roles within a portfolio and what considerations are important for a Gold IRA.

- Market Analysis and Updates: Regular updates on the precious metals market are provided, highlighting how factors such as inflation rates, currency movements, and geopolitical events can impact the value of gold and silver.

- Retirement Planning Tips: CMI offers resources specifically for retirement planning, explaining the benefits of a Gold IRA in the context of a broader retirement strategy. Topics covered include how gold can help hedge against inflation and the potential tax benefits of a self-directed IRA.

- Personalized Consultation: For clients who need personalized advice, CMI offers consultations where representatives discuss individual financial goals, risk tolerance, and retirement timelines to tailor investment strategies to each client’s needs.

CMI Gold & Silver Reviews and Ratings on Different Platforms

With over five decades of experience, this gold dealer has built a strong presence as well.

Here are the ratings of this company on different consumer platforms:

Detailed Review Analysis of CMI Gold and Silver

CMI Gold and Silver has garnered attention and positive feedback across several review platforms, underlining its long-standing reputation in the precious metals industry. Here’s a deeper look into how they fare on key consumer review sites:

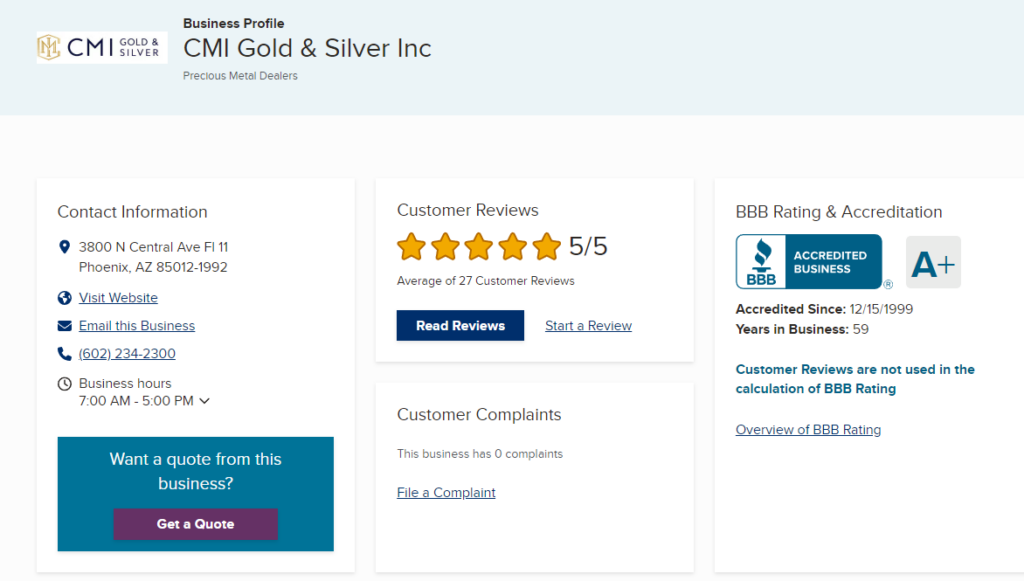

Better Business Bureau (BBB)

- Rating: A+

- Details: CMI Gold and Silver holds an A+ rating from the BBB, which reflects the highest level of business performance and customer service standards. This rating is particularly important because it indicates the company’s consistent commitment to resolving any customer issues and maintaining trust. No complaints have been registered against CMI Gold and Silver in the past three years, which speaks to their customer satisfaction and issue resolution efficiency.

Google Reviews

- Rating: 4.71 out of 5 stars

- Volume: 14 reviews

- Customer Feedback: The reviews on Google are overwhelmingly positive, highlighting the professionalism and courtesy extended to clients. This platform shows a strong sense of reliability, with customers appreciating the straightforward and transparent dealings when purchasing precious metals.

Yelp

- Rating: 5 out of 5 stars

- Volume: 3 reviews

- Insights: Although the number of reviews is limited, the perfect score on Yelp further confirms positive customer experiences. Reviewers on Yelp emphasize CMI’s attentive customer service and the quality of their products, suggesting that personal attention to client needs is a strong aspect of their service.

Key Strengths and Customer Perceptions

Professionalism and Reliability

Customers frequently cite CMI Gold and Silver’s professionalism in handling transactions and customer inquiries. The company’s long history and experienced management are often noted as confidence-inspiring aspects that encourage new and repeat business.

Transparency and Education

CMI Gold and Silver is also commended for its transparency in pricing and the educational resources it provides to clients. The company ensures that all potential fees and charges are clearly communicated upfront, preventing any surprises and helping clients make informed decisions.

Customer-Centric Approach

The consistent praise for CMI’s customer service across various platforms highlights their dedication to a customer-first approach. Whether dealing with large or small investors, CMI is noted for treating all clients with respect and providing personalized service that meets individual investment goals.

Areas for Improvement

Despite the overwhelmingly positive reviews, the limited number of feedback entries on some platforms like Yelp suggests that a broader customer base feedback could provide more insights into the company’s operations across different client experiences.

Conclusion

CMI Gold and Silver has established itself as a trustworthy and customer-oriented precious metals dealer with a strong emphasis on professionalism, transparency, and customer service. While the volume of reviews is not extensive, the content of existing reviews provides a consistently positive portrayal of the company’s operations. Potential customers and investors considering CMI Gold and Silver would benefit from these insights but should also seek out more extensive reviews and possibly contact the company directly to address any specific concerns or questions.

For more information, potential customers should refer directly to CMI Gold and Silver’s BBB profile and other review platforms to ensure the most comprehensive understanding of the company’s service quality.

Examples of CMI Gold & Silver Reviews Online:

Here, I’m sharing a few examples of the customer reviews I found on this company.

They will give you an idea of what to expect when working with them:

#1. During my dealings with CMI, I have engaged in several transactions involving the purchase and sale of gold. Each of these transactions has been distinguished by an exceptionally high degree of professionalism, efficiency, and personal safety. I have every intention of continuing to rely on their services for the management of my precious metal interests.

#2. Over the past half year, my experience with CMI Gold has been nothing short of remarkable. I decided to send them my gold coins and bars through the postal service, and as soon as they received them, CMI swiftly carried out a comprehensive inspection so that they could transfer the monies that had been agreed upon within just one day. In the past, dealing with them for transactions involving precious metals has been a snap.

#3. Those who are truly pros. Approximately two years ago, I was initially introduced to CMI, and ever since then, I have had nothing but the most positive experiences. In addition to providing a fantastic deal, they consistently go above and above to increase my education in order to enable me to execute the most profitable transactions. I simply do not have enough gratitude for these gentlemen!

#4. The very finest in every way. Extremely helpful and accommodating, as well as easy to work with. In the past, I’ve had the opportunity to collaborate with a couple of their sales representatives, and both of them were exceptional.

Comparing CMI Gold & Silver to Other Precious Metals IRA Providers

In the competitive market of precious metals IRAs, it’s beneficial to understand how CMI Gold & Silver measures up against other providers. Here are some aspects to consider when comparing:

- Experience: CMI’s long-standing presence in the market (over five decades) provides a level of stability and trust. Many newer companies lack this track record, making CMI a safer choice for those who value an established reputation.

- Fee Structure: While CMI is known for transparent pricing, fees can vary among providers. Some companies may offer “zero fees” or discounts, but these often come with conditions or hidden costs. CMI provides a clear and detailed breakdown of its fees, allowing clients to make an informed comparison.

- Educational Emphasis: Compared to many precious metals companies, CMI places a strong focus on educating clients. This feature is particularly useful for first-time investors who may be less familiar with the nuances of precious metals investing.

- Product Range: CMI’s selection of IRA-eligible metals is broad, though it may not be as expansive as some companies that specialize solely in rare and collectible coins. However, CMI’s focus on IRA-approved metals ensures compliance and simplifies the selection process for IRA investors.

- Security and Storage Options: The partnerships that CMI has with reputable custodians and depositories ensure that clients’ investments are securely stored. In contrast, some companies may offer storage options that don’t align with IRS requirements, potentially jeopardizing the tax benefits of the IRA.

Potential Risks and Considerations of a Gold IRA

Investors should be aware of certain risks and limitations associated with a Gold IRA:

- Illiquidity: While gold itself is a liquid asset, liquidating metals within an IRA can sometimes involve additional steps or fees, particularly if RMDs are required. Investors should understand the liquidity constraints that might arise with a Gold IRA compared to a traditional IRA.

- Market Volatility: Although gold is a relatively stable asset, it can experience price fluctuations. Those sensitive to short-term volatility should consider their tolerance levels when allocating a significant portion of their retirement to precious metals.

- Storage Fees: As previously mentioned, there are costs associated with storing precious metals. These fees can add up over time, and investors should factor these costs into their expected returns from the investment.

- Economic Sensitivity: Gold generally performs well during times of economic stress but may not yield substantial gains in a strong and stable economic environment. Those with Gold IRAs should be mindful of these economic dependencies when setting performance expectations.

CMI Gold and Silver Review: Conclusion

CMI Gold & Silver offers a comprehensive approach to Gold IRAs, backed by decades of industry experience and a commitment to customer education and transparency. For investors looking to diversify their retirement portfolios and hedge against inflation, a Gold IRA through

CMI provides an avenue to safeguard wealth with tangible assets. By working with established custodians, focusing on IRA-approved metals, and offering a robust suite of educational resources, CMI helps clients make informed decisions suited to their long-term financial goals.