Mariner Wealth Advisors operates across the country, but its New York City office stands out as a major hub for high-net-worth individuals and business owners seeking customized financial guidance. Located at 1500 Broadway on the 28th floor, right in the heart of Times Square, the NYC branch delivers the firm’s full spectrum of services with a team of seasoned professionals.

Looking for a Smart Hedge Against Market Volatility?

If you’re already working with—or considering—an advisor for long-term financial planning, don’t overlook the power of diversification. A Gold IRA can help protect your retirement savings from inflation, economic uncertainty, and market downturns.

High-net-worth investors and business owners use Gold IRAs not just as a safety net, but as a strategic asset within a broader portfolio.

Explore how a Gold IRA fits into your financial plan. Speak with a trusted advisor or request a free Gold IRA guide today.

✅ Protect your wealth

✅ Diversify your holdings

✅ Take control of your retirement future

What Services Does the NYC Office Offer?

The New York City office of Mariner Wealth Advisors offers a comprehensive suite of wealth management services designed to meet the needs of high-net-worth individuals, families, and business owners with complex financial lives. Their team uses a coordinated, client-first approach to manage all aspects of financial planning under one roof—removing the need to juggle multiple advisors or firms.

Wealth Planning

Clients receive highly customized financial plans tailored to both short- and long-term goals. Whether it’s planning for retirement, funding education, or aligning investments with philanthropic values, advisors focus on building a clear and adaptable strategy.

Investment Management

Mariner’s investment philosophy emphasizes risk-adjusted returns, diversification, and alignment with personal financial objectives. Portfolios are actively monitored and adjusted based on changing market conditions, tax implications, and evolving client needs.

Tax Strategy & Filing

With in-house CPAs and tax experts, the NYC office offers proactive planning aimed at minimizing tax liabilities. Services include income tax planning, capital gains strategy, tax-loss harvesting, and preparation of tax filings—making tax season far less stressful.

Estate & Trust Planning

Advisors help structure estates to preserve wealth across generations. This includes setting up trusts, planning for charitable giving, and ensuring tax-efficient asset transfers.

Insurance Solutions

Clients receive guidance on life, disability, and long-term care insurance. Advisors evaluate existing coverage and recommend policies that complement the overall financial plan.

Business Services

For business owners, Mariner provides retirement plan consulting, succession planning, business valuation support, and liquidity event strategies—helping protect both the business and personal financial outcomes.

This integrated, high-touch service model is ideal for clients who want a central, trusted team managing the full scope of their financial life.

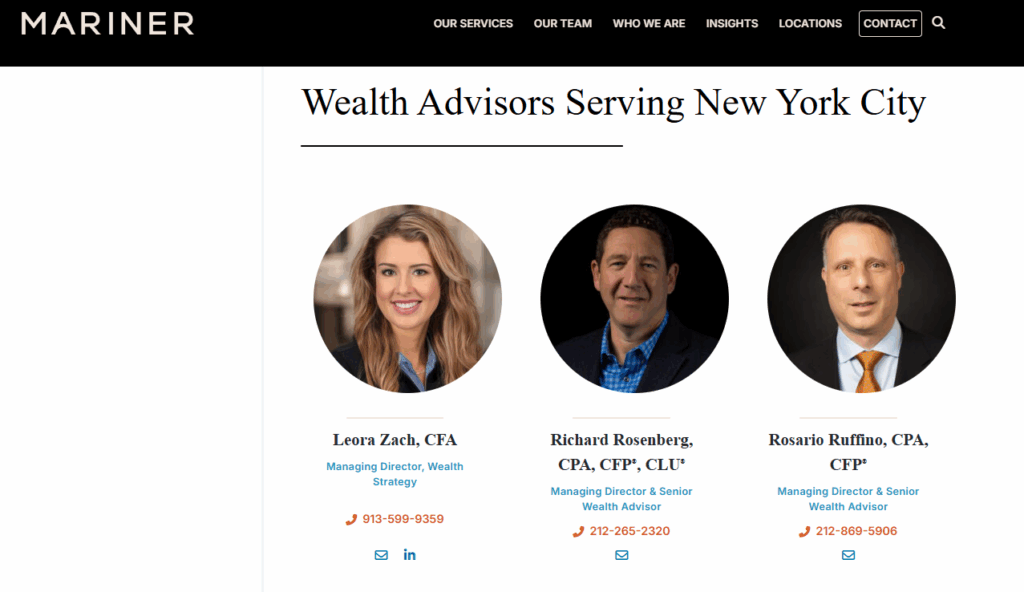

Who Are the Advisors?

The New York team is made up of professionals with decades of experience and deep technical knowledge. Many hold top-tier designations like CPA, CFP®, CFA®, and EA (Enrolled Agent), combining tax, legal, and investment expertise.

Here’s a list of wealth advisors at Mariner Wealth Advisors’ New York City office, located at 1500 Broadway, 28th Floor, New York, NY 10036:

Managing Directors & Senior Wealth Advisors

- Richard Rosenberg, CPA, CFP®, CLU®

- Rosario Ruffino, CPA, CFP®

Directors & Senior Wealth Advisors

- Adam Kotz, CPA

- Christopher Koehler, EA

- Christopher Sosa, CFP®, AEP®

- Justin McCarthy, CFP®, EA

- Maja Janko, CFP®

Senior Wealth Advisors

- Amanda Cuccinello, CFP®

- Angel Colón, CFP®

- Christine Wentzler, CFP®, CFA

- Connor Lacher, CFP®, CRPC®

- George Greco, CFP®

- Gloria Shouldis, CPA

- Gregory Ebeyer, CFP®, ChFC®, CMFC®, CRPC®

- Hasan Chowdhury

- Jason Monteleone, CFP®

- Jesse Maltzman, CFP®, CFA®, ChFC®

- Kate Kelly, CFP®

- Ken Paglio, CPA

- Lawrence Rosa, CFP®, CPA, JD

- Sonia Morales, CFP®

Wealth Advisors

- Adrian Huerta, CFP®

- Brian Pomarici, CFP®

- Christopher Ferrara

- Cory Doliner

- Manida Alarcon

- Michael Fields, CPA

- Morgan Nover, CFP®

- Muhammad Karim, CPA

- Robert Catalino

- Thomas Ahern

- Turner Linginfelter

Associate Wealth Advisors

- Forrest Swisher

- Jillian Gottbetter

- Kevin Flynn

Senior Wealth Consultants

- Alicia Fryc

- Marcus Christopher Williams, CFP®

- Michael McGinty

This team offers a comprehensive range of financial services, including wealth planning, investment management, tax strategy, estate planning, and business services. If you need assistance connecting with a specific advisor or learning more about their services, feel free to ask!

Some senior advisors have additional credentials in estate planning, insurance, or business finance, allowing for specialized guidance depending on client needs. The team structure encourages collaboration, ensuring that clients benefit from a broad base of knowledge rather than a single viewpoint.

What Makes This Office Unique?

1. Location and Access

The Times Square location makes it convenient for professionals and executives in Manhattan. Being in the financial capital of the world also allows Mariner’s advisors to stay close to financial market trends, institutional partners, and evolving client needs.

2. Client Diversity

From Wall Street veterans to family-owned business operators, the NYC office serves a wide range of client profiles. The diversity of the advisor team reflects this, offering multilingual support and culturally sensitive financial planning where needed.

3. Team Depth

With over 30 advisors and support staff, this office is one of the larger Mariner branches. Clients benefit from access to specialists in taxes, investments, insurance, and estate law—all coordinated under a unified planning process.

Is It a Good Fit?

Mariner Wealth Advisors’ New York City office is best suited for individuals and families with sophisticated financial needs. If you have significant assets or require planning that goes beyond basic investment advice—such as managing real estate holdings, optimizing tax strategies, or preparing for intergenerational wealth transfer—this team offers the experience and resources to handle it all in one place.

Ideal candidates include:

- High-income professionals and executives navigating stock options, deferred compensation, or high tax burdens.

- Entrepreneurs and business owners preparing for succession, managing liquidity events, or setting up retirement plans.

- Multigenerational families concerned with legacy building, estate tax planning, and asset protection.

- Clients with international interests, such as overseas investments or residency and taxation issues across borders.

On the other hand, if you’re looking for basic financial coaching, debt reduction strategies, or simple investment help, the NYC office’s premium service model may be more than you need—and more than you want to pay.

How to Connect

The New York office can be reached at 1500 Broadway, 28th Floor, New York, NY 10036 or by phone at 212-869-5900. A consultation typically includes a discovery meeting, needs analysis, and an overview of how the advisory team can help.