If you’re considering hiring Golden Tree Wealth Partners to manage your finances or support your business strategy, it’s essential to understand what the firm offers, who they’re best suited for, and how they operate. Here’s a full breakdown to help you make an informed decision.

Who Is Golden Tree Wealth Partners?

Golden Tree Wealth Partners is a Chicago-based financial advisory and consulting firm known for delivering holistic, integrated wealth management solutions. Founded with the goal of providing strategic financial guidance under one roof, the firm caters to a diverse client base—including high-net-worth individuals, multigenerational families, and privately held business owners. Their services go beyond typical investment advice, combining financial planning, tax services, estate strategies, and business consulting into a unified approach.

With a focus on long-term relationships and tailored financial plans, Golden Tree aims to simplify complex financial lives and empower clients to make confident, informed decisions.

Looking for a Smart Hedge Against Market Volatility?

If you’re already working with—or considering—an advisor for long-term financial planning, don’t overlook the power of diversification. A Gold IRA can help protect your retirement savings from inflation, economic uncertainty, and market downturns.

High-net-worth investors and business owners use Gold IRAs not just as a safety net, but as a strategic asset within a broader portfolio.

Explore how a Gold IRA fits into your financial plan. Speak with a trusted advisor or request a free Gold IRA guide today.

✅ Protect your wealth

✅ Diversify your holdings

✅ Take control of your retirement future

Services Offered

Golden Tree Wealth Partners offers a robust suite of financial services designed to address both personal and business needs in a cohesive, strategic manner.

Financial Planning

Their advisors build fully customized financial plans tailored to your specific life goals—whether that’s early retirement, funding a child’s education, or building generational wealth. Plans are reviewed regularly to adjust for life changes and market conditions.

Tax Services

In-house tax professionals handle everything from annual filing to long-term tax minimization strategies. Their proactive approach helps clients keep more of what they earn, avoid costly surprises, and stay compliant year-round.

Investment Management

Portfolios are crafted to reflect your individual goals, risk tolerance, and time horizon. The firm takes a disciplined, data-driven approach, focusing on diversification, performance, and downside protection.

Business Consulting

For entrepreneurs, Golden Tree offers advanced financial oversight through Fractional CFO services. This includes budgeting, forecasting, profit improvement, and strategic planning—without the overhead of a full-time executive.

Estate Planning

They help clients preserve and transfer wealth effectively, coordinating with attorneys and tax professionals to set up wills, trusts, and charitable vehicles.

Golden Tree’s integrated model ensures all financial pieces work in sync.

How Golden Tree Charges for Services

Golden Tree Wealth Partners uses a fee-based compensation model, which means their income can come from both advisory fees and, in some cases, commissions on certain financial products. This hybrid model allows for flexibility in pricing, but it also means that transparency is essential—and prospective clients should ask detailed questions about how their advisor is compensated.

Assets Under Management (AUM) Fees

This is the most common fee structure used by Golden Tree for ongoing portfolio management. Clients are charged a percentage of the assets the firm manages on their behalf. Rates typically range from 0.50% to 1.25% annually, with lower percentages generally available for larger portfolios. This model incentivizes advisors to grow your portfolio since their compensation scales with your assets.

Flat Fees or Hourly Rates

For specific projects—such as one-time financial plans, business consulting, or tax strategy sessions—Golden Tree may charge a flat fee or hourly rate. This is often beneficial for clients who want expert input without committing to ongoing asset management.

Minimum Investment Requirements

While not always publicized, Golden Tree may require a minimum level of investable assets to access certain services. This threshold varies based on the advisor and engagement type.

Before signing on, request a complete, written explanation of all fees—including any performance-based incentives or product-related commissions—to ensure alignment with your expectations and financial goals.

Who Is a Good Fit for Golden Tree Wealth Partners?

Golden Tree Wealth Partners is best suited for clients who need comprehensive, hands-on financial guidance. Their ideal clients are typically dealing with layered financial challenges that require more than just basic investment advice.

This includes:

- High-net-worth individuals looking for active portfolio management, sophisticated tax planning, and long-term wealth strategies.

- Business owners in need of operational support, strategic planning, and exit readiness through services like Fractional CFO consulting.

- Families managing legacy planning, multi-generational wealth transfer, or setting up charitable foundations.

- Clients with complex asset structures, such as real estate portfolios, private investments, or international holdings.

These clients benefit most from Golden Tree’s team-based, multidisciplinary approach. Their advisors are experienced at navigating overlapping financial issues—from taxes and investments to estate and business planning.

However, for individuals with simpler needs—like basic retirement saving or budgeting—Golden Tree’s premium services may be more than necessary, both in scope and cost.

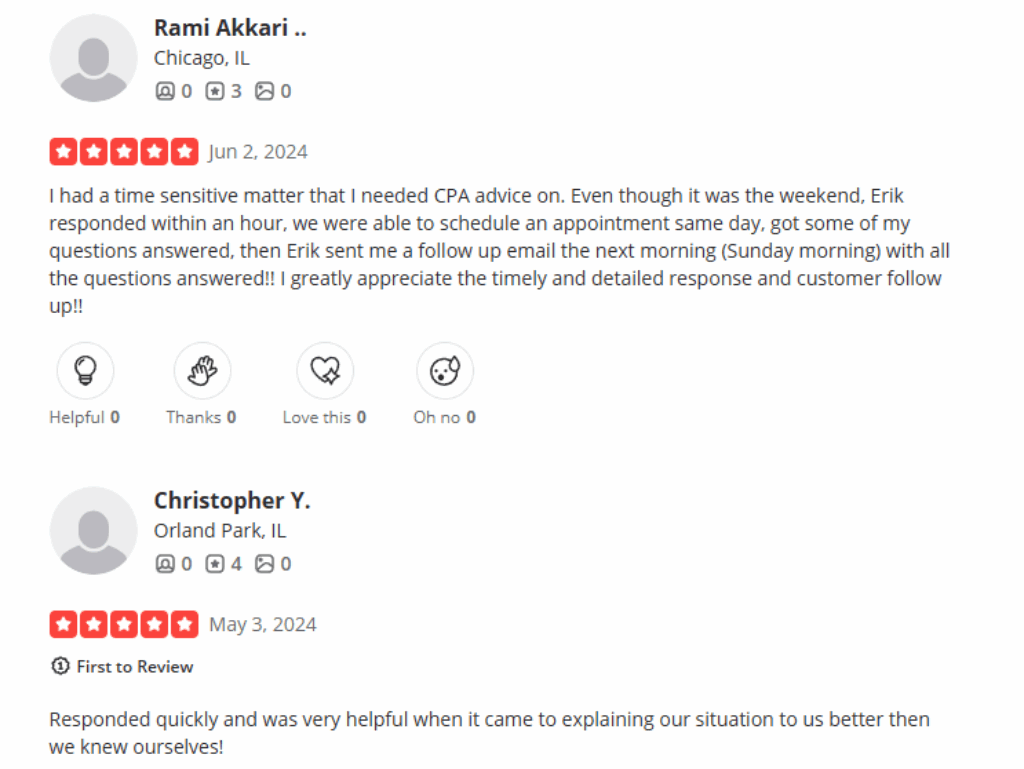

Client Experience

Golden Tree Wealth Partners places a strong emphasis on personalized, relationship-driven service. Their approach is designed for clients who value not just financial expertise, but clear communication, transparency, and consistent engagement.

Clients typically receive regular strategy sessions, often quarterly, to revisit goals, update financial plans, and assess portfolio performance. These check-ins are an opportunity to address changes in income, tax law, market conditions, or family dynamics—ensuring your plan stays current and aligned with your objectives.

The firm also provides transparent performance tracking, delivered through user-friendly reporting tools and one-on-one advisor discussions. Whether you’re reviewing investment returns or analyzing tax projections, the focus is on clarity and control.

One of the key advantages at Golden Tree is access to a multidisciplinary advisory team. Rather than working with a single generalist, you may have a lead advisor supported by specialists in investment management, tax strategy, business consulting, and estate planning. This team-based model can be a major asset when managing more complex financial scenarios.

That said, prospective clients should ask early on about point-of-contact expectations. Who will lead your relationship? Will you work with the same advisor consistently? How responsive is the team? These are critical factors that can shape your experience.

Golden Tree’s client service model is built for those who value ongoing engagement, proactive insights, and customized attention. If you’re the kind of investor who wants to “set it and forget it,” this level of interaction may be more than you need—but for others, it’s what makes Golden Tree stand out.

Final Verdict

Golden Tree Wealth Partners brings real value to the table for those who need more than just investment advice. Their blend of financial planning, tax services, business consulting, and legacy planning makes them a strong candidate for clients who want everything handled under one roof.

Before hiring them, take time to:

✅ Clarify fees and compensation

✅ Understand what services are included

✅ Evaluate how well their model fits your financial needs

If you’re looking for integrated financial guidance and long-term strategic support, Golden Tree Wealth Partners may be the right partner to help you build, protect, and grow your wealth.