Choosing the right financial advisor can make or break your long-term financial goals. If you’re looking at Cook Wealth, LLC, you’re likely interested in more than just investment returns—you want a team that understands the full picture: your values, tax situation, family needs, and future legacy. Cook Wealth positions itself as a firm that does exactly that, combining financial planning with in-house tax expertise to offer a truly integrated service model.

With so many advisory firms offering cookie-cutter solutions or focusing solely on investments, Cook Wealth stands out by delivering personalized, advice-first planning for individuals and families looking for a long-term partner. Whether you’re approaching retirement, navigating a business exit, or planning generational wealth, it’s critical to know what you’re signing up for.

This review will break down everything you need to know before hiring them—services offered, fee structure, real client feedback, and how they compare to both national and regional competitors in today’s advisory landscape.

Looking for a Smart Hedge Against Market Volatility?

If you’re already working with—or considering—an advisor for long-term financial planning, don’t overlook the power of diversification. A Gold IRA can help protect your retirement savings from inflation, economic uncertainty, and market downturns.

High-net-worth investors and business owners use Gold IRAs not just as a safety net, but as a strategic asset within a broader portfolio.

Explore how a Gold IRA fits into your financial plan. Speak with a trusted advisor or request a free Gold IRA guide today.

✅ Protect your wealth

✅ Diversify your holdings

✅ Take control of your retirement future

What Is Cook Wealth, LLC?

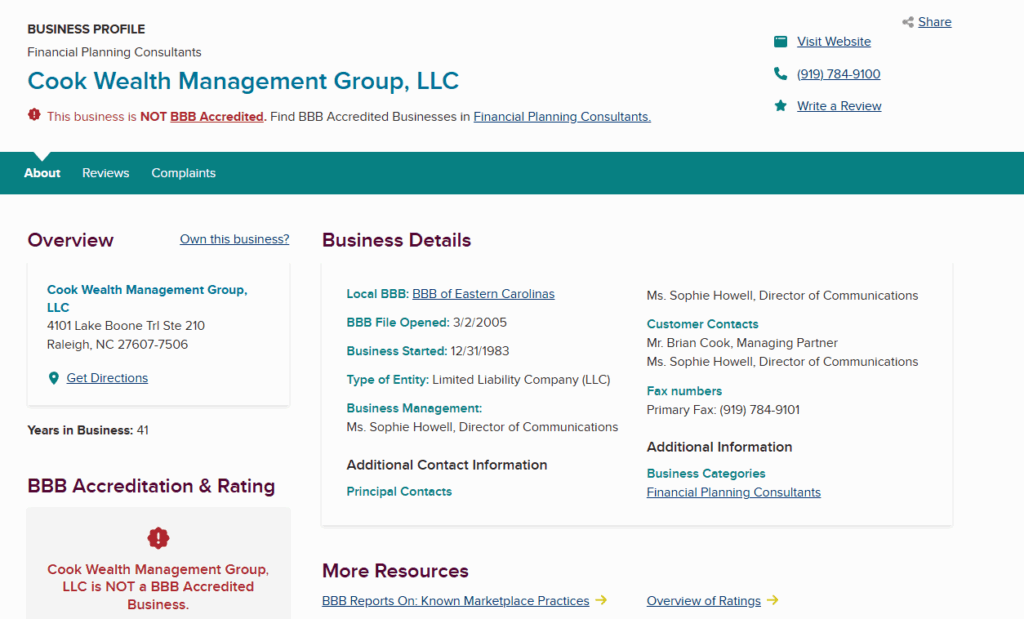

Cook Wealth is a fee-only financial advisory firm headquartered in Raleigh, North Carolina, with additional offices in Wilmington and Charlotte. Founded by Davis Cook, the firm has positioned itself as a fiduciary advisory team that combines financial planning, tax strategies, and investment management under one roof.

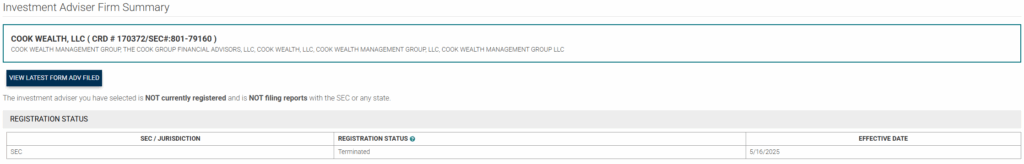

As a Registered Investment Advisor (RIA), Cook Wealth is legally required to act in your best interest. Their team includes CFP® professionals, CPAs, and advisors focused on creating long-term, values-driven financial plans tailored to each client.

Services Offered

Cook Wealth provides a comprehensive suite of integrated financial services, designed to meet the complex needs of individuals, families, and business owners. What sets them apart is their seamless combination of financial planning, investment management, and tax expertise, all under one roof—a rare and valuable offering in the advisory world.

Comprehensive Financial Planning

Cook Wealth takes a holistic view of your financial life, helping you build a plan that supports both short-term needs and long-term ambitions. This includes retirement readiness assessments, college funding strategies, insurance analysis, budgeting guidance, and more. Their planners prioritize clear, actionable strategies rooted in your personal values and life goals.

Investment Management

Their investment philosophy is grounded in evidence-based strategies, not speculation or market timing. Portfolios are customized based on each client’s risk tolerance, time horizon, and financial objectives, with regular reviews and rebalancing to stay aligned with life changes and market conditions.

Tax Planning and Preparation

One of Cook Wealth’s standout services is the integration of tax planning and preparation into their financial advising. Their in-house CPAs don’t just file returns—they work year-round to develop tax-efficient strategies, such as Roth conversions, charitable giving plans, and retirement account optimization.

Estate Planning Coordination

The firm works directly with estate attorneys to help clients build wills, trusts, healthcare directives, and legacy plans that minimize tax burdens and align with family priorities.

Business Owner Services

For entrepreneurs, Cook Wealth offers succession planning, business tax strategies, and retirement plan consulting to support smooth transitions and sustainable growth.

They are especially well-suited for clients seeking ongoing, relationship-driven financial stewardship, not one-off advice.

Fee Structure and Minimum Investment

Cook Wealth operates as a fee-only advisory firm, which means their compensation comes solely from the fees paid by clients—not from commissions, product sales, or third-party incentives. This structure eliminates conflicts of interest and ensures that the advice you receive is always in your best interest, not influenced by sales quotas or kickbacks.

How Fees Work

Their primary model is assets under management (AUM), where clients are charged a percentage of the portfolio Cook Wealth manages. This typically starts at around 1% annually for portfolios up to $1 million and decreases as assets increase. For high-net-worth individuals, the sliding scale can offer significant cost savings over time.

In addition to AUM pricing, Cook Wealth offers tiered flat-fee planning packages, particularly for clients who may not yet meet the AUM thresholds but still want access to strategic financial advice. These flat-fee options are ideal for younger professionals, business owners, or families in growth phases who need planning support without ongoing investment management.

Minimum Investment

While the firm doesn’t enforce a public minimum, the majority of their AUM clients hold at least $500,000 in investable assets. However, their flexible fee structure ensures they remain accessible to a wider range of clients than many traditional firms.

Importantly, there are no hidden fees, trading markups, or product-based commissions—just clear, transparent pricing aligned with your goals.

Pros and Cons of Hiring Cook Wealth

Pros

- ✅ Fee-only fiduciary model

- ✅ Integrated tax planning and preparation

- ✅ Certified professionals across financial and tax disciplines

- ✅ Custom, values-based approach to planning

Cons

- ❌ May not be ideal for DIY investors or those seeking self-directed tools

- ❌ Not as well known outside the Southeast U.S.

- ❌ Minimums may still be high for younger investors

What Clients Are Saying: Reviews & Reputation

Cook Wealth has built a reputation for delivering high-quality, personalized service with a strong emphasis on trust, clarity, and long-term relationships. Reviews across various platforms, particularly Google, consistently reflect high satisfaction among clients, with many describing the firm as a rare find in the financial advisory space—one that combines technical expertise with a truly client-first mindset.

Online Review Summary

- Google Ratings: Across its Raleigh, Wilmington, and Charlotte offices, Cook Wealth earns between 4.8 and 5 stars, with reviewers frequently highlighting the professionalism, responsiveness, and attention to detail of their advisors and support staff.

- Better Business Bureau (BBB): The firm has no major complaints or unresolved issues listed. While not currently BBB-accredited, their clean record suggests a strong track record of ethical practices and client satisfaction.

What Clients Love

Clients commonly praise the firm’s transparency, especially around pricing and investment strategy. Many note that their advisor takes time to explain concepts in plain language, rather than financial jargon, helping them feel more confident and in control. The integration of tax and financial planning is a standout feature for many—allowing clients to get comprehensive advice without bouncing between professionals.

Room for Improvement

Some clients mention that onboarding paperwork can be a bit cumbersome, especially for those unfamiliar with financial processes. Others wish the firm had more robust digital tools or a client portal with more interactive features. However, these critiques are typically minor and don’t overshadow the positive client experience.

Overall, Cook Wealth is seen as a firm that delivers thoughtful, personalized service with a clear commitment to doing what’s right for the client—something that continues to earn them loyalty and referrals.

How They Compare to Other Financial Advisors

In a crowded field of advisory options, Cook Wealth distinguishes itself through its human-centered, integrated approach. Unlike larger firms such as Vanguard Personal Advisor Services, Charles Schwab, or Fidelity, which rely heavily on automated tools and broad investment models, Cook Wealth delivers customized, advisor-led strategies with an added layer of in-house tax planning—a combination that’s rare, even among fee-only firms.

Compared to regional competitors like Modera Wealth Management, Beacon Pointe Advisors, or Carson Wealth, Cook Wealth’s edge lies in its tight collaboration between financial advisors and CPAs. This structure allows clients to benefit from synchronized financial and tax strategies, all managed by one coordinated team.

Where Cook Wealth may fall short is in tech-forward conveniences. They don’t offer AI-powered robo-advisory platforms, expansive mobile apps, or 24/7 online dashboards that some national brands provide. However, for clients who prioritize deep relationships, ongoing guidance, and holistic planning, Cook Wealth offers a level of service and attention that algorithm-driven models simply can’t match.

Final Verdict: Should You Hire Cook Wealth?

If you’re looking for a true partner in your financial life—someone who can help you with investing, taxes, estate issues, and long-term planning—Cook Wealth is worth considering. They offer a holistic, client-first approach that’s hard to find in large national firms.

Just keep in mind that they’re best suited for people who want ongoing, advisor-led relationships rather than a quick portfolio review or app-based solution.

FAQs

Is Cook Wealth a fiduciary?

Yes. Cook Wealth is a Registered Investment Advisor and operates under a fiduciary obligation.

What’s the minimum investment?

Typically $500,000, but they offer flexible planning models for those with lower assets.

Do they offer tax preparation in-house?

Yes. Unlike most advisory firms, Cook Wealth has CPAs on staff who handle both tax planning and filing.

Do they offer virtual meetings?

Yes. Cook Wealth serves clients both locally and remotely, offering meetings via phone or video.

Are their advisors certified?

Yes. Their team includes CFP®s, CPAs, and other credentialed professionals.

What makes Cook Wealth different?

The integration of tax and financial planning, transparent fees, and a strong emphasis on values and family priorities set them apart.